MANTRA plans to tokenize assets worth more than $1 billion of DAMAC Group in early 2025, according to Thursday’s announcement.

DAMAC Group, led by UAE-based Hussain Sajwani, operates as a diversified conglomerate with interests in real estate, hotels and data centers.

MANTRA Takes Big Step In Real Asset Tokenization

DAMAC started accepting cryptocurrency payments in 2022 and is now moving towards blockchain-based asset tokenization. This initiative will allow investors to access DAMAC’s diverse portfolio, including real estate developments and other projects, through digital Tokens.

This approach aims to simplify the investment process and expand opportunities for individual and institutional investors. Details of tokenized properties and products will be announced in the coming weeks and launch is expected in early 2025.

“The partnership with DAMAC consortium is a nod to the real asset tokenization industry. We are delighted to partner with such a prestigious group who share the same ambitions and see great opportunity in bringing traditional finance opportunities up-chain.” speak CEO of MANTRA, John Patrick Mullin.

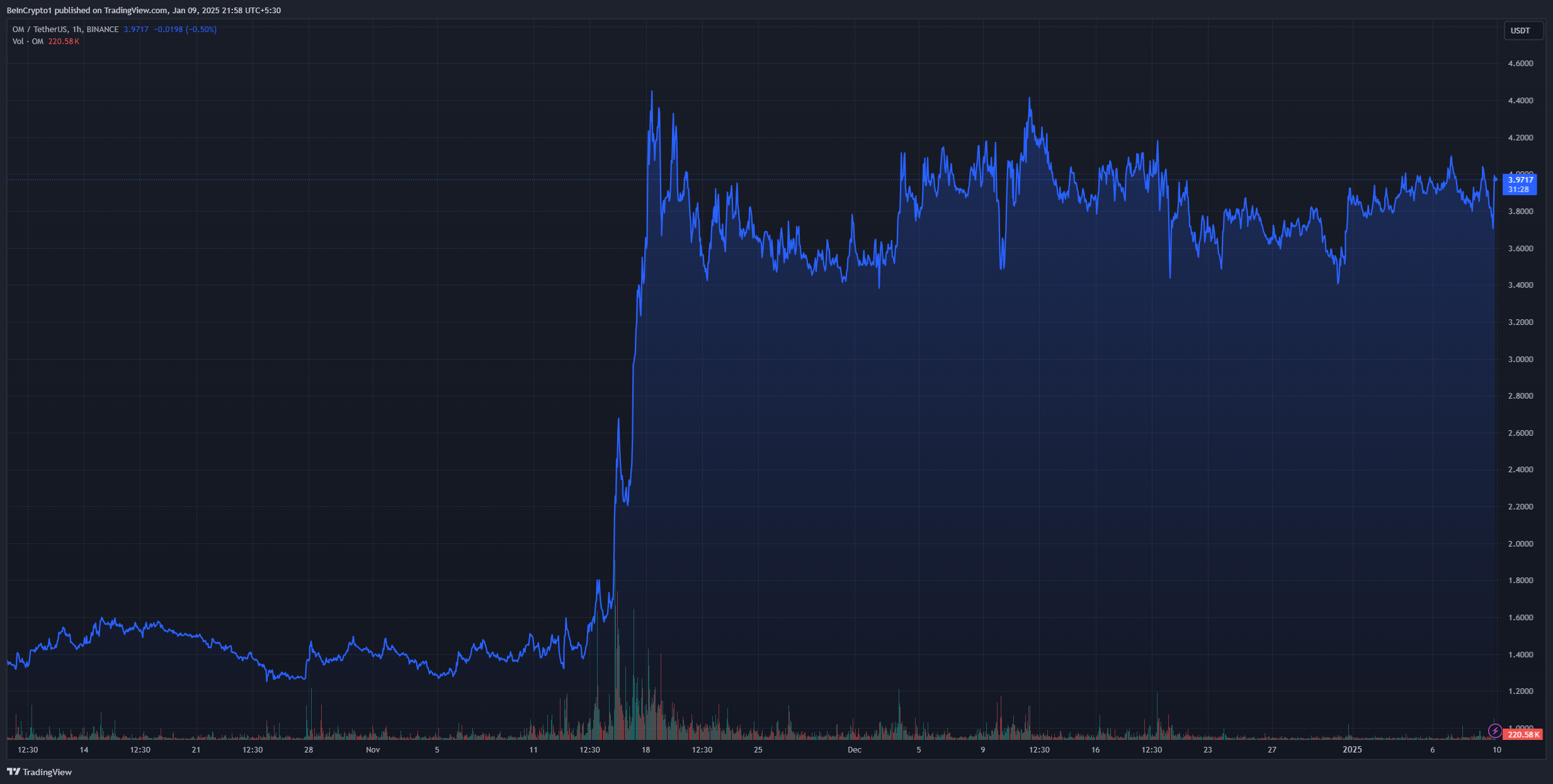

MANTRA launched its mainnet in October. Since then, MANTRA’s OM Token has increased significantly in market capitalization. The token has increased 200% in the past three months to reach $3.6 billion, with an all-time high in October February.

The partnership between DAMAC and MANTRA represents a growing shift towards blockchain-based investment models, which promise to change the way traditional markets operate by improving efficiency and capacity. access for global investors.

Growing Interest in Real Asset Tokenization

Asset tokenization is the process of converting traditional assets such as real estate, stocks, and commodities into blockchain-based digital Tokens that represent ownership.

This process is attracting global interest thanks to its ability to improve payment speed and expand access for investors. Reports estimate the market for tokenized real assets could reach trillions of dollars by the end of the decade.

The industry has seen significant activity throughout 2024. BlackRock launched its tokenized BUIDL fund in March and has expanded across five major blockchain chains, including Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

This fund offers on-chain yields, flexible custody, and integrated features. Several projects such as Ethena and Frax have launched stablecoins backed by this fund.

Tether has also enhanced its encryption strategy, preparing to launch Hadron, a platform for real asset tokenization. From February 2025, Hadron will provide full user interface and API support for institutional use.