XRP price has dropped more than 4% in the past seven days, indicating sustained weakness. Trading volume has dropped 33% in the past 24 hours, to $5.2 billion. Despite the sluggish momentum, the market shows signs of stabilizing, thanks to whale activity and technical indicators hinting at the possibility of changes ahead.

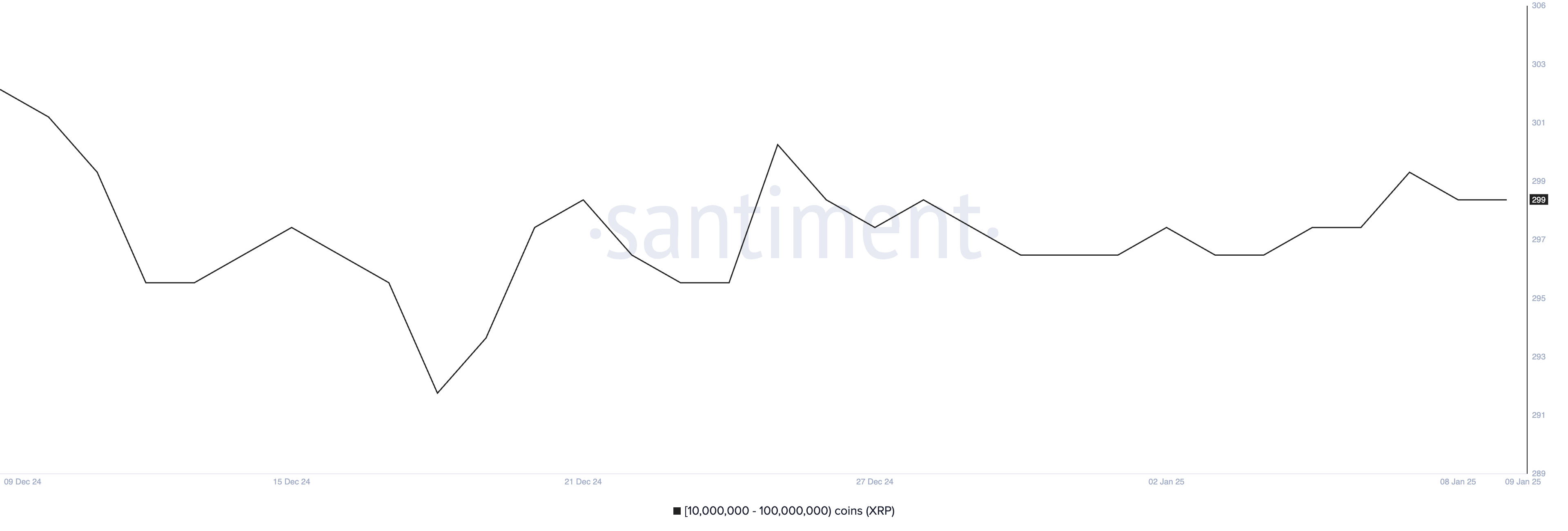

Whale addresses holding between 10 million and 100 million XRP have increased slightly, reaching 299 on January 8, which indicates cautious accumulation. However, without stronger buying momentum or improved market sentiment, XRP still faces the risk of a further correction or prolonged consolidation.

XRP Whales Remain Cautious

The number of XRP whales, defined as addresses holding between 10 million and 100 million XRP, provides important insight into the market behavior of large investors. These whales often have a large influence on price movements, as their accumulation or distribution can impact market sentiment and liquidity.

After reaching a monthly low of 292 on December 18, the number of XRP whales recovered to 301 on December 25 but has since shown signs of stabilization with minor fluctuations.

As of press time, the number of whales is 297. This steady activity shows cautious but increasing interest from large investors, even though XRP is in a consolidation phase.

The gradual increase in whale addresses could signal re-established trust in XRP, which could lay the groundwork for near-term price stabilization or recovery. However, without a stronger accumulation trend, the market may continue to see limited momentum in both directions.

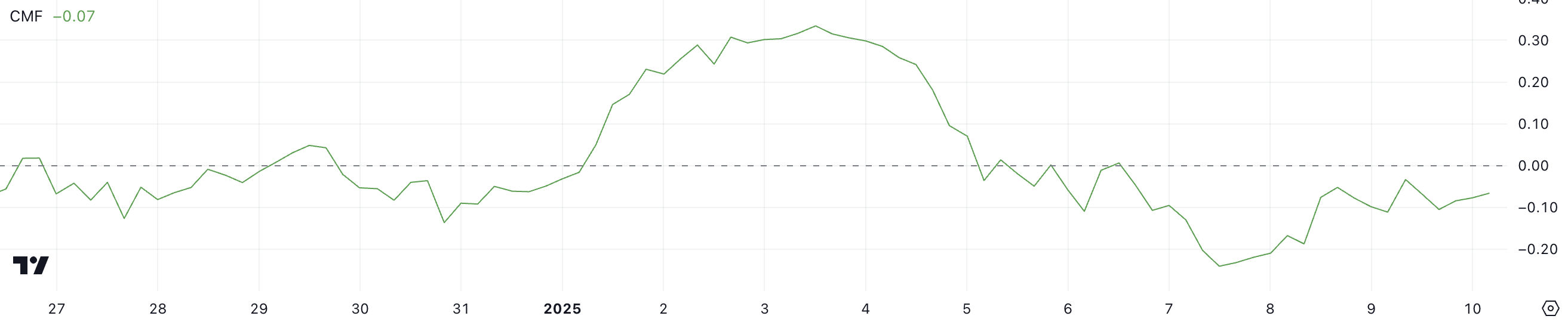

CMF XRP Still Negative

XRP’s Chaikin Money Flow (CMF) is currently -0.07, recovering from a recent low of -0.24 on January 7. CMF is a technical indicator that evaluates capital flows into or out of a given currency. asset, using price and volume data over a certain period of time.

Values above zero indicate net buying pressure, reflecting bullish sentiment, while negative values indicate net selling pressure and bearish sentiment.

At -0.07, XRP’s CMF remains in negative territory, suggesting that selling pressure still outweighs buying activity. However, the move up from -0.24 shows that selling intensity has decreased, possibly implying stabilization or a transition to more balanced market conditions.

If the CMF continues to recover and moves into positive territory, this could imply a revival of buying interest and support a possible price recovery. Conversely, if the indicator trends bearish again, XRP could face additional downward pressure.

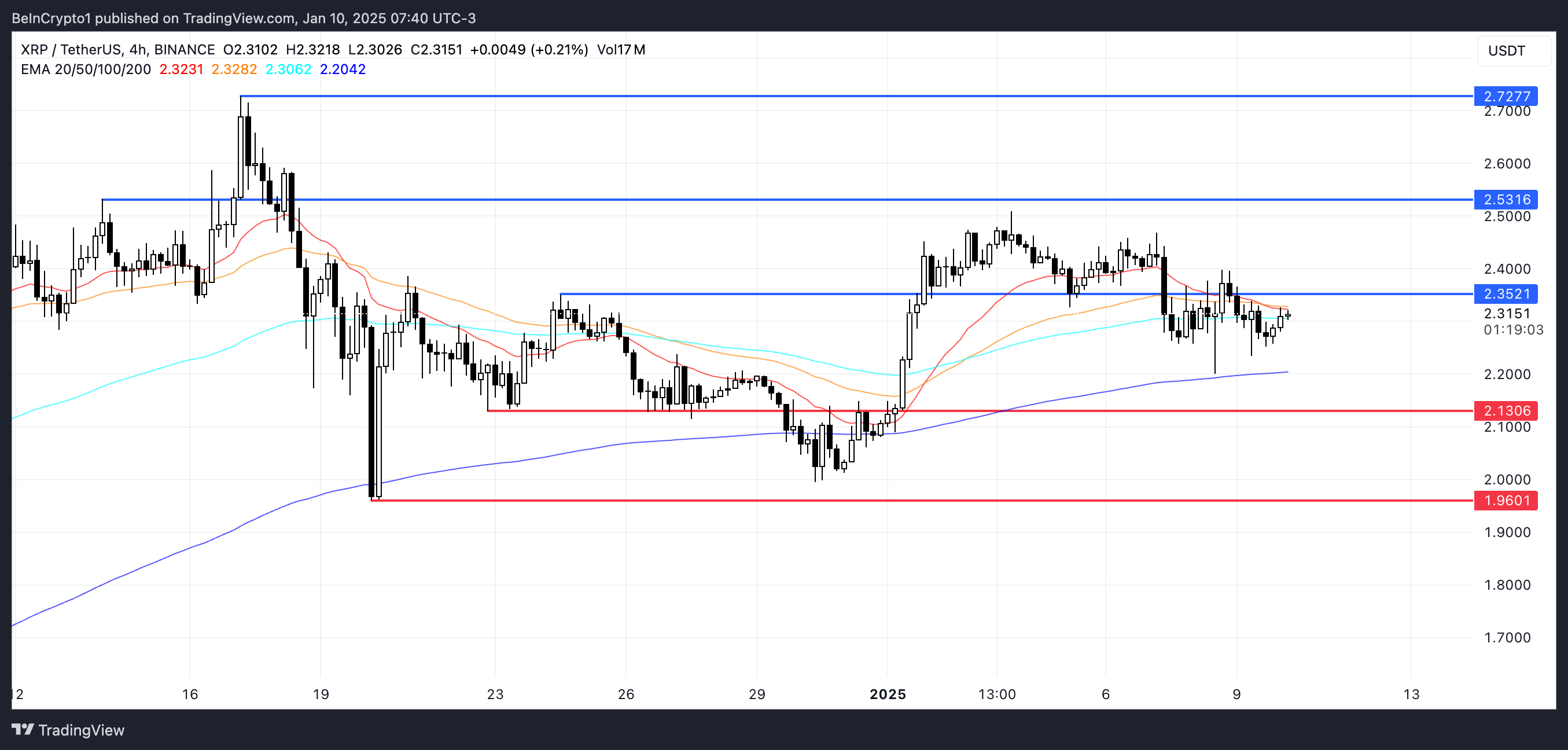

XRP Price Prediction: Resistance at $2.35 Is Fundamental

XRP’s EMAs currently show uncertainty, with no clear directional signals emerging. This indecisiveness emphasizes a balanced market environment where both bullish and bearish outcomes are possible, as demonstrated by whale and CMF metrics.

If an uptrend develops and XRP price breaks above the resistance at $2.35, it could lay the groundwork for further price increases. A continuation of the bullish momentum could push the price to $2.53 and even $2.72, offering a potential 17.6% upside.

Conversely, a downtrend could result in XRP price testing the support at $2.13. If this level fails to hold, the price could experience further downward pressure, potentially falling to $1.96, which would be the lowest since mid-December.