Bitcoin (BTC) recently hit an all-time high (ATH) of $109,588. However, the coin’s price fell 8%, partly due to reduced retail trading activity.

With decreasing demand from this group of BTC investors, BTC may continue to decline in price in the short term.

Bitcoin retail investors reduce accumulation

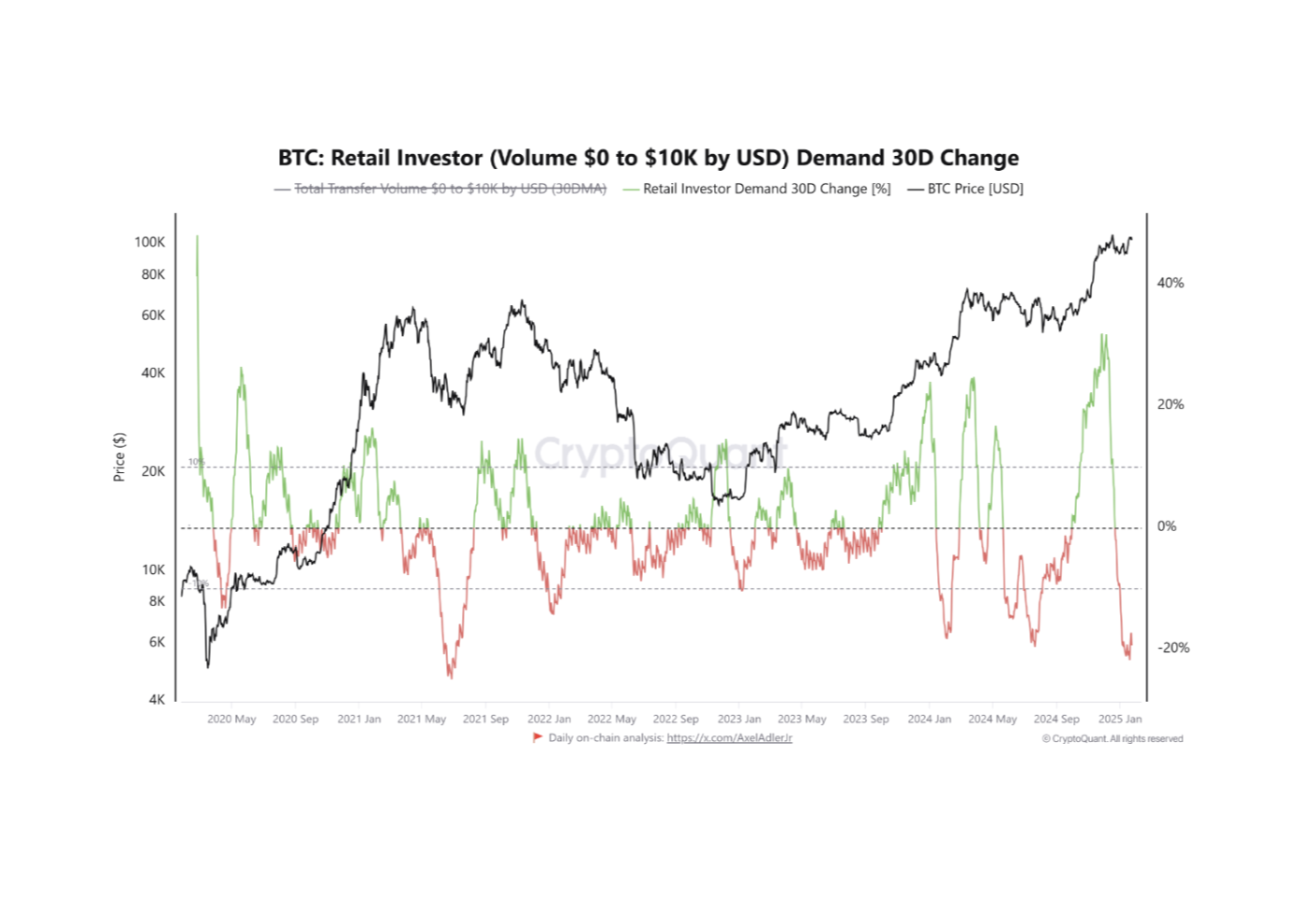

One report A recent report from pseudonymous analyst CryptoQuant, Caueconomy, states that retail investors, who often lead small but important market movements, have sharply reduced their Bitcoin accumulation over the past month.

According to Caucenomy, over the past few days, on-chain activity for BTC transactions up to $10,000 has decreased by 19.34%, reflecting a decline in retail trading activity. This comes even as the coin’s price touched an ATH of $109,588 on Monday.

This decline in retail activity is notable given Bitcoin’s current high price volatility. During times of high volatility like this, on-chain activity typically increases, as retail investors try to buy low or take profits on rising prices. However, the decline in on-chain transactions suggests that retail investors are not participating in BTC at the level expected under these market conditions.

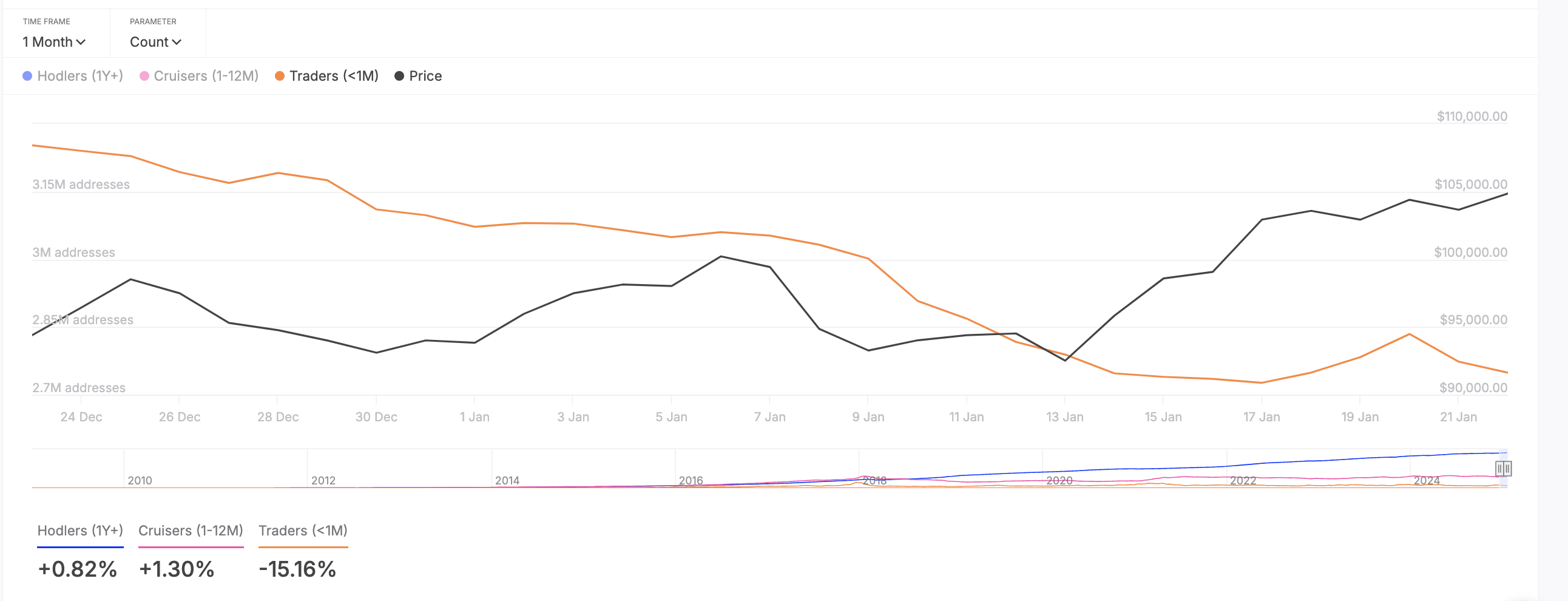

Furthermore, despite the excitement surrounding the recent ATH, retail BTC investors are not holding their positions for long, confirming a decline in their accumulation. According to IntoTheBlock, this group of investors has reduced their holding period by 15% over the past month.

As retail investors reduce their holding periods, this indicates a loss of confidence and increased caution among small investors. This could lead to more frequent buying and selling cycles, increased market volatility and could put downward pressure on the currency.

BTC price prediction: Is $94,000 the next stop?

Without significant participation from smaller investors, the BTC market may lack the necessary push to sustain its rally to all-time highs. If these coin holders continue to sell, the BTC price could drop to $94,523.

Conversely, if they continue to accumulate coins, BTC price could retest its all-time high and rise even further.