- Bitcoin Magazine’s CEO announces merger with KindlyMD.

- Newly raised $710M targets Bitcoin holdings.

- Merger aims to impact Bitcoin treasury strategies.

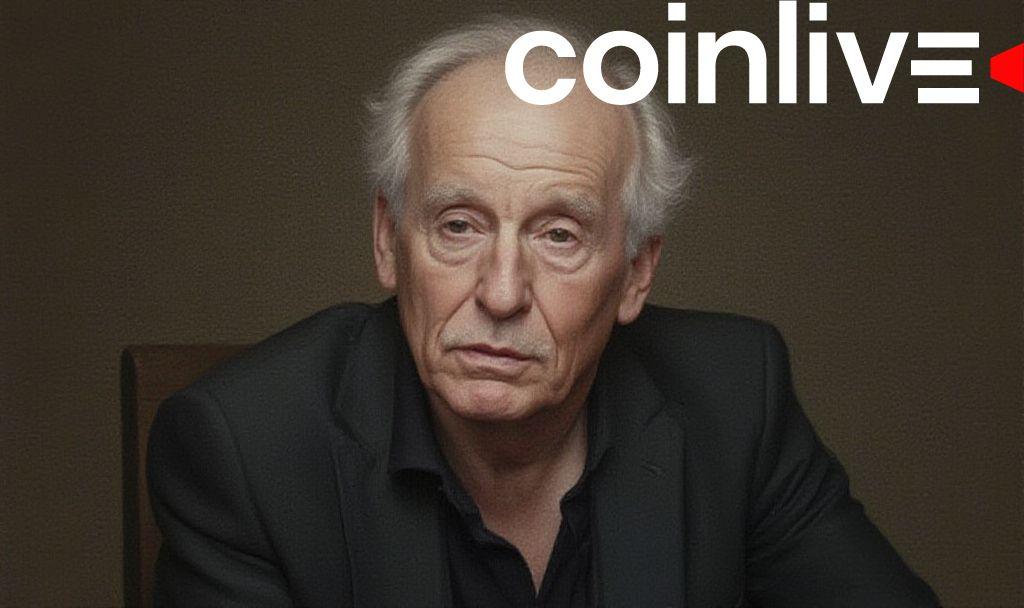

David Bailey, CEO of Bitcoin Magazine, has announced the merger of his firm Nakamoto with KindlyMD, raising $710 million for a Bitcoin-focused treasury vehicle. The combined entity aims to enhance its market position significantly.

David Bailey’s strategic moves aim to bolster Nakamoto’s Bitcoin-focused treasury with significant investment, setting a notable precedent in the industry. The merger signifies heightened institutional interest in cryptocurrency holdings.

The merger involves Bitcoin Magazine’s head, David Bailey, overseeing strategic initiatives. KindlyMD and Nakamoto will form a Bitcoin treasury entity. Their combined efforts seek to surpass existing market strategies through a new financing injection.

This financial maneuver significantly impacts market perceptions of institutional Bitcoin investment. The decision marks a prominent shift, drawing parallels with similar strategies by industry leaders like MicroStrategy, which closely mirrors their mass acquisition strategies.

Potential outcomes include expanded Bitcoin holdings and enhanced market valuations for the newly merged entity. Regulatory approval processes continue, ensuring legitimacy across financial markets following the merger. This act could influence further institutional investments in Bitcoin.

The merger reinforces the trend of involving more institutional resources in cryptocurrency. With unprecedented funding levels, the industry looks toward innovative regulatory and technological outcomes guided by emerging market dynamics and investment strategies.

“David Bailey and Bitcoin-Native Holding Company Nakamoto Announce Merger with KindlyMD to Establish Bitcoin Treasury.” – David Bailey, CEO, Bitcoin Magazine, head of Nakamoto source