The continued decline of Bitcoin (BTC) has induced the complete industry to “falter” because the starting of the week. However, just as BTC showed a slight rebound nowadays, Avalanche (AVAX) manufactured a magnificent move to attain a new all-time substantial.

Where is the “stop” for AVAX?

It looks that the barrier coming from the “big brother” Bitcoin may perhaps be slowing down AVAX’s development not too long ago. However, the recent effects make traders “overwhelmed” by the platform’s breakthrough.

– See far more: Bitcoin (BTC) is recovering somewhat, the “green” is back on the industry: what did the Fed say and how is Evergrande now?

Take a terrific chance from Bitcoin’s “green” signal. The AVAX breakout continued to set a new substantial on September 23 at $ 78.85. More broadly, AVAX was up 5x from its $ twelve price tag in August and in excess of a hundred% in early September. At press time, AVAX is trading at USD 77.04.

DeFi, stablecoin, and so forth. AVAX all over the place

The to start with notable driving force behind AVAX’s “miraculous” development is the really sturdy promotion and growth of the Avalanche ecosystem.

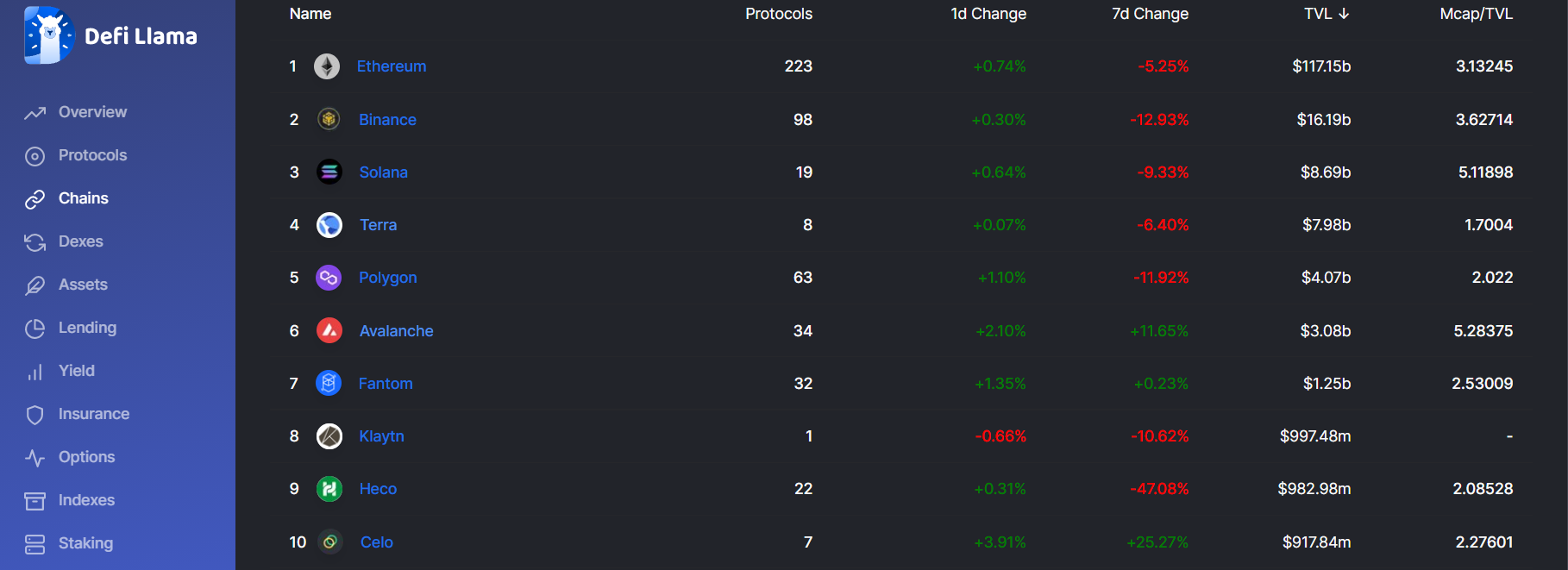

Based on information from Defillama.com, we can obviously see that the leading five chains have all suffered a TVL drop due to the volatility of BTC in excess of the previous seven days, but for Avalanche it is a finish story. complete, an eleven.65% improve in complete TVL, bringing complete TVL to $ three.08 billion at the time of creating.

In distinct, AVAX’s development method does not seem to be impacted by information of hacking attacks on tasks in the platform’s ecological universe. For instance, the to start with significant assault on Avalanche was Zabu Finance (ZABU), which misplaced $ three.two million. O Vee Finance (VEE) was hacked a handful of days following its launch on Avalanche.

So why can Avalanche not only stand up, but also accelerate so promptly? Hacks have normally been a big “threat” to most mainstream platforms in the DeFi room, particularly “nascent” tasks like Avalanche. However, an more level need to be offered to the AVAX advancement workforce, which responds really promptly to occasions and will take timely measures.

Not only that, AVAX also can make traders really feel safer with the team’s perform following specifically what the new Roadmap launched by AVAX in early June. This is even further reinforced by the degree of dedication. Together with the contribution to the protocol, AVAX reached the leading of the most actively created tasks in the recent trend. To discover out far more about AVAX’s upcoming journey, read through the short article beneath.

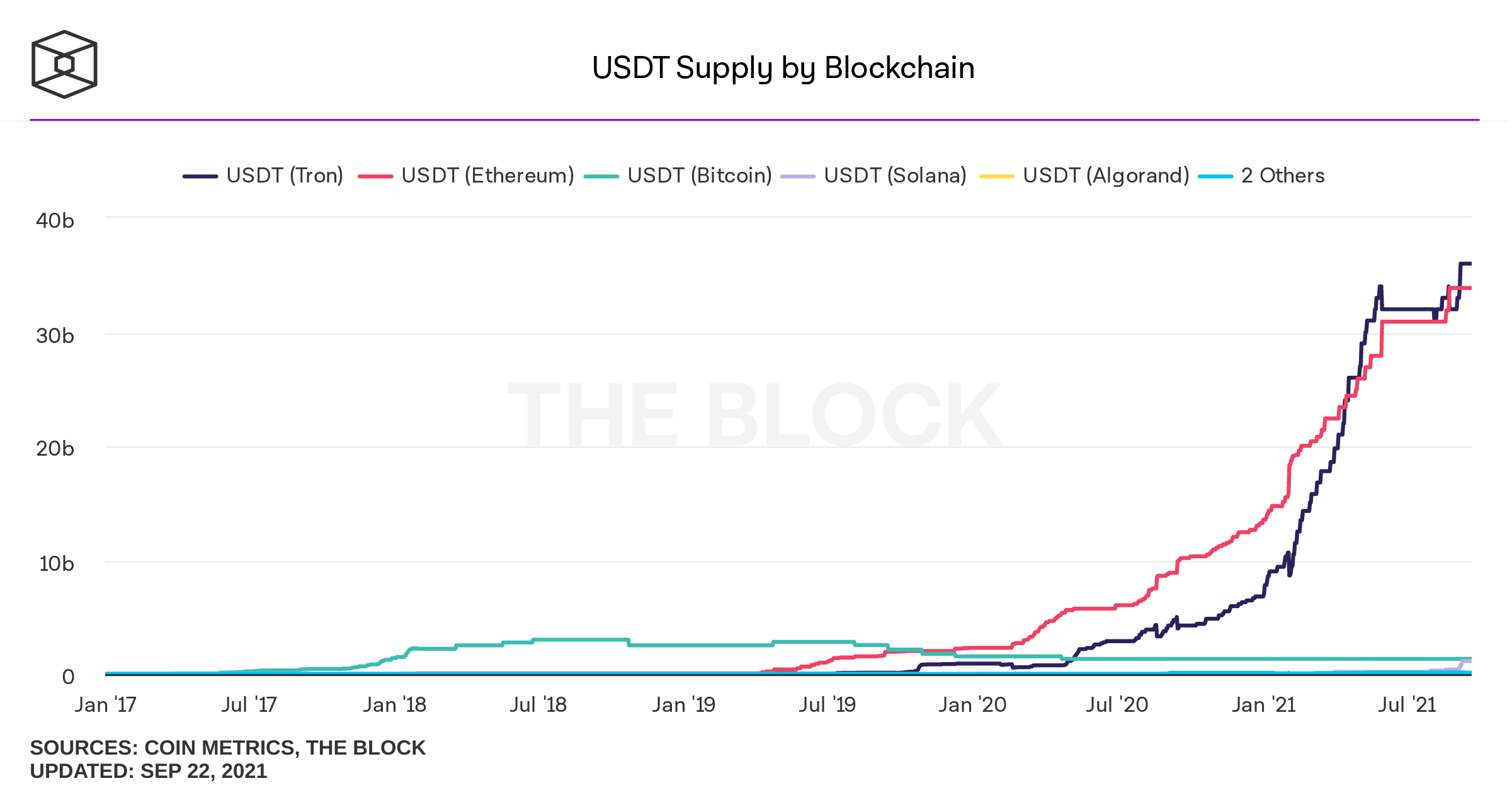

Furthermore, Avalanche (AVAX) is officially the ninth title to concern USDT, competing with eight diverse blockchains: Algorand, Bitcoin Cash Simple Ledger Protocol, Ethereum, EOS, Liquid Network, Omni, Tron and Solana.

Currently Tron and Ethereum are nevertheless the two blockchains that account for the bulk of the complete USDT provide issued. With USDT’s bid figure on Tron at $ 36 billion, though on Ethereum, it is hovering all around $ 33.86 billion.

Ethereum’s substantial fuel charges have normally been a central concern. As this kind of, USDT is turning into far more well known on other blockchains. USDT’s space for development on Avalanche (AVAX) is nevertheless really significant when we search at the major image of Tether’s (USDT) providing. Since early 2021, USDT provide has greater 178% from 21 billion on January one to recent amounts and will attain even far more as the industry slowly expands.

AVAX has attracted the consideration of lots of terrific guys

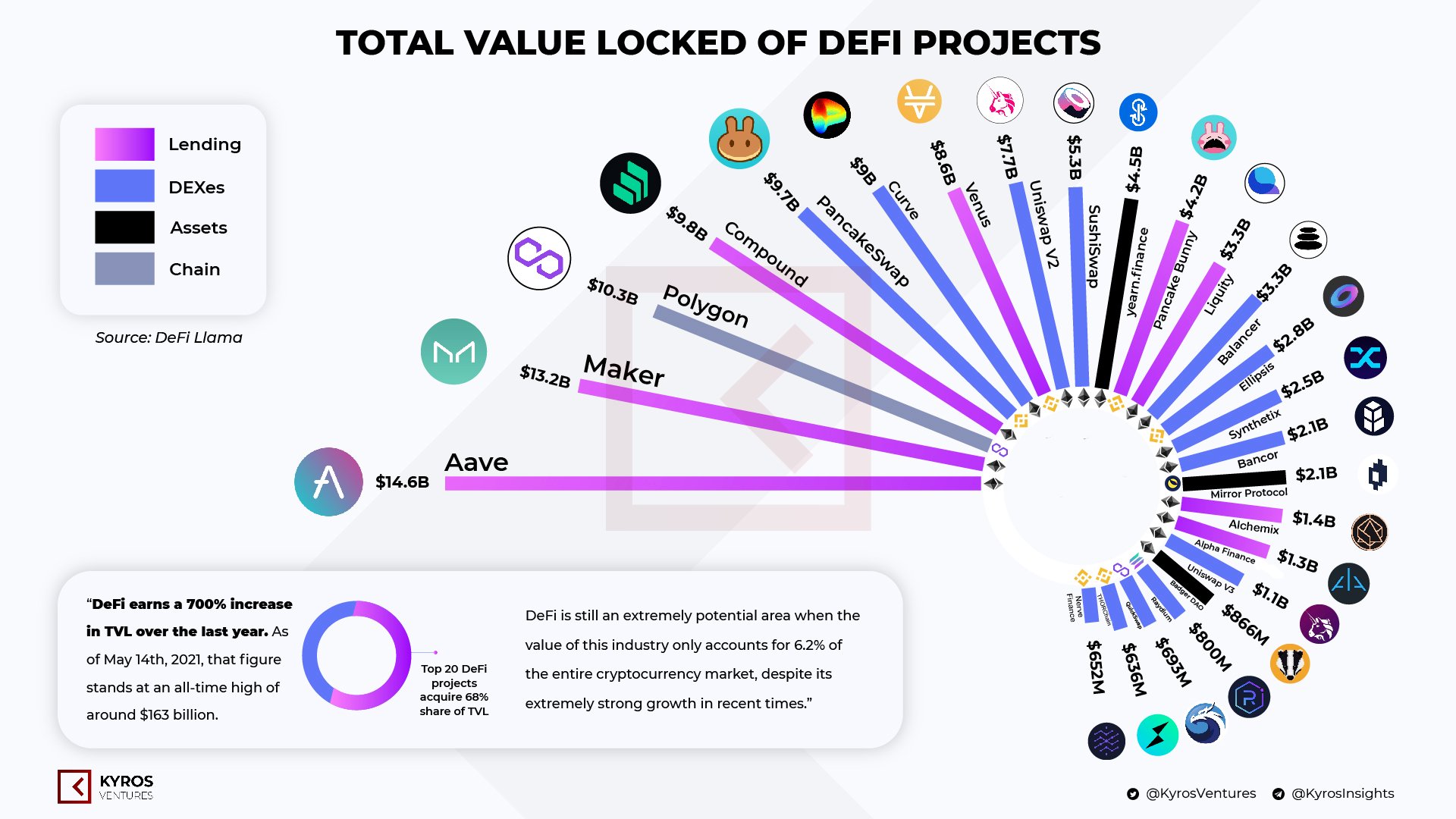

The believe in and effects attained by AVAX’s efforts have really caught the eyes of lots of of the market’s foremost pioneering platforms. Partnering with Aave and Curve to launch a $ 180 million DeFi attraction system is a prime instance. With the recent TVL, Aave and Curve are truly the primary giants of DeFi.

Even the major institutional traders had been convinced, “nodding” to give power to AVAX. The checklist of mid-sized traders investing income in Avalanche incorporates Polychain Capital, Three Arrows Capital, R / Crypto Fund, Dragonfly, CMS Holdings, Collab + Currency and Lvna Capital, with a complete investment worth of $ 230 million.

Great information@Polychaincap and Three Arrows Capital led a $ 230 million investment in the #Avalanche ecosystem to help the development of the platform.https://t.co/T141NFEOoIG

– Avalanche (@avalancheavax) September 16, 2021

Additionally, AVAX has acquired further help from significant worldwide well known exchanges. On August three, the to start with brick was laid by KuCoin, functioning with the platform to support accelerate the Avalanche ecosystem. Most not too long ago, Binance also announced that it will help Avalanche in carrying out network updates for AVAX.

#Binance Will help the @valancheavax $ AVAX Network updatehttps://t.co/Rm7ebdKSnL

– Binance (@binance) September 21, 2021

summary

AVAX at present possesses outstanding momentum, significant pieces are slowly appearing with a thicker frequency. It can be concluded that the ailments for a bigger breakthrough in the long term for AVAX are entirely entrenched in the long term.

Synthetic currency 68

Maybe you are interested: