- Pi Network sees volatility ahead of token release.

- July 1 event brings $215M worth of tokens.

- Active user growth despite market uncertainties.

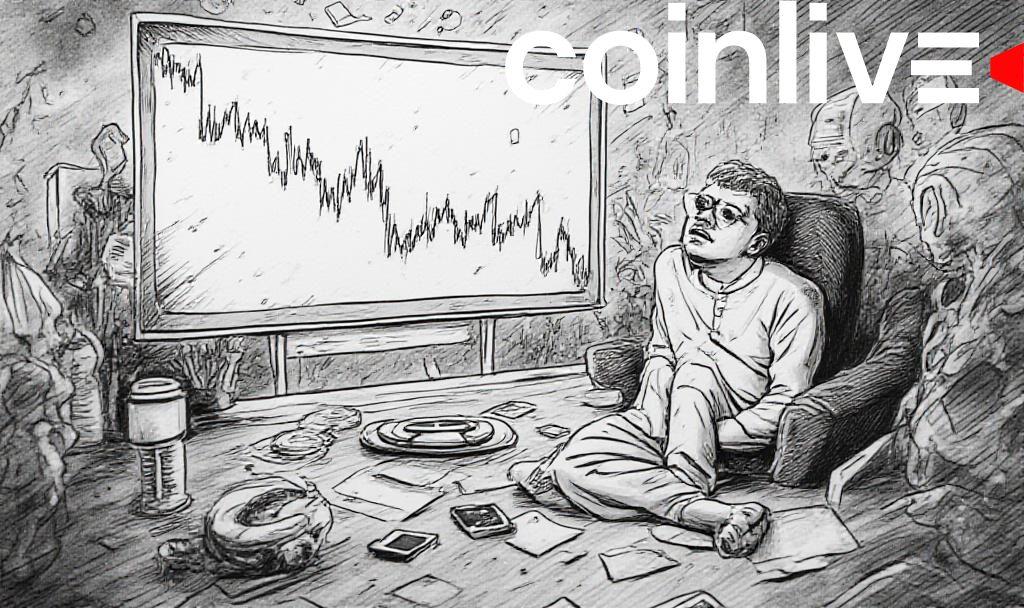

Pi Network’s upcoming token unlock is gaining attention due to its potential market impact, highlighting significant price changes and community reactions.

Impending Release and Market Concerns

The impending release of 40 million PI tokens is set to exert considerable pressure on the market, raising concerns over potential price declines. Recent PI token values have showcased volatility, primarily due to prior unlock events, highlighting a pattern of post-release price dips. Key leadership figures, including Dr. Nicolas Kokkalis, continue to oversee ecosystem developments, but have not addressed buy strategies directly. With over 13 million active users, the network grows steadily, despite lacking specific institutional investment announcements for PI accumulation.

Market Sentiment and Historical Trends

Crypto markets brace for the July unlock, fearing further price corrections following observed trends. Historical precedent suggests supply increases may outpace demand, creating bearish conditions. The Relative Strength Index indicates PI is in oversold territory, but signals for a reversal remain absent, marking a cautious investor outlook.

Observers anticipate liquidity shifts post-July 1, with expectations of increasing sell-off behavior. Investor sentiment heavily factors into potential market shifts, with community engagement maintaining momentum, but lacking substantial price catalysts. Pi Ventures’ initiatives signal ecosystem expansion, though without immediate financial influxes, market stabilization remains speculative.

Expert Opinions and Future Outlook

Recent activity around Pi Network indicates potential market turbulence ahead, with experts closely monitoring post-unlock developments. Historical data suggests caution, as liquidity impacts could significantly alter trading behaviors. Technological advancements and network growth underscore Pi’s potential, yet confirmed exchange listings or major updates could decisively influence its market dynamics.

It’s not just the increase in token supply that investors should be wary of, but also the broader market conditions influencing cryptocurrency dynamics.