While Bitcoin is normally viewed as the backbone of the crypto market, a single ought to never ever underestimate the part stablecoins perform in the market place.

Stablecoins are primarily the fiat currency of the crypto ecosystem and serve as the main liquidity supplier for the market place.

In viewing the crypto market place as a closed process containing only stablecoins and cryptocurrencies, the provide of stablecoins and their habits gets to be more and more critical. This is specially handy when analyzing Bitcoin’s efficiency, as the ratio concerning the two can indicate upside probable.

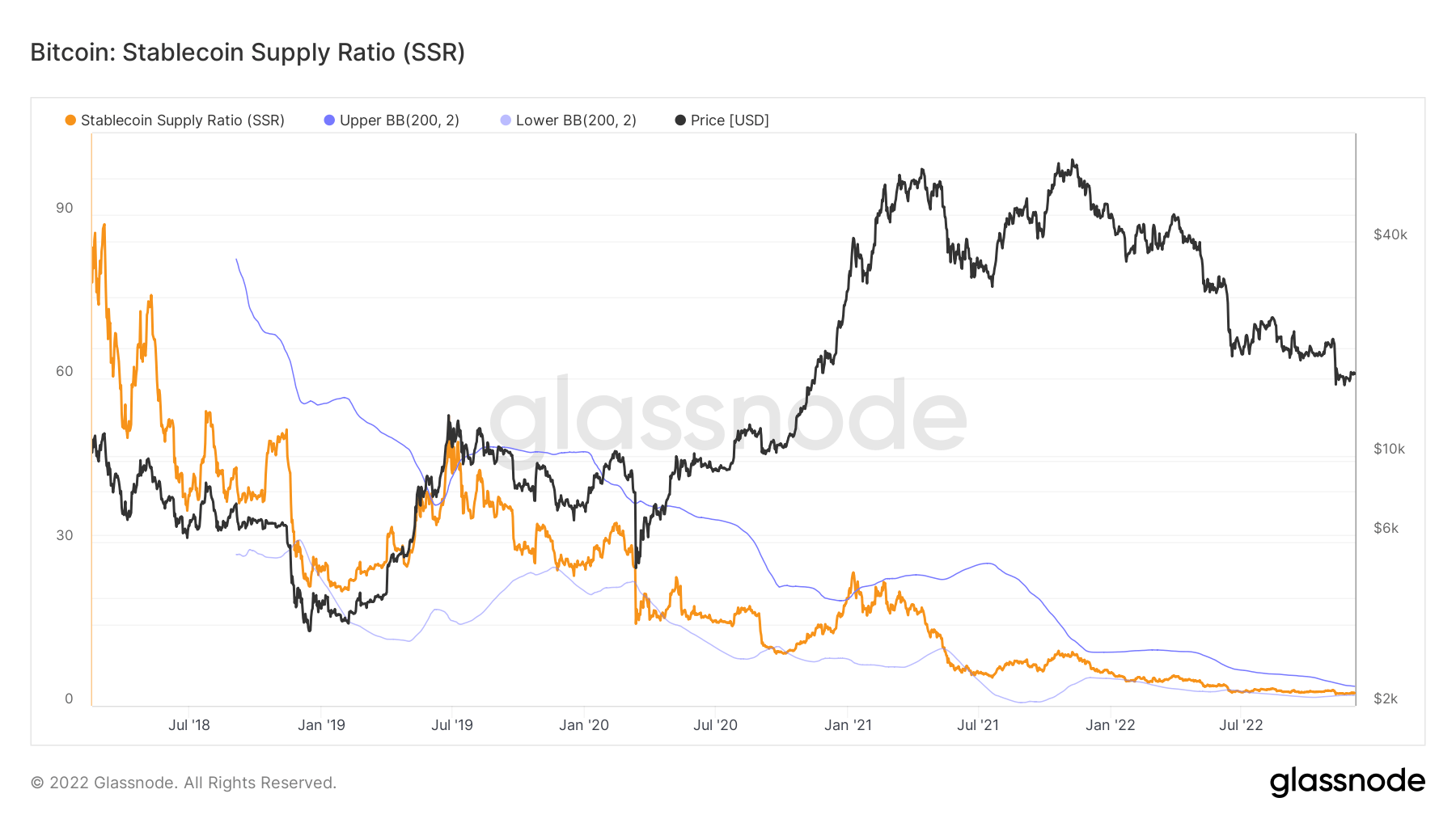

Stablecoin Supply Ratio (SSR) exhibits the ratio concerning Bitcoin’s circulating provide and stablecoin’s provide.

Any motion viewed in the SSR presents insights into what has far more fat in the market place — Bitcoin or stablecoins. The ratio mainly compares the energy state concerning the two.

When the SSR is higher, it signifies a reduced stablecoin provide when in contrast to Bitcoin’s market place cap. This suggests that there is very little purchasing stress in the market place, as there are fewer stablecoins (i.e. liquidity) hitting the market place. Low purchasing stress could indicate that the Bitcoin value could drop and be taken as a bearish indicator.

A reduced SSR suggests a higher provide of stablecoins when in contrast to Bitcoin’s market place cap. It is viewed as a bullish indicator as it exhibits extra liquidity waiting to be implemented into Bitcoin.

Seeing an maximize in SSR signifies a slowing down of acquiring energy, though a downtrend signifies an maximize in the acquiring energy of stablecoins.

Data analyzed by CryptoSlate exhibits that the SSR has been steadily reducing given that the starting of the yr. The ratio has viewed two close to-vertical declines this yr — after following the demise of Luna and the other due to the boom of FTX.

The ratio now stands at two.34, the lowest degree given that 2018.

The falling SSR is more confirmed by the quickly escalating stablecoin balances on exchanges.

Like the SSR, balances on exchanges demonstrate the volume of “untapped” liquidity that lies on the margins of centralized exchanges. According to information from glass buttonstablecoin stability on exchanges has grown exponentially given that January 2021. And even though it has plummeted in the weeks following the fall of Luna and the aftermath of FTX, its uptrend stays proceed during the yr.

As of December six, far more than $42 billion of stablecoins are sitting on centralized exchanges. This suggests that there is about $42 billion of liquidity on the sidelines, prepared to be deployed into cryptocurrencies like Bitcoin.