It can be mentioned that in the latest ecosystems, Ethereum is nevertheless the greatest identify with the productive launch of Ethereum two., which marks a key turning level. Let’s get a seem back at a 2022 Ethereum in this write-up!

See a lot more:

Ecosystem overview

2022 is a difficult yr for the Crypto market place in standard and the Ethereum ecosystem in specific. Facing strain from a declining market place, declining end users and income movement, as properly as competitors from new entrants, Ethereum is nevertheless reaping success.

After a lot of testnets, in September 2022, Ethereum officially deployed The Merge effectively. This update assists Ethereum transition from PoW to PoS, building it a “cheaper” blockchain for every person. Removing miners assists the network eat significantly less power, so the reward for validators on PoS will also be reduced than the reward for miners. This when mixed with burning mechanism of EIP-1559 assists make an helpful deflation for ETH.

As of right now (December seven, 2022), the quantity of ETH burned has reached a lot more than two.seven million ETH, which is really worth above $eight.seven billion at the latest exchange fee. This is a pretty extraordinary quantity.

Cash movement info

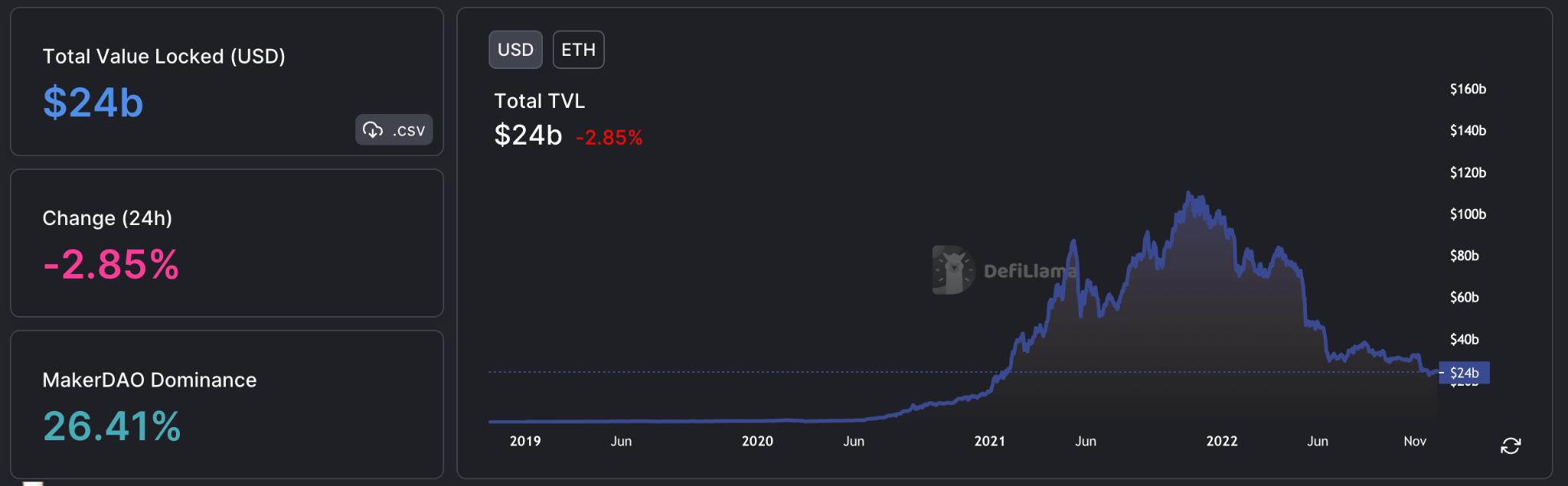

Since it reached ATH in late 2021, TVL on Ethereum has decreased by about 76.92% (from $104B to just $24B). If we get the milestone from the start out of 2022, that figure is 74.eight% (down from $95.four billion, now just $24 billion).

We will dive into evaluating Ethereum to other ecosystems:

| Ecosystem | A reduce from ATH TVL

(Data 07/twelve/2022) |

| Ethereum | 76.92% |

| BSC extension | 76.45 |

| Close | 83.seven% |

| Avalanche | 93.two% |

| Polygon | 89.three% |

Thus, in terms of five common ecosystems, the TVL reduction of Ethereum and BSC is very similar and reduced than that of ecosystems this kind of as Near, Polygon and Avalanche.

chain pursuits

User

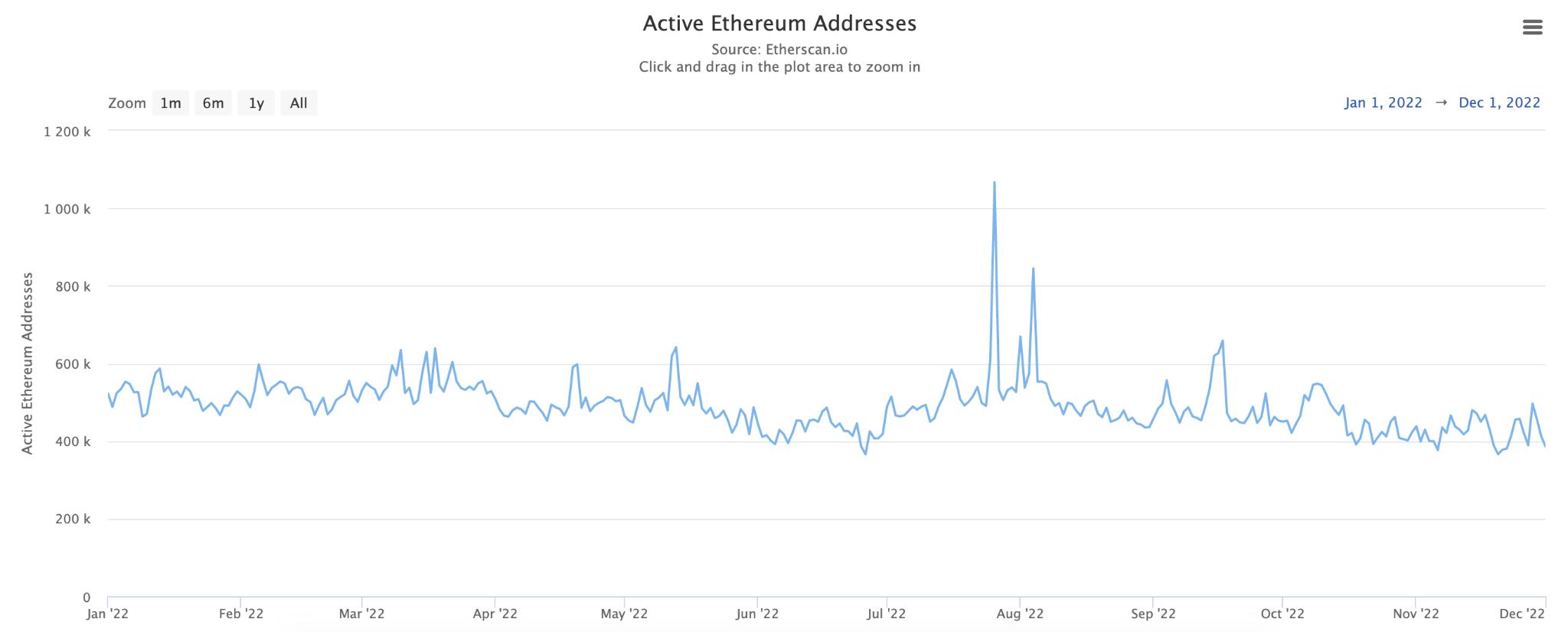

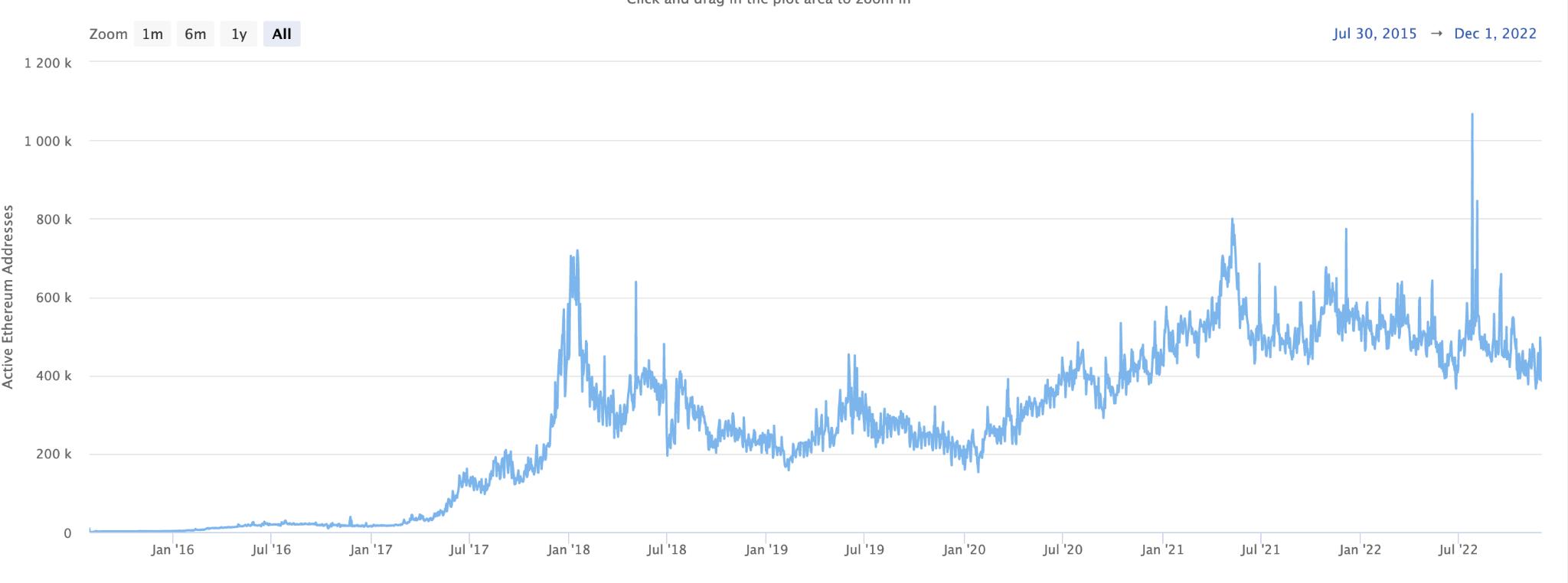

In 2022, Ethereum did a very good work of retaining end users when the quantity of energetic wallets per day usually held regular at close to 500,000 wallets per day, the quantity of energetic wallets also greater Sudden surge in July-September 2022 (induced by the market place fomo occasion The Merge.

If we zoom out a bit, the Daily Active Wallet chart on Ethereum would seem like this:

You can see various from the ecosystems I’ve analyzed like Near or Avalanche, the quantity of energetic Ethereum wallets maintained an “uptrend” for the duration of the creation of ATH in July 2022 regardless of market place woes. This displays that the Ethereum group nevertheless understands how to entice end users and income movement.

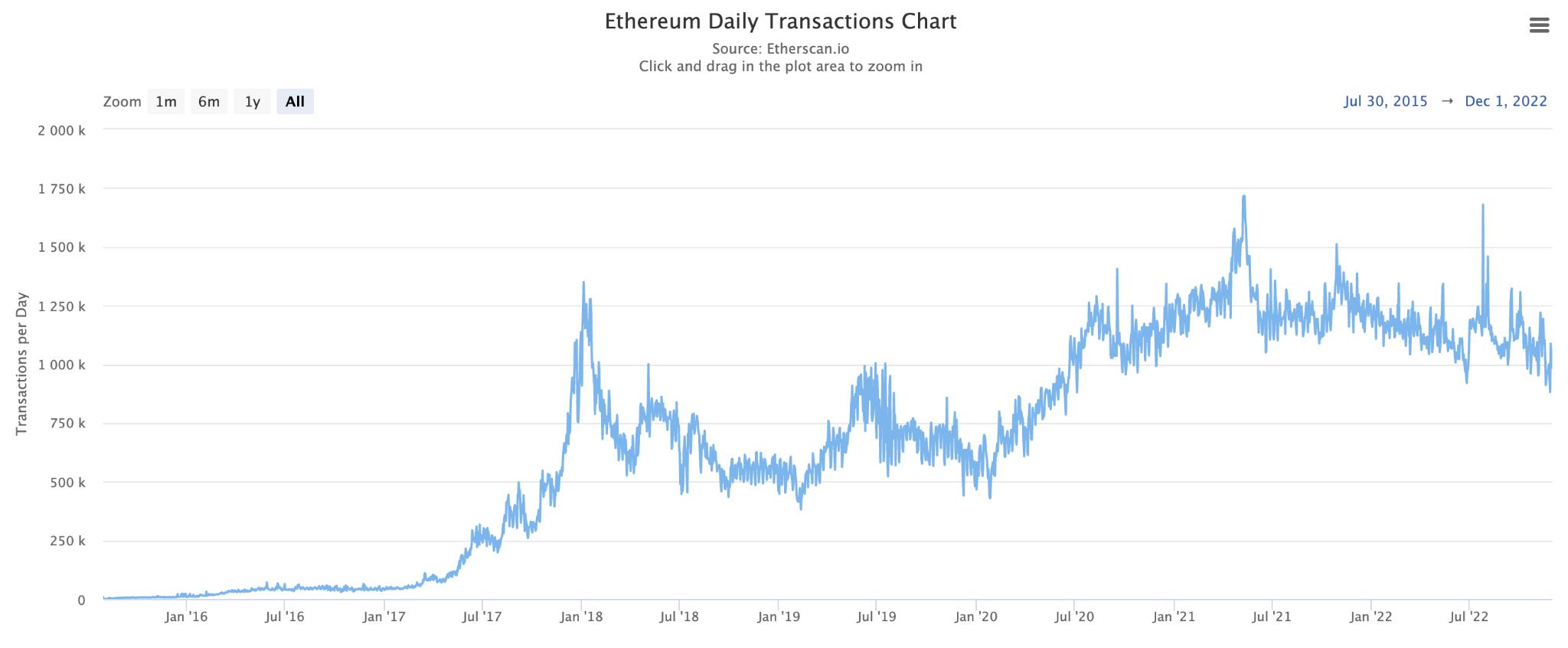

Related to the quantity of energetic wallets, the quantity of Ethereum transactions is also flat in 2022. Overall, the quantity of Ethereum transactions is nevertheless going through very good development.

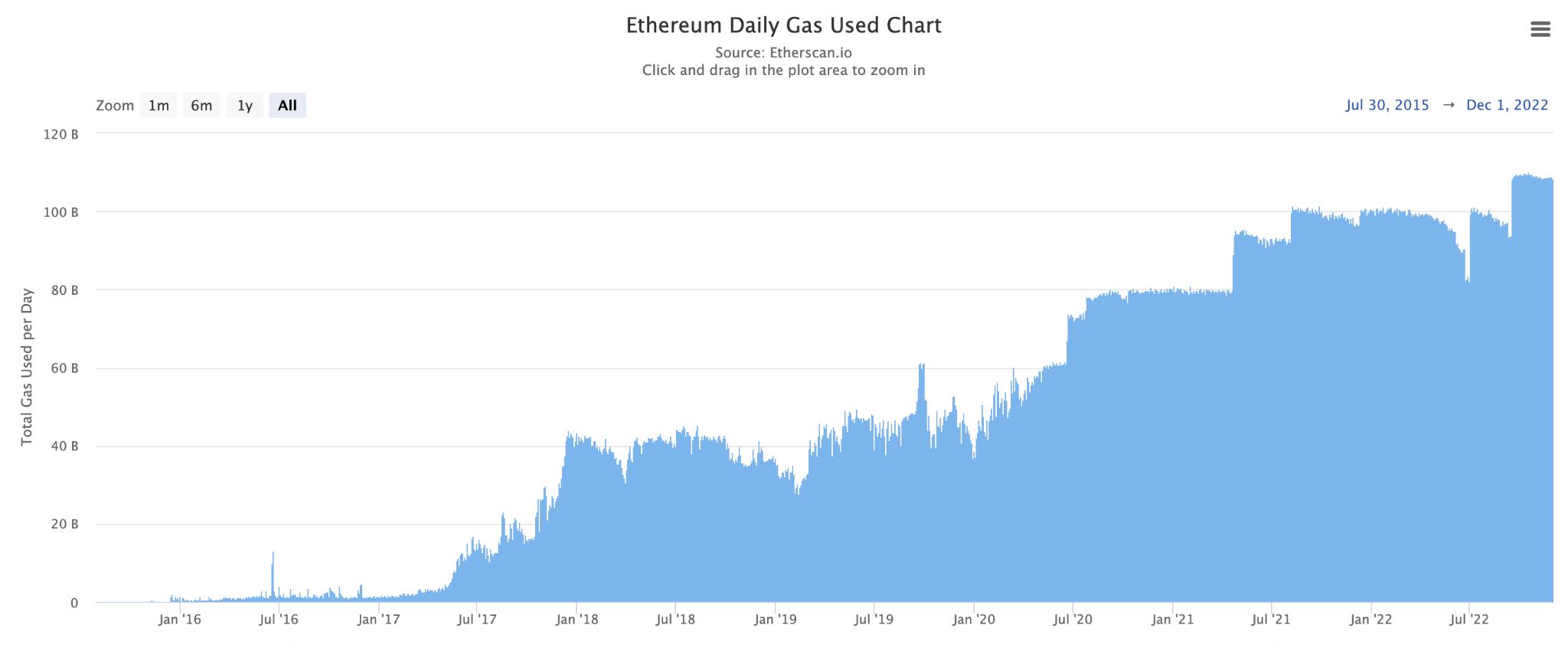

Thanks to the over success, even though gasoline fees have been considerably reduced considering that The Merge, the complete quantity of gasoline utilised per day on Ethereum is nevertheless rising, bringing very good revenues to the undertaking.

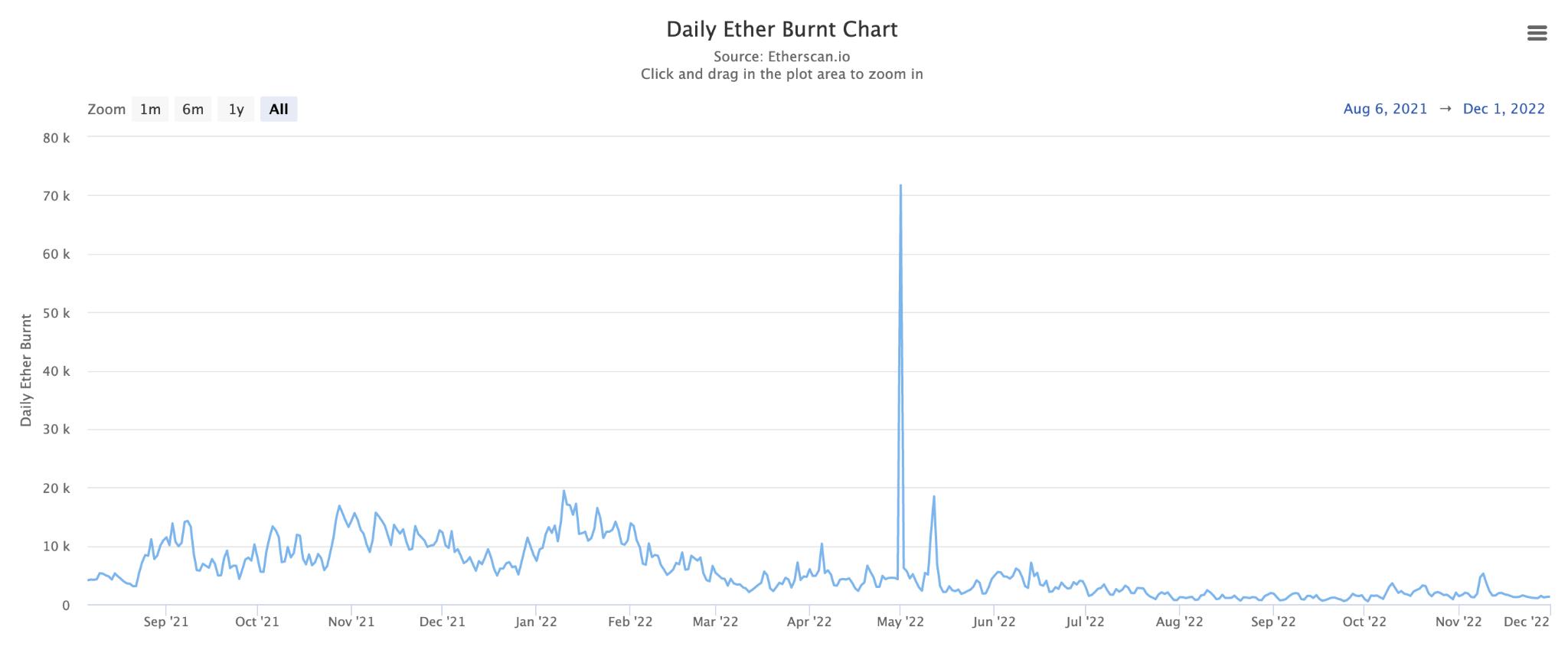

We also are unable to mention the constructive results of EIP-1559 and The Merge in ETH deflation. As described over, the quantity of ETH burned is really extraordinary. You can observe the Daily ETH Burnt Chart appropriate under:

Except for the peak in May 2022, the normal quantity of ETH burned per day in standard stays relatively secure. Since July 2022, the quantity of ETH burned per day has been reduced than ahead of. This arises for the following factors:

- ETH transaction volume has decreased considering that the starting of the yr.

- Cost of gasoline per transaction has decreased considering that The Merge => significantly less ETH burned.

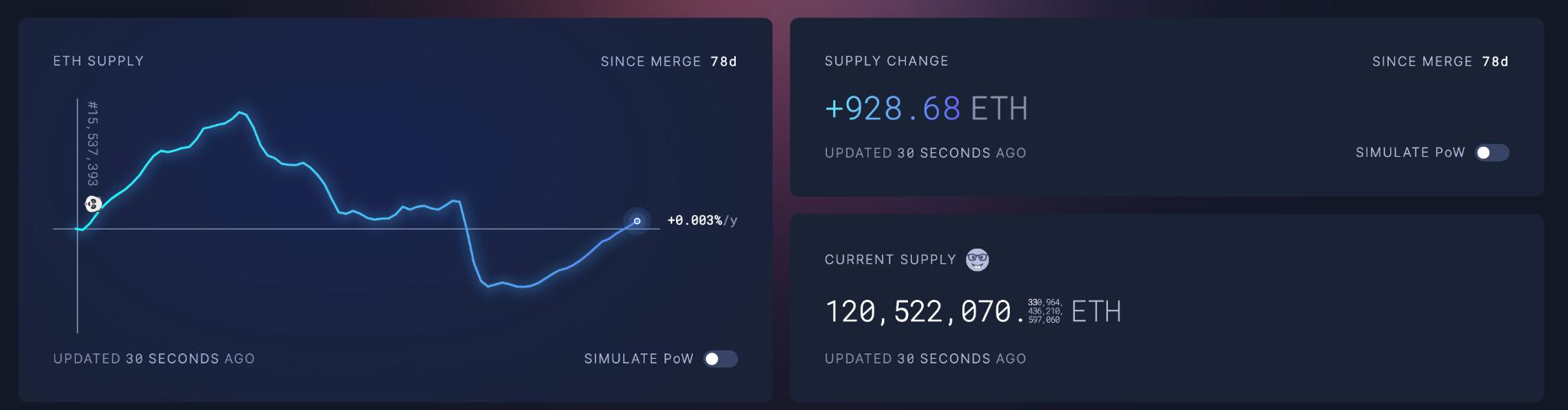

As you can see, considering that the implementation of The Merge, the complete provide of ETH has decreased drastically and there was a level wherever it went from inflation to deflation. This is a pretty constructive indicator.

Since The Merge, ETH has officially had an inflation fee of only .003%/yr, reduced than BTC’s inflation fee (one.716%/yr) and its very own inflation fee when utilizing PoW (three.578%/yr)/ 5).

Analysis of the pieces of the Ethereum puzzle

DeFi

DEX

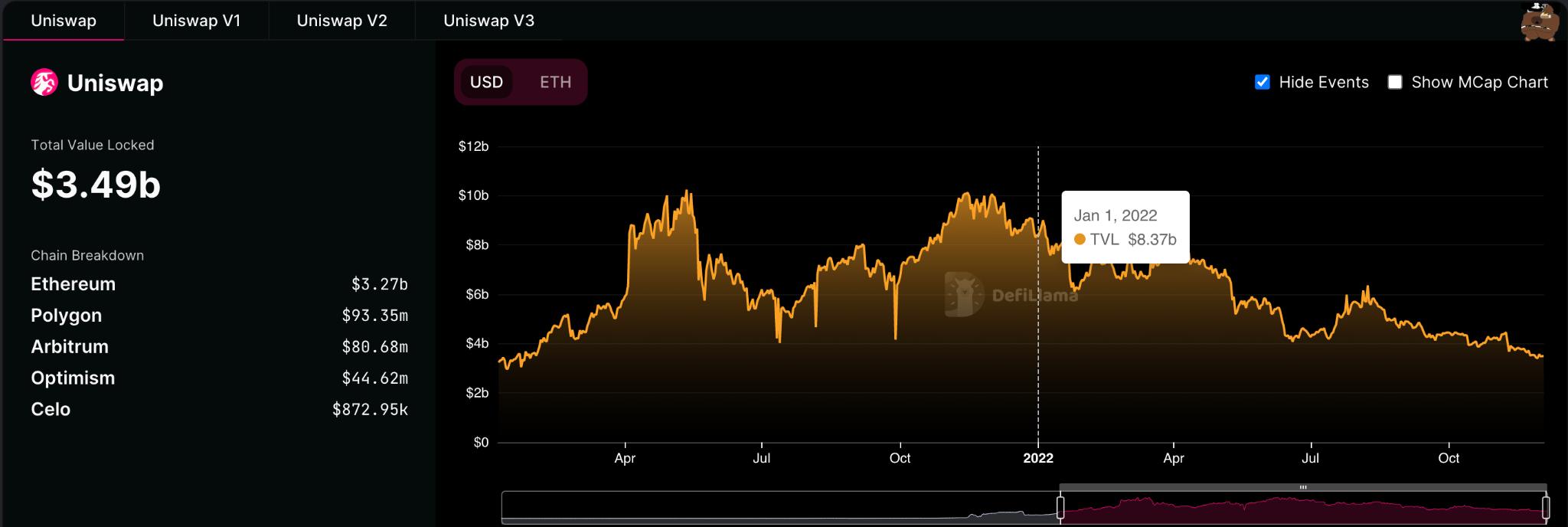

Of program, we’ll speak about it uniswap First when it comes to the DEX array on Ethereum. Uniswap nevertheless maintains its place as the #one DEX in the market place.

The latest TVL on Uniswap is about $three.five billion. Compared to the starting of 2022, Uniswap’s TVL recorded a decline of 58.one%. When in contrast with the general fee of decline of the whole Ethereum technique (74.four% yr-to-date), it is clear that Uniswap maintains considerably much better income movement than the general normal.

TVL on Uniswap primarily focuses on Ethereum, a bigger aspect belongs to Layer-two which are Polygon, Arbitrum and Optimism. Despite the multichain implementation, TVL on other chains is negligible.

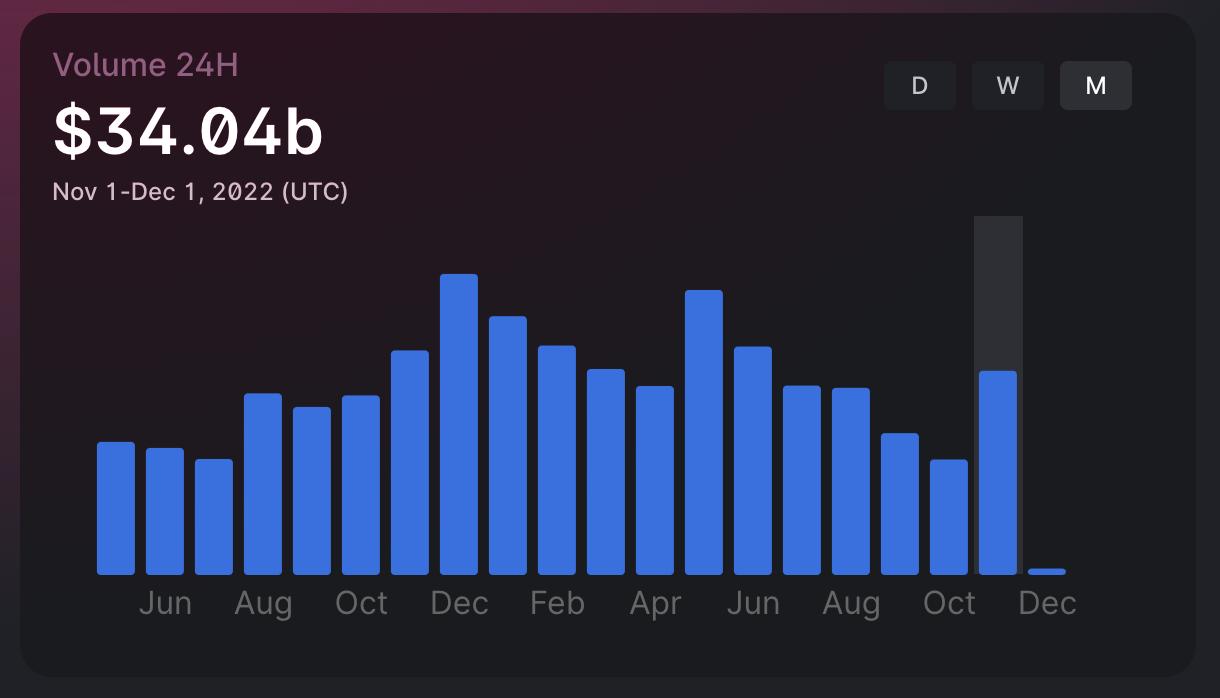

According to statistics, Uniswap’s normal transaction volume on Ethereum alone in 2022 (as of December three, 2022) is about $33.9 billion per month. Currently, Uniswap is nevertheless the greatest decentralized exchange by volume, accounting for about 33.three% of the complete trading volume of the decentralized exchanges.

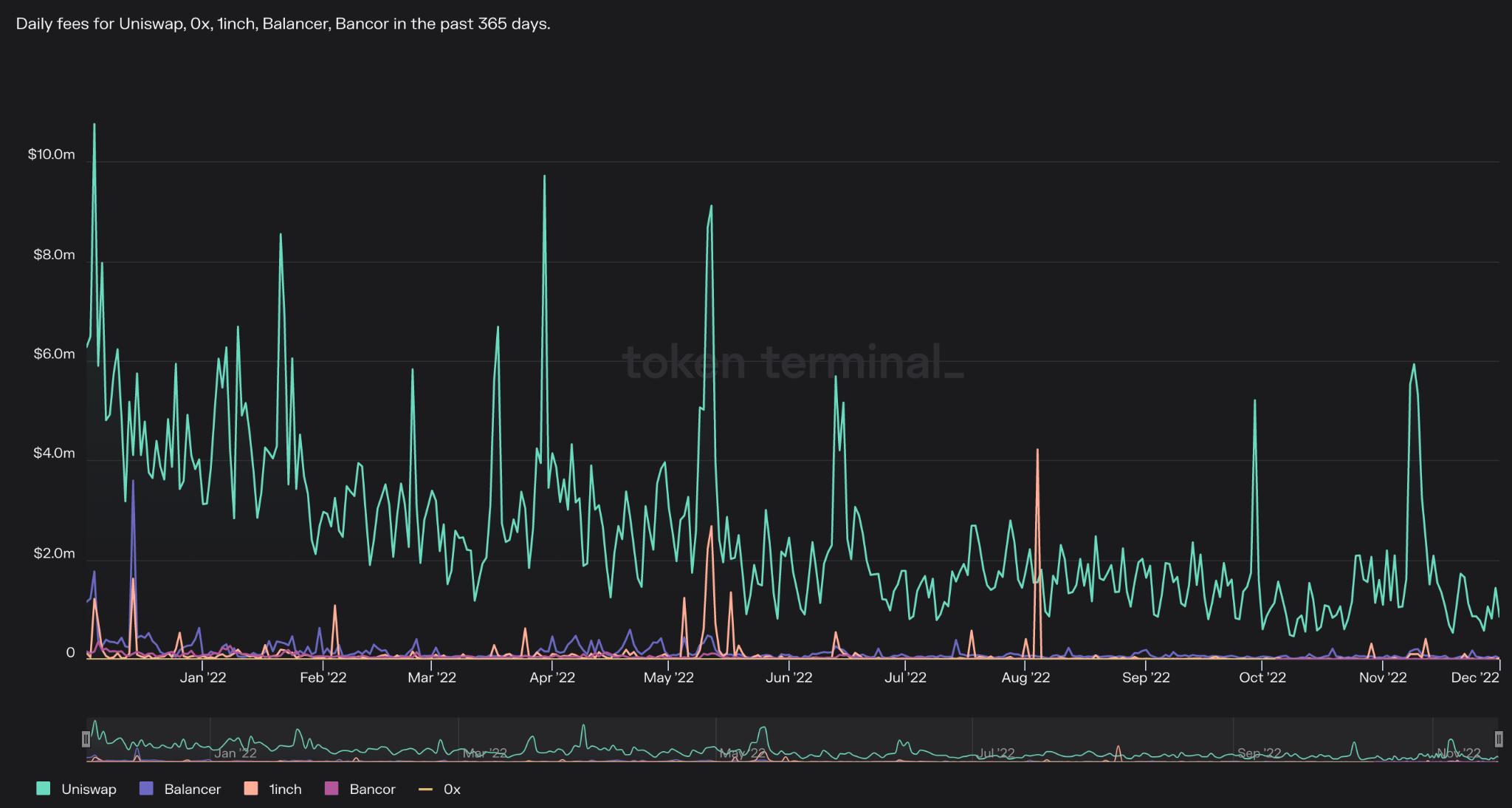

Uniswap’s superiority is evident if you seem at the graph of charges created by decentralized exchanges. Uniswap is entirely superior to other rivals like Balancer, 1inch, Bancor or 0x.

Recently, Uniswap has also officially announced that it will assistance NFT trading by the advancement of a new NFT Marketplace. With end users out there, the launch of an supplemental NFT Marketplace will support Uniswap entice a lot more trading volumes and be in a position to compete with platforms this kind of as OpenSea.

Besides Uniswap, Ethereum also has other top quality DEXs like Curve or Balancer. Recently, Curve also ideas to launch the stablecoin crvUSD and the LLAMMA merchandise. Balancer also has some aggressive edge with impermanent reduction optimization. These are all very good tasks that you can proceed to pursue on Ethereum.

Loan

MakerDAO is presently nevertheless the highest TVL lending undertaking on Ethereum with a worth of up to $six.seven billion. We will analyze collectively how this protocol functions.

As you can see, there are presently virtually five.eight billion DAI borrowed out of a complete of seven.47 billion DAI that can be borrowed at most.

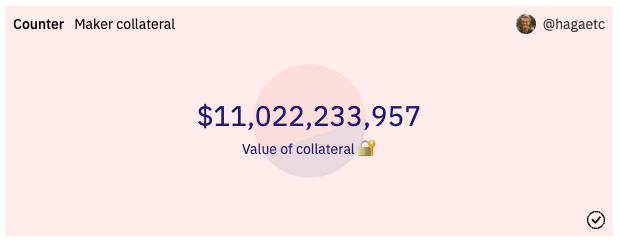

Next, we will be interested in the capital efficiency of DAI. To determine the capital efficiency of DAI, I use the complete collateral information on Dune’s MakerDAO.

Therefore, the capital efficiency of DAI will be five.eight/eleven ~ 52.seven%. In truth, this is a effectiveness that I take into consideration pretty very good, since:

- DAI can nevertheless make a revenue, as evidenced by liquidity pools that nevertheless have an acceptable APY. This is entirely various from the BenQi Avalanche undertaking that I reviewed in the prior publish.

- Ensuring the protection of the protocol: As a lending platform, in the context of a bear market place, MakerDAO will bear a lot more liquidation possibility due to a reduce in the worth of the collateral. Maintaining the loan-to-ensure ratio at a risk-free degree is crucial in the latest surroundings.

Besides MakerDAO, AAVE is also a undertaking that we need to have to mention. While TVL is no much better than MakerDAO, AAVE nevertheless has practically $four billion really worth of assets locked into the protocol. According to information on DefiLlama, the complete quantity borrowed on AAVE is $one.98 billion. Therefore, AAVE’s capital efficiency is also rather very good at close to 50%. The prime three most borrowed assets on AAVE are Ethereum ($630M), USDC ($479M) and USDT ($231M).

Liquid staking

Lido Finance is nevertheless a family identify occupying the top place of this merchandise niche. Although influenced by a lot of phrases details of 3AC and Celsius mid-yr, but now the Lido nevertheless maintains secure operation.

Currently, the quantity of ETH staking by way of Lido has reached four.78 million ETH, which is equivalent to above $six billion.

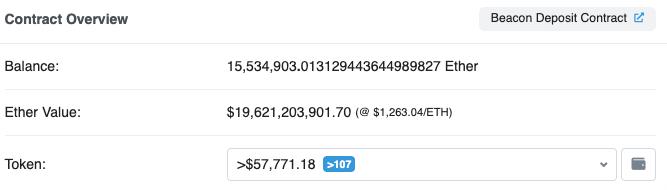

Let’s get a seem at the complete quantity of ETH deposited in Beacon Chain to participate in staking

Thus, Lido accounted for practically ⅓ of ETH staking in ETH two.. This is a pretty extraordinary quantity. From right here, you can get an additional essential note: the health and fitness of the Lido will drastically have an effect on ETH two..

GameFi

Previously, Ethereum has never ever been the promised land for GameFi tasks since the expense of a transaction is “too expensive”. With the current updates, let us analyze no matter if the GameFi array on Ethereum is much better?

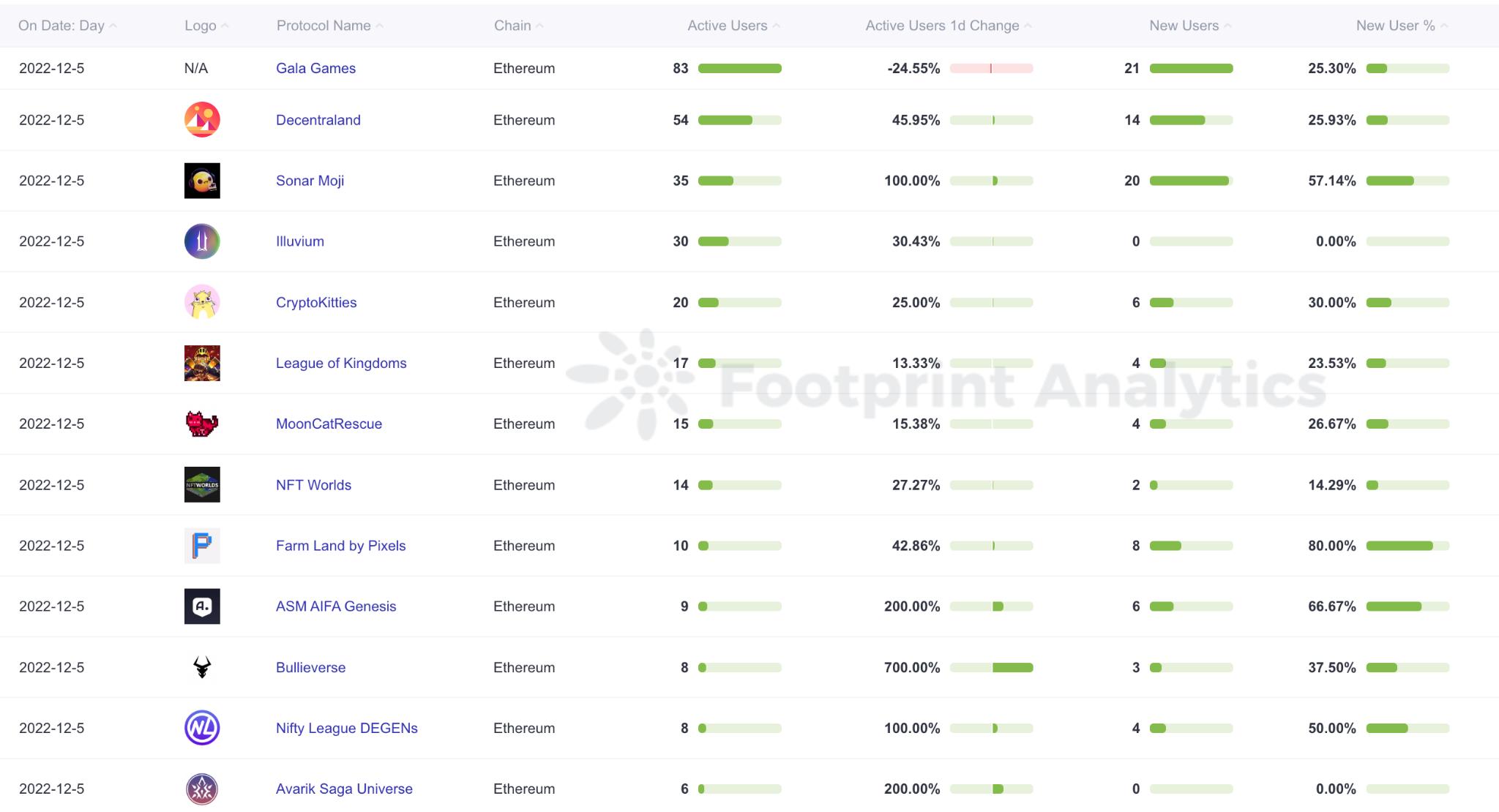

First, let us seem at some information from common video games on the Ethereum platform:

You can see that the quantity of energetic end users of game tasks on Ethereum is pretty “scary”, only a couple of to a couple of dozen people today are energetic just about every day. If we take into consideration the quantity of new end users (end users…