As 1 of the greatest ecosystems in the market place now, backed by the initial exchange, BNB Chain (formerly acknowledged as Binance Smart Chain) has usually been trusted by several traders and consumers. Faced with the troubles of 2022, will BNB Chain even now keep its growth? Let’s uncover out with me in this report!

Overview of the ecosystem of the BNB chain

Binance Smart Chain is an ecosystem made by Binance, the exchange that is at this time even now in the best place in the cryptocurrency market place. Although it formulated later on than other ecosystems, given that its launch Binance Smart Chain has swiftly attracted funds flows, tasks and consumers to its ecosystem, climbing and strongly getting the best two ecosystem, just behind Ethereum.

February 2022, BNB Chain is the new identify of Binance Smart Chain and Binance Chain, two blockchain platforms launched by the greatest cryptocurrency exchange Binance in 2019 and 2020. The over identify transform determination, as explained by the group behind BNB Chain, is to verify that they are no longer tied to the Binance exchange, as nicely as demonstrate their connection to the BNB token and make this coin a device. network transfer.

Operational state of the ecosystem

Cash movement facts

Since it reached ATH in late 2021, TVL on BNB Chain has decreased by around 80.98% (from $21.56B to practically $four.1B). If we consider the milestone from the get started of 2022, this figure is 66% (from $twelve.08 billion now to $four.one billion). If you study the report A seem back at Ethereum in 2022you will see that the TVL decline of BNB Chain and Ethereum is fairly comparable and reduce than that of other ecosystems this kind of as Avalanche, Near or Polygon.

chain routines

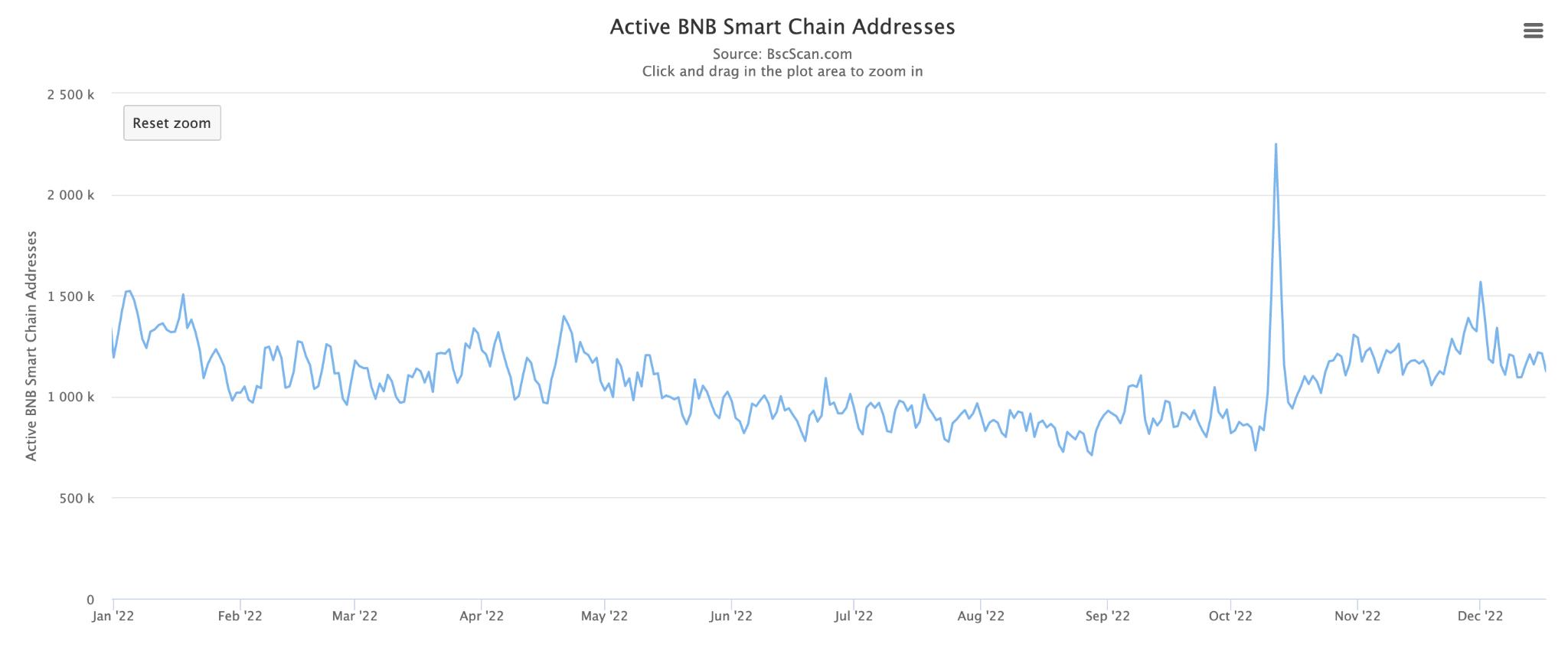

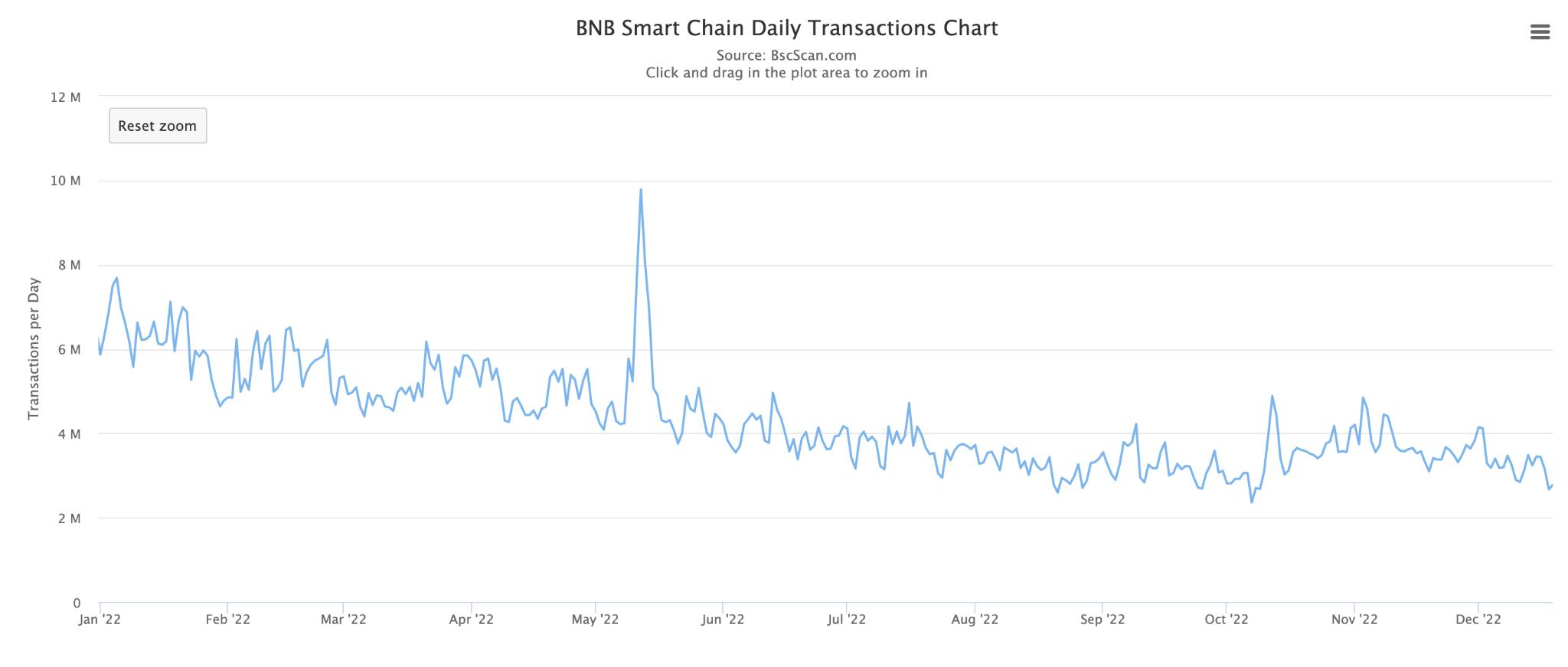

In 2022 BNB Chain did a fantastic occupation of consumer retention when the quantity of energetic wallets per day usually remained secure at an typical of close to 800,000 wallets/day, This quantity is improved than Ethereum.

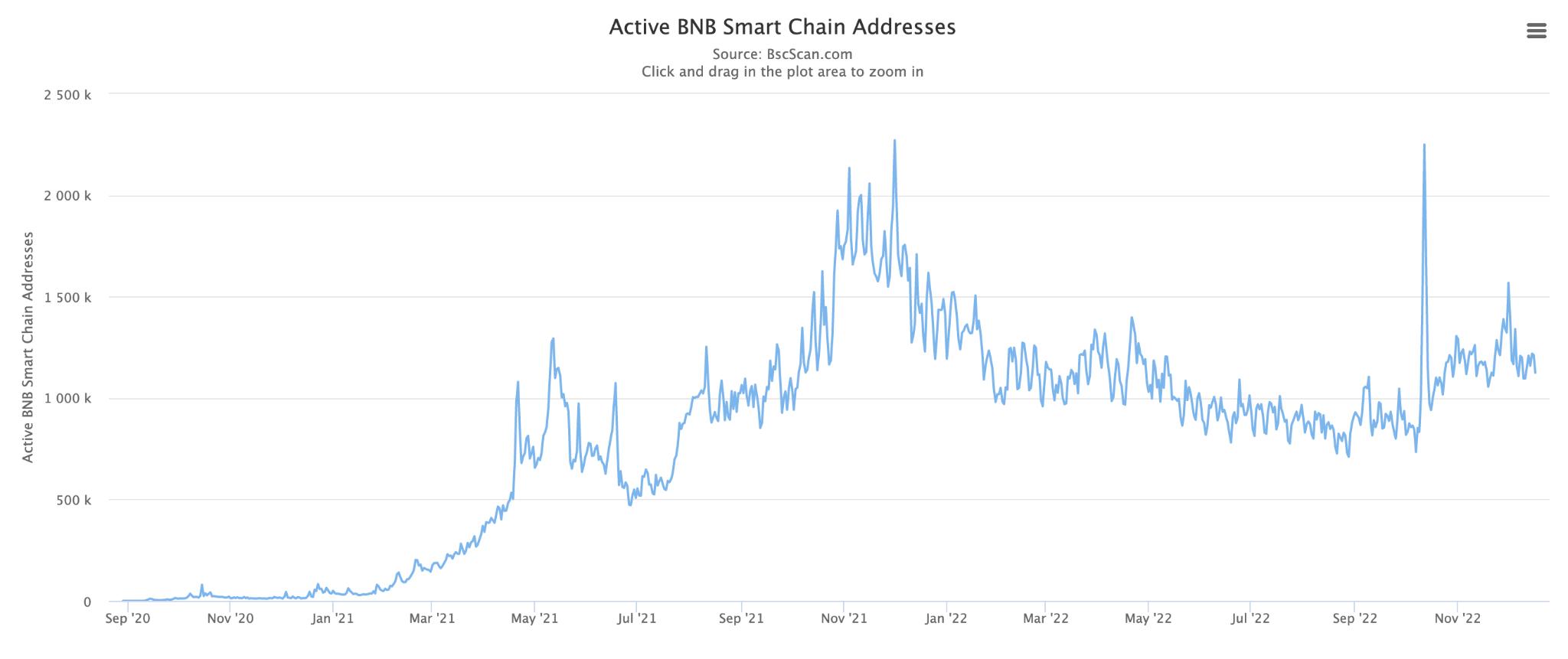

If we zoom out a bit, the everyday energetic addresses graph on Binance Smart Chain would seem like this:

You can see diverse from the ecosystems I’ve analyzed as Close Beautiful Avalanchethe quantity of energetic wallets on BNB Chain maintains a fantastic extended-phrase upward trend.

While preserving a fantastic quantity of energetic wallets, the quantity of transactions executed per day on BNB Chain is even now beneath significant stress recording a decline from seven.five million transactions per day to only close to two.seven million transactions per day (equivalent to a reduction of about 64%). This decline is not difficult to realize when nearly all market place niches like Defi, Gamefi, NFT or even IDO are dealing with several troubles and it is nearly tricky to make a revenue => consumers no longer interested in participating.

Analysis of the pieces of the puzzle on BSC

DeFi

DEX

PancakeSwap is at this time even now the quantity 1 DEX on BNB Chain with superior TVL and trading volume.

The existing TVL on PancakeSwap is around $two.two billion. Compared to the get started of 2022 ($five.58 billion), PancakeSwap’s TVL is now down about 60%. This reduction is equivalent to UniSwap (about 58%) and greater than other native-dex this kind of as TraderJoe or Ref Finance.

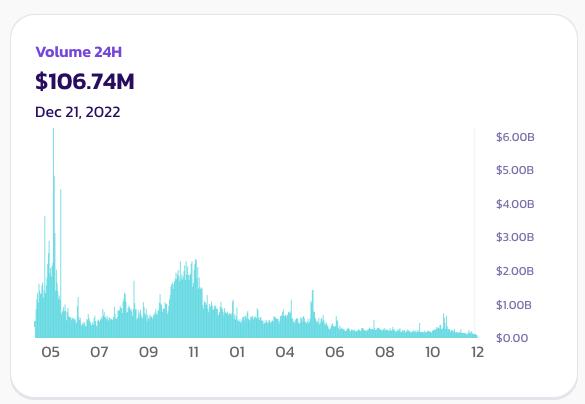

Currently, TVL on Pancake even now mostly focuses on BNB Chain. This DEX is implementing multi-chain on Aptos and Ethereum but did not get considerably impact. The trading volume on Pancake has decreased substantially given that the starting of 2022, at this time holding around additional than one hundred million USD per day.

For a additional in-depth seem at PancakeSwap, you can study the report PancakeSwap and efforts to retain consumers.

Loan

Venus is even now the undertaking with the excellent TVL Lending on BNB Chain with additional than USD one billion, of which the quantity utilised to lend is around USD 432.five million, which is around 43% of the complete TVL.

The most borrowed assets on Venus contain USDT, USDC, BUSD, BNB… Currently, the APY degree when giving loan assets on Venus falls amongst two% and five%.

In terms of capital efficiency, Venus Protocol is carrying out fairly nicely at close to 43% efficiency. Other foremost lending protocols like MakerDAO or AAVE are only marginally improved at 52% and 50% overall performance.

Liquid staking

Ankr is at this time the #one staking answer on BSC with a TVL of close to $73M. This quantity is even now really modest in contrast to the complete worth of staked BNB.

According to information on BNB Chain, the complete worth of staked BNB at the time of creating is around $five.seven billion. Therefore, the quantity of BNB staking through Ankr’s answer represents only .0013%. This is a really, really tiny quantity. This demonstrates that liquid staking options on BNB Chain are even now not really dependable. Furthermore, we should also mention the “centralization” issue of BNB, a coin heavily dominated by CZ and Binance.

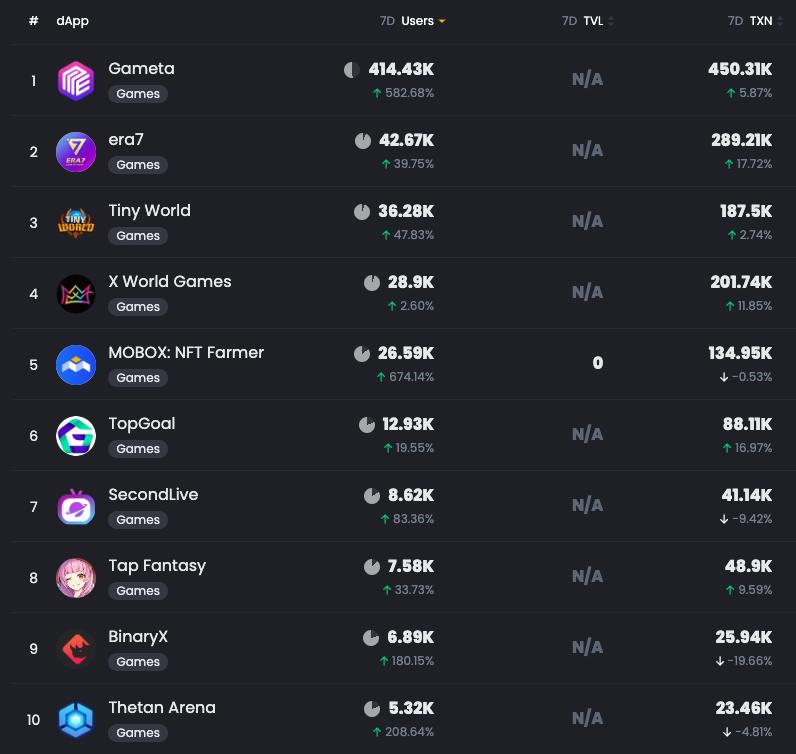

GameFi

With the benefit of lower transaction charges, rapidly transaction processing pace, and a big quantity of consumers, GameFi has usually been 1 of the quickest increasing parts of BNB Chain.

You can see that BNB Chain totally dominates the complete quantity of consumers and energetic consumers in contrast to other ecosystems.

Although GameFi is no longer a trend, thanks to its strengths, BNB Chain even now maintains a secure consumer base, attracting additional new tasks to its ecosystem.

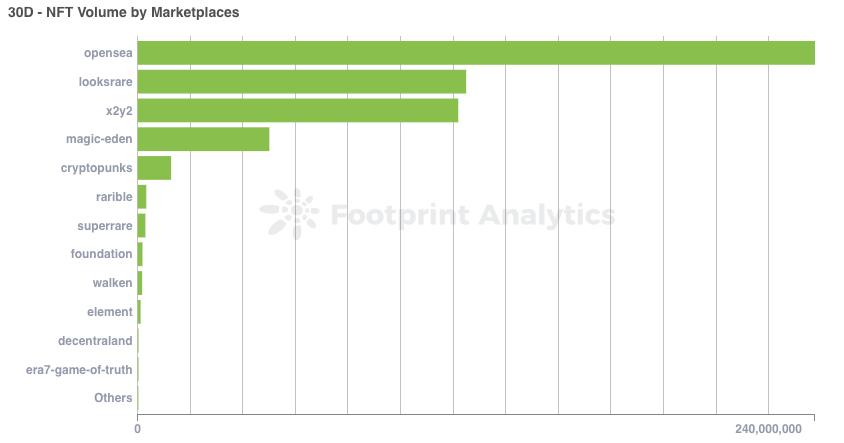

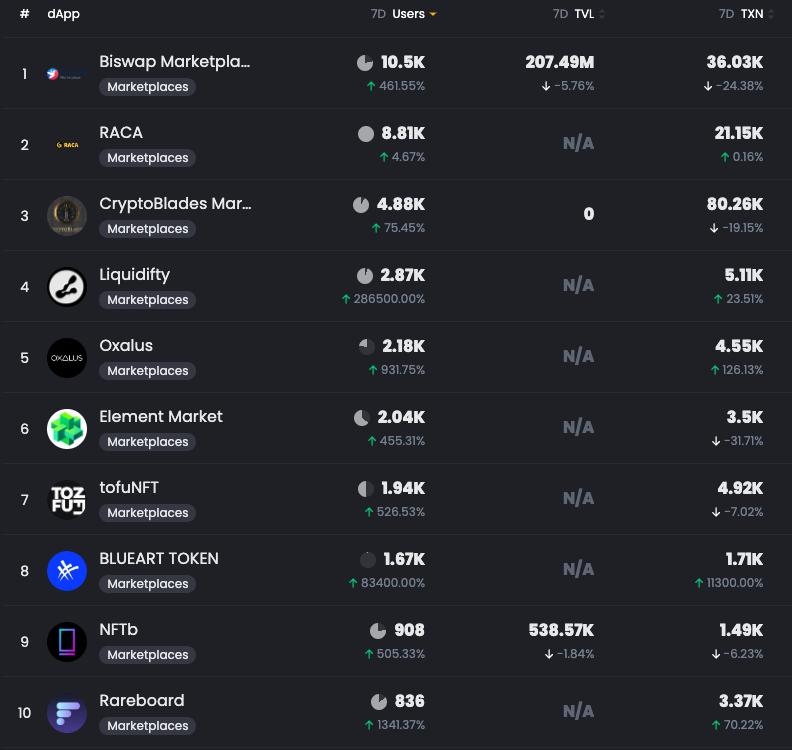

NFTs

Unlike Ethereum, NFT on BNB Chain is mostly formulated based mostly on GameFi (video games with trading, obtaining, offering goods, characters) rather than based mostly on well known collections. So in 2022, when GameFi has a great deal of troubles, goods are heavily discounted, NFT on BNB Chain is also owning a great deal of troubles.

You can observe the thirty-day greatest trading volume of the NFT markets beneath:

You can see that the best belongs to OpenSea, LooksRare or x2y2, all of which are marketplaces on Ethereum, the best four is Magic Eden, a marketplace platform on Polygon. BNB Chain only has Marketplace Element on best but the volume is not as well important.

secure coins

Currently, the complete capitalization of stablecoins on BSC reaches $9.26 billion, of which BUSD accounts for additional than 51%.

If you shell out shut awareness, you will see that there have been hefty withdrawals of stablecoins recently. The root bring about for this comes from the issues of prior consumers the fuds that CZ and Binance have suffered in the previous. Currently, the condition has stabilized and the movement of dollars has stopped withdrawing from BNB Chain.

Some significant updates and occasions

Despite the gloomy 2022, nevertheless, the BNB Chain group continues to preserve creating the ecosystem with notable updates:

- Sidechain launch: According to facts from the BNB Chain group, they are creating and establishing a BAS (BNB Chain Application Sidechain) answer to assistance alleviate the stress of transaction processing on the core network. BAS will do the job comparable to Ronin of Axies, DOT’s parachain…

- Launch of very own Oracle answer: This is viewed as a move to assistance Binance and BNB Chain include a hugely significant piece of infrastructure to their ecosystem. If effective, BNB Chain will proceed to have a basis to establish Defi, NFT or Gamefi in a improved way, though currently being much less reliant on external options like ChainHyperlink.

In addition to the optimistic information, BNB Chain also fell victim to hacks in 2022 with The incident was attacked with a reduction of $586 million: On Oct. six, BNB Chain grew to become the hottest identify to be hacked, stealing up to $586 million. BNB Chain then had to carry out a difficult fork to resolve the challenge and resolve the protection. Also, as I described over, the fuds linked to the Binance exchange also have a great deal of influence on BNB Chain.

The last

From the over evaluation, we can draw the following conclusions:

(one) BNB Chain has not had as well several key upgrades, but thanks to the strengths readily available (rapidly transaction processing pace, lower expense, big local community), this ecosystem continues to carry out nicely in contrast to other nascent ecosystems and maintains the best place two .

(two) Native tasks like PancakeSwap, Venus… even now run rather stably and carry out improved than rivals in other ecosystems. A tiny unfavorable level is that the remaining tasks on BNB Chain are dropping the means to compete with the over tasks, leaving consumers with fewer selections. Liquid staking has very little prospective on BNB Chain.

(three) GameFi is even now a sturdy level in contrast to other ecosystems, in particular in contrast to BNB Chain’s direct competitor, Ethereum. However, NFTs on BNB Chain are not really important in contrast to collections on Ethereum.

(four) The announcement of its sidechain answer and Oracle demonstrates BNB Chain’s target of getting an independent growth ecosystem, as nicely as its ambition to broaden in the extended phrase. (with sidechain, BNB Chain has confirmed to be prepared for additional consumers, funds flows and transactions).

(five) Despite struggling a great deal of crashes and fuds, BNB Chain has proven its “strength”…