Analysts are praising the likelihood of the US Securities and Exchange Commission approving applications for Ethereum ETF futures.

A researcher suggests acquiring ETH rather of BTC just before the SEC approves the ETF

According to the cryptocurrency marketplace evaluation company Research K33Ethereum (ETH) is possible to overtake Bitcoin (BTC) following the US Securities Commission (SEC) releases approval outcomes in mid-October.

Vetle Lunde, an analyst at K33, explains that the value of ETH could advantage from the SEC’s green light to ETF futures asset registration requests and probably come ahead of Bitcoin ETF futures. Furthermore, the evaluation of property charges on the raise of 60% in the preceding 3 weeks First Bitcoin futures ETF accredited two many years in the past.

In mid-August, Bloomberg signaled a substantial likelihood SEC to Approve Ethereum Futures ETF Proposals have been announced concurrently in the previous, which include Volatility stocks, bitwise, Roundhill, VanEck, grayscale, Direction, ProSharesAND Valkyrie. But this information has not confirmed something nevertheless.

The US Securities and Exchange Commission has so far only manufactured a level License for the Bitcoin futures ETF series in October 2021 and nonetheless continues to say no to spot ETFs, saying this marketplace lacks adequate policies to guard ordinary traders.

Meanwhile, the Bitcoin spot ETF asset class is viewed rather positively by analysts, with a 75% probability of approval following Grayscale’s current win towards the SEC. Even if it fails this yr, analysts predict the probability of a spot Bitcoin ETF launching just before the finish of 2024 is as substantial as 95%.

Analyst Lunde commented:

“It appears that the market is underestimating the potential impact of a spot Bitcoin ETF. The approval of a spot ETF will attract capital inflows from outside, creating significant buying pressure for BTC. Conversely, if the spot Bitcoin ETF is rejected, nothing changes.”

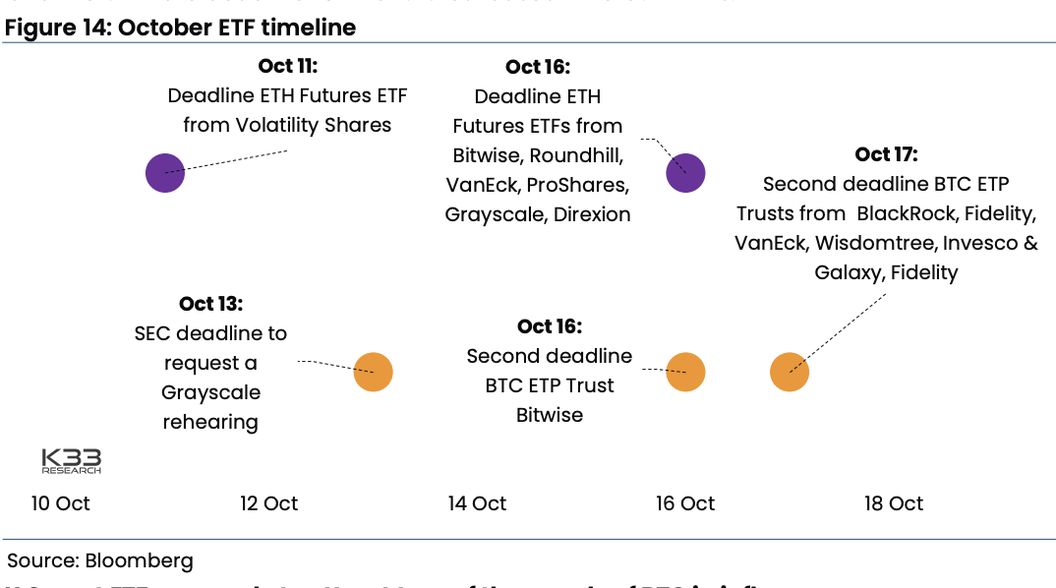

Returning to the ETH futures ETF, the SEC has deadlines of October eleven-17 to make choices concerning the approval, denial or delay of applications for ETH futures ETFs. This is the time period that traders need to have to shell out awareness to for the reason that it will influence asset charges.

ETH is now priced at USD one,629, recovering from a reduced of one,550 on Aug. 18, which was the currency’s lowest degree due to the fact March 2023.

ETH value fluctuations in the 1D frame on Binance

ETH value fluctuations in the 1D frame on Binance

Coinlive compiled

Join the discussion on the HOTTEST difficulties of the DeFi marketplace in the chat group Coinlive Chats with the administrators of Coinlive!!!