What is the Trader Joe Project?

Merchant Joe is a DeFi platform initially regarded as DEX – AMM created on Blockchain Avalanche Network. Currently, Trader Joe has finished just about all the functions initially targeted.

Get in depth info on Trader Joe here

Trader Joe Features Overview What is Trader Joe?

- Trade: Exchange of tokens

- Pool: Page that offers liquidity for DEX

- Farm: The web page makes it possible for the return of the Farm LP token

- Loan: Loan and loan pools consider area

- Pole: Bet JOE to get xJOE and earn commissions from the platform exercise

- Zap: Exchange JOE for LP tokens

Trading directions over on Trader Joe

Step one: Metamask and Avalanche C-chain settings in detail right here. Then you withdraw AVAX from the Binance exchange to the Metamask wallet.

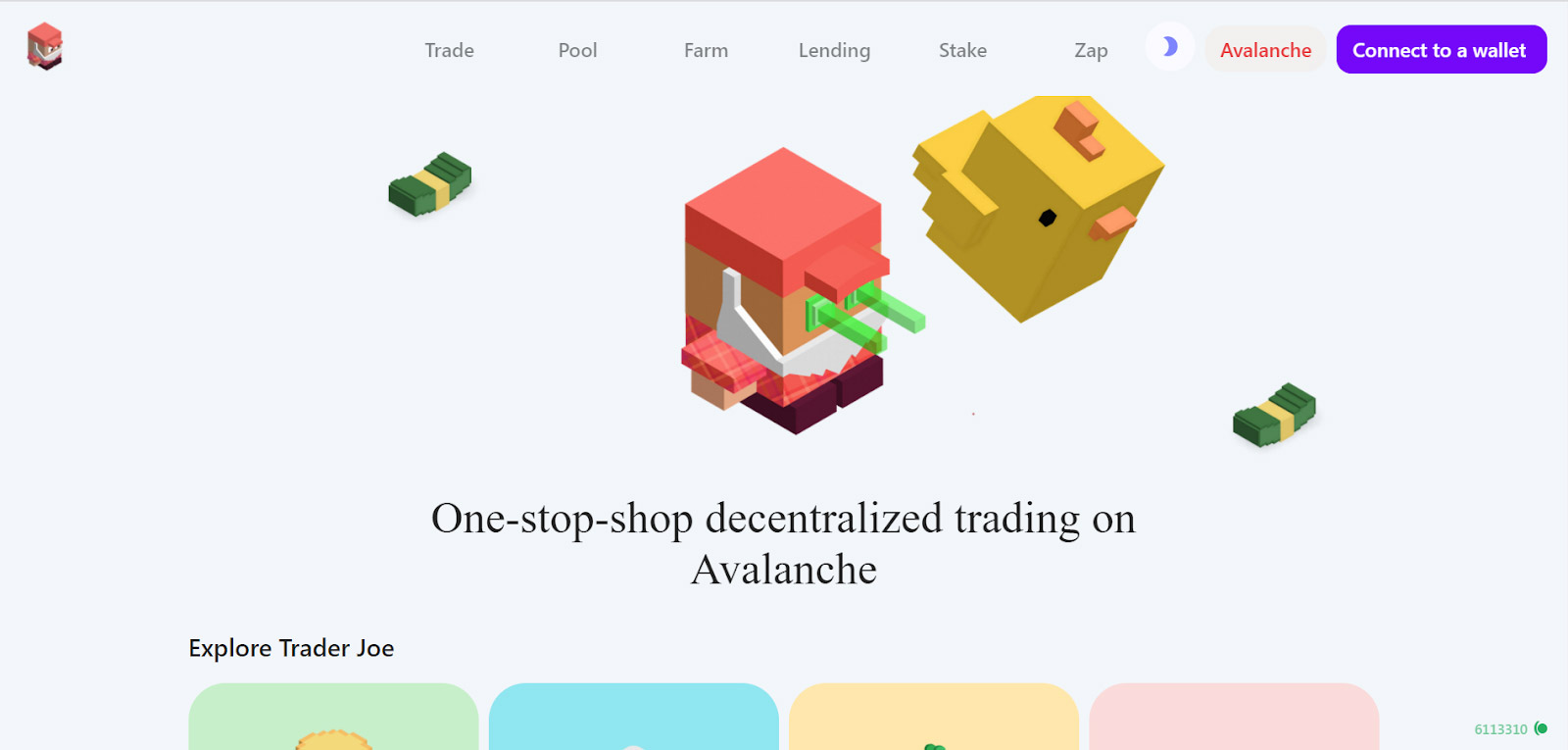

Step two: Log into the site here: https://traderjoexyz.com/#/home

Step three: to press “Connect to wallet” and connect to Metamask.

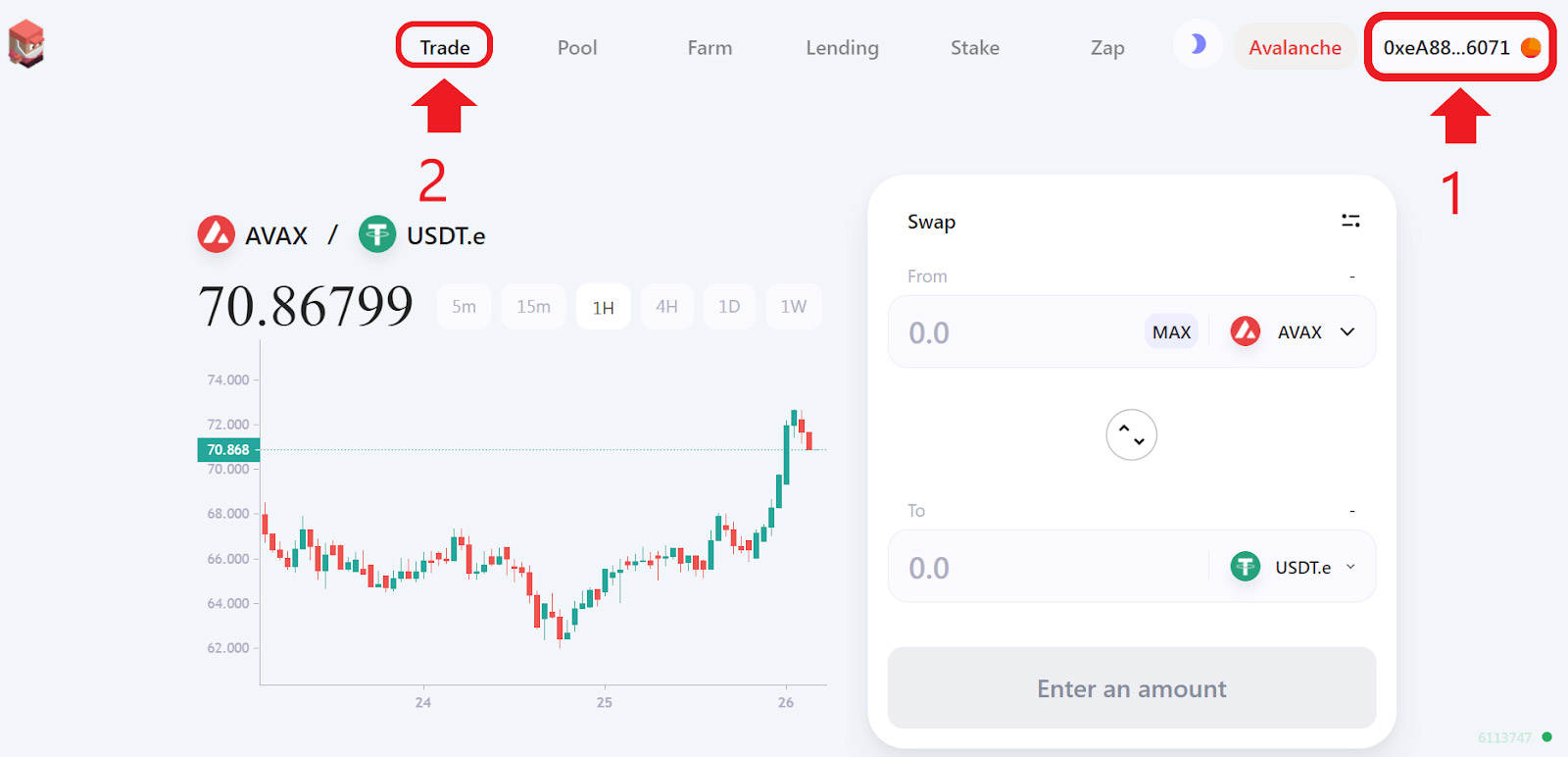

So decide on “Trade” to go to the transactions area as proven over. Then set the quantity of token pairs you want to trade. In this illustration AVAX and JOE

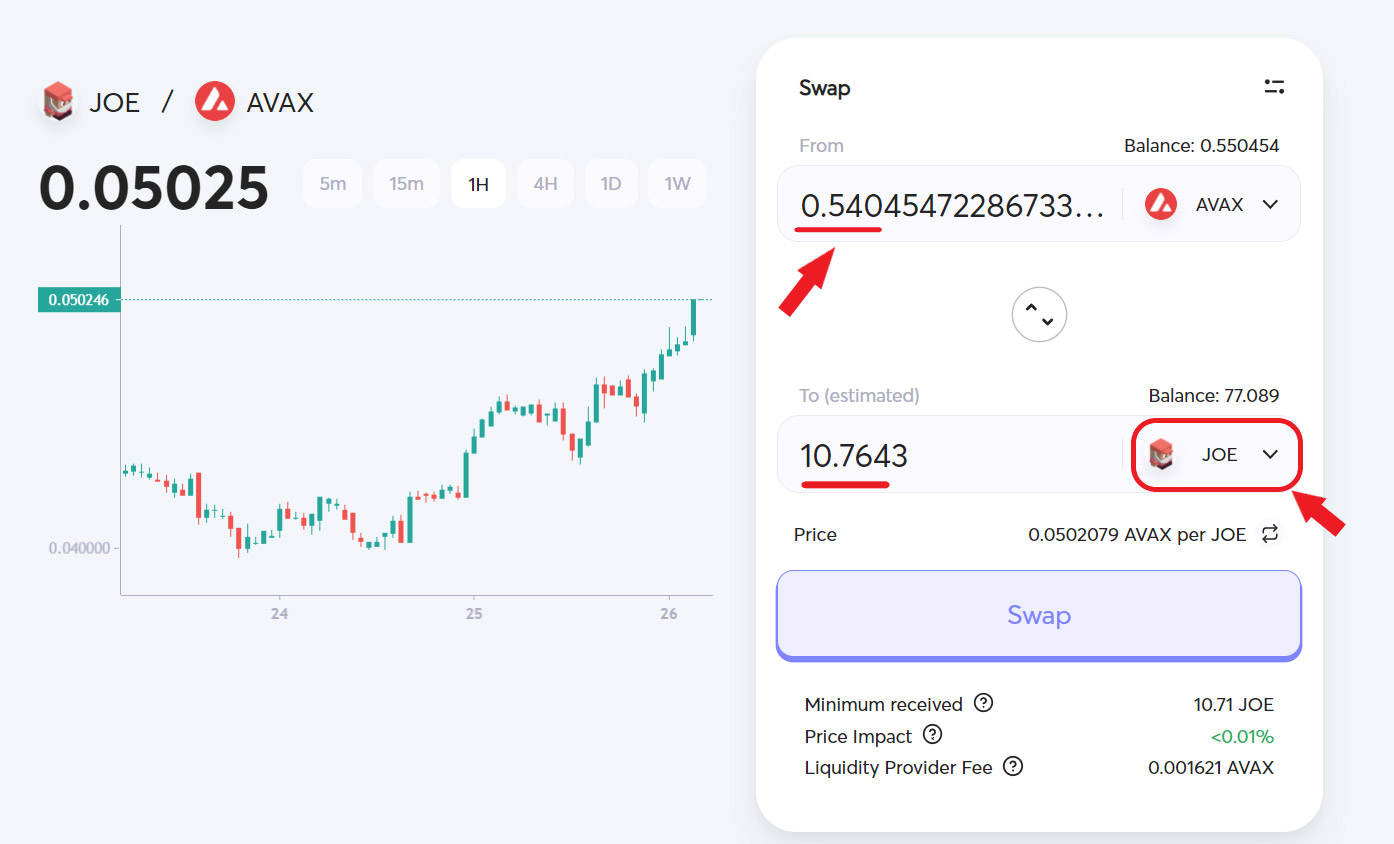

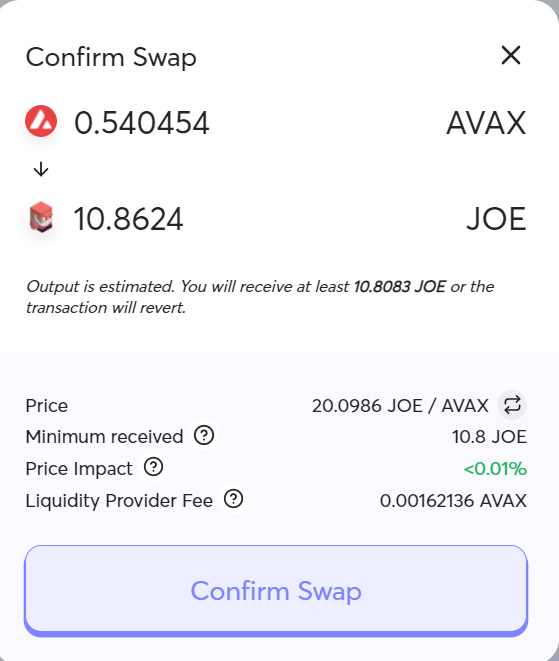

Select the style of token you want to trade ideal beneath the Balance area. Enter the amount or prizes “maximum” in the area “From” is .05404 AVAX, the technique will determine the converted quantity as ten.7643 JOE. Next click “Exchange”.

Step four: Show amount confirmation calculation, transaction charge is .0162136 AVAX. Then click “Confirm trade” once more.

Then the Metamask wallet displays the exchange verification request as finished.

Liquidity Pool Trading Guide

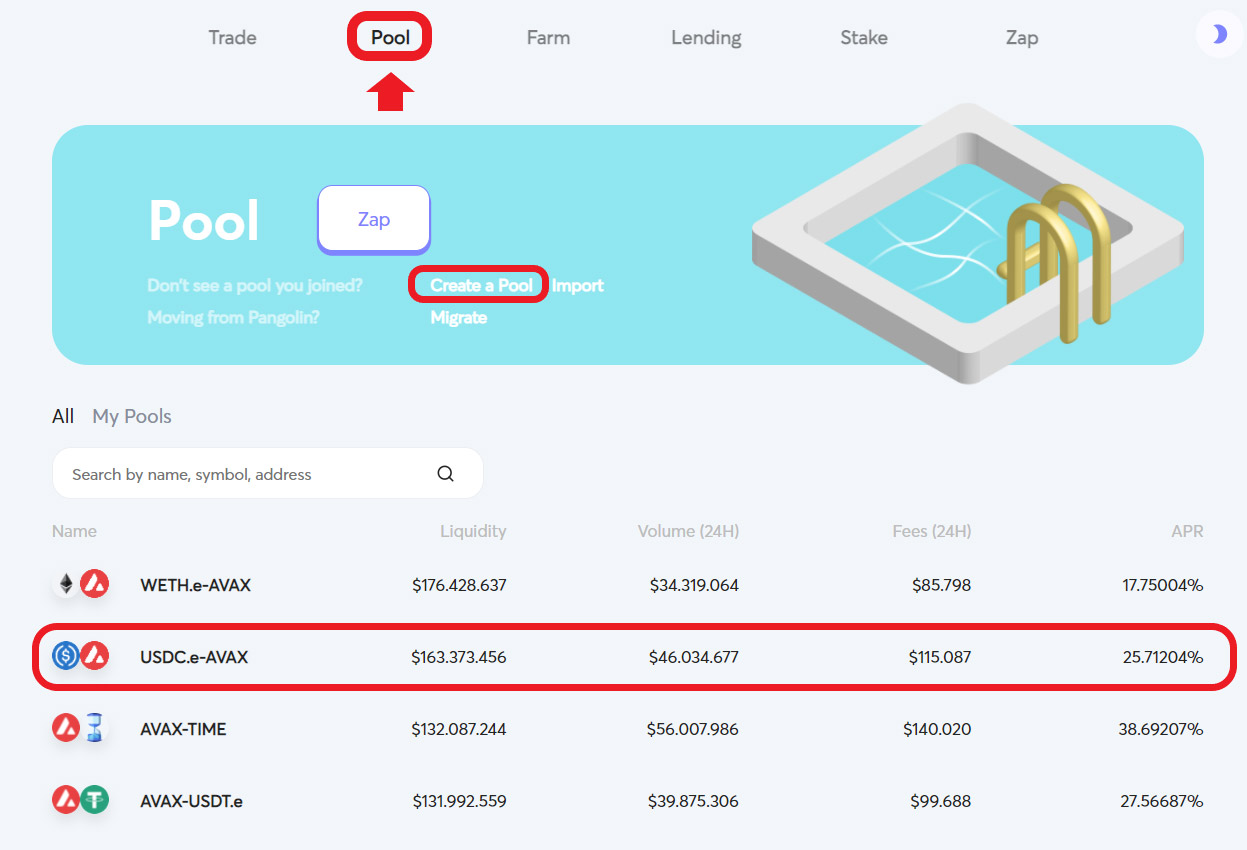

Step one: Access the Liquidity Pool area as follows

You can decide on “Create a pool” or decide on any pool like the one particular beneath, for illustration USDC and AVAX (USDC.e-AVAX) pools.

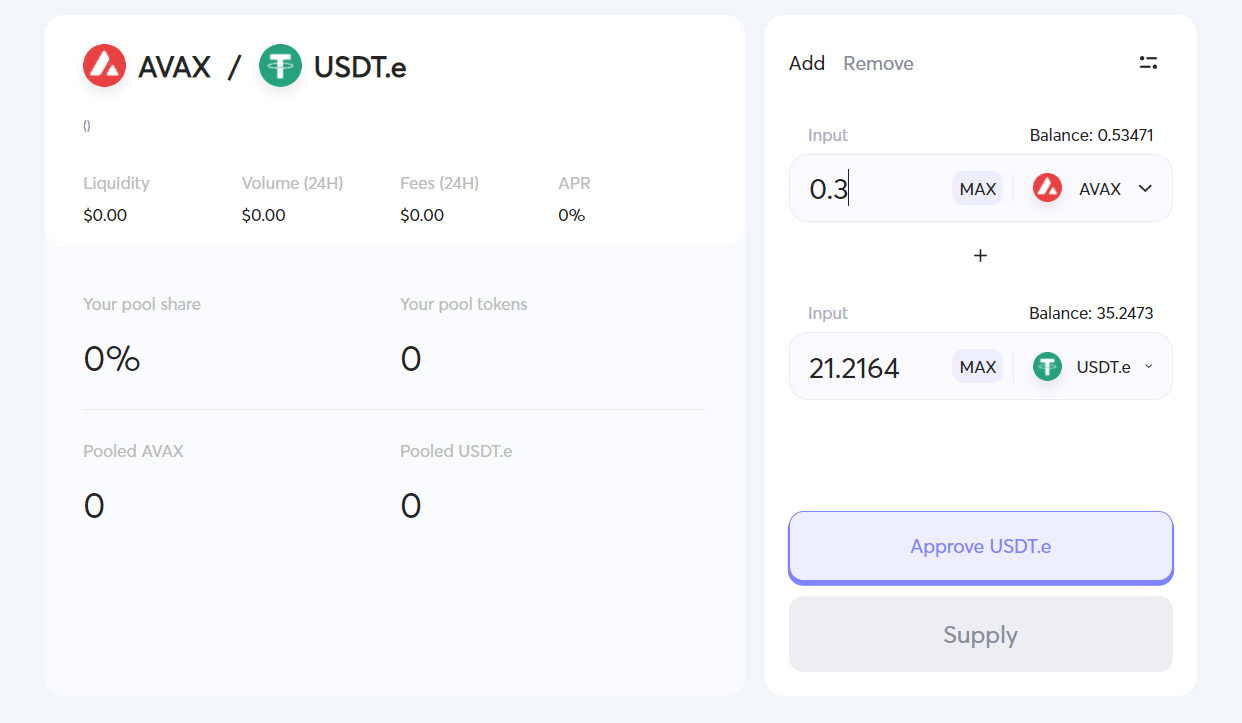

Step two: After picking out Pool, the liquidity provide area is displayed as follows

Enter the quantity of the liquidity pair offered in the input box

- Input: The liquidity quantity offered over is AVAX, beneath is USDTe.

- The technique immediately calculates the demanded quantity of USDT.e.

- You want to click on Appove USDT.e to convert the USDT in the wallet to USDT.e (i.e. deposit USDT in the pool as a wrapped synthetic asset).

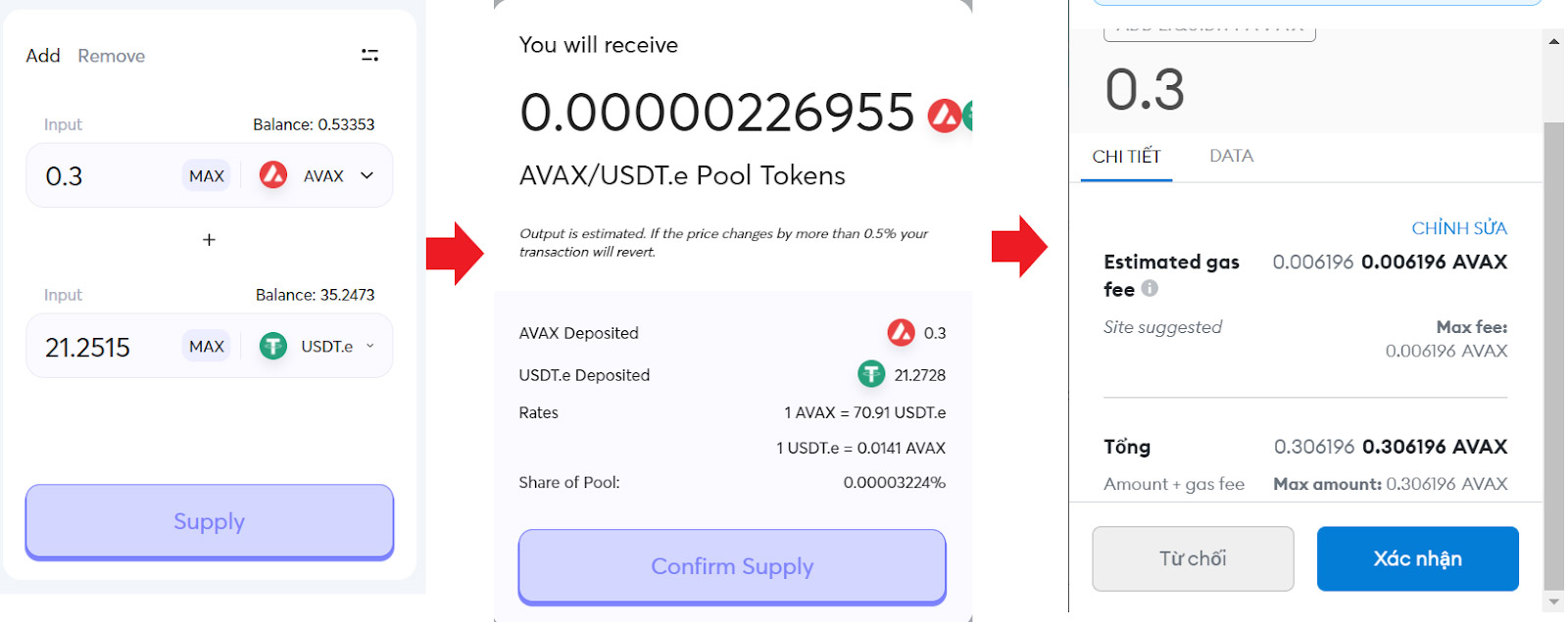

Step three: to press “Supply” To deliver liquidity, the share acquired in the pool is .0000226955 LP (AVAX / USDT.e)

Then, the liquidity transaction is finished

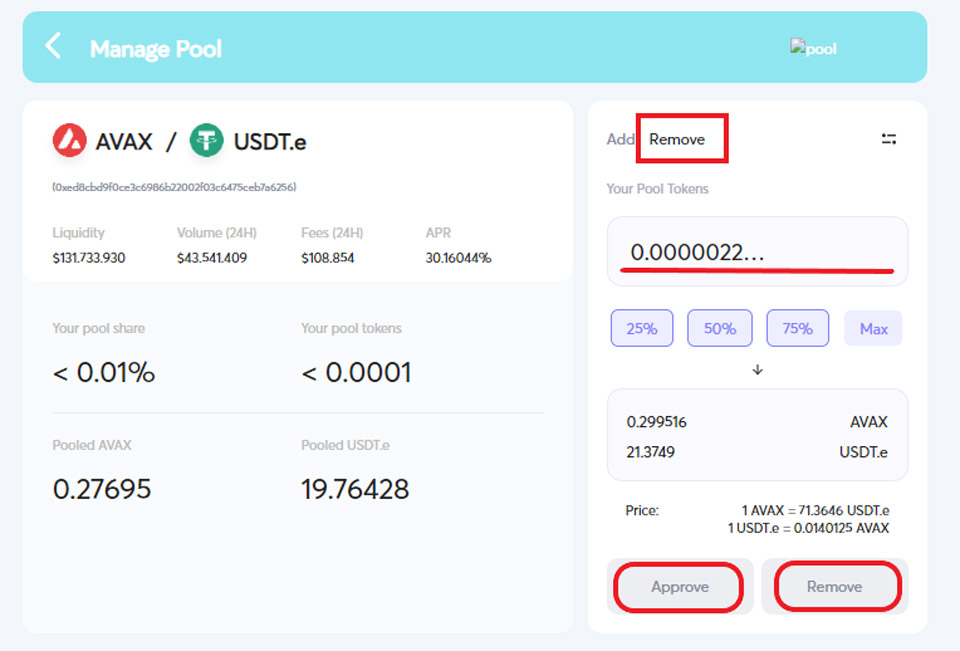

Step four: If you want to cancel the liquidity provision, pick the perform “To remove”. Enter the quantity of liquidity you want to get rid of, click on Appove then click on “Remove”, every time you want to authenticate with metamask and it prices a little commission.

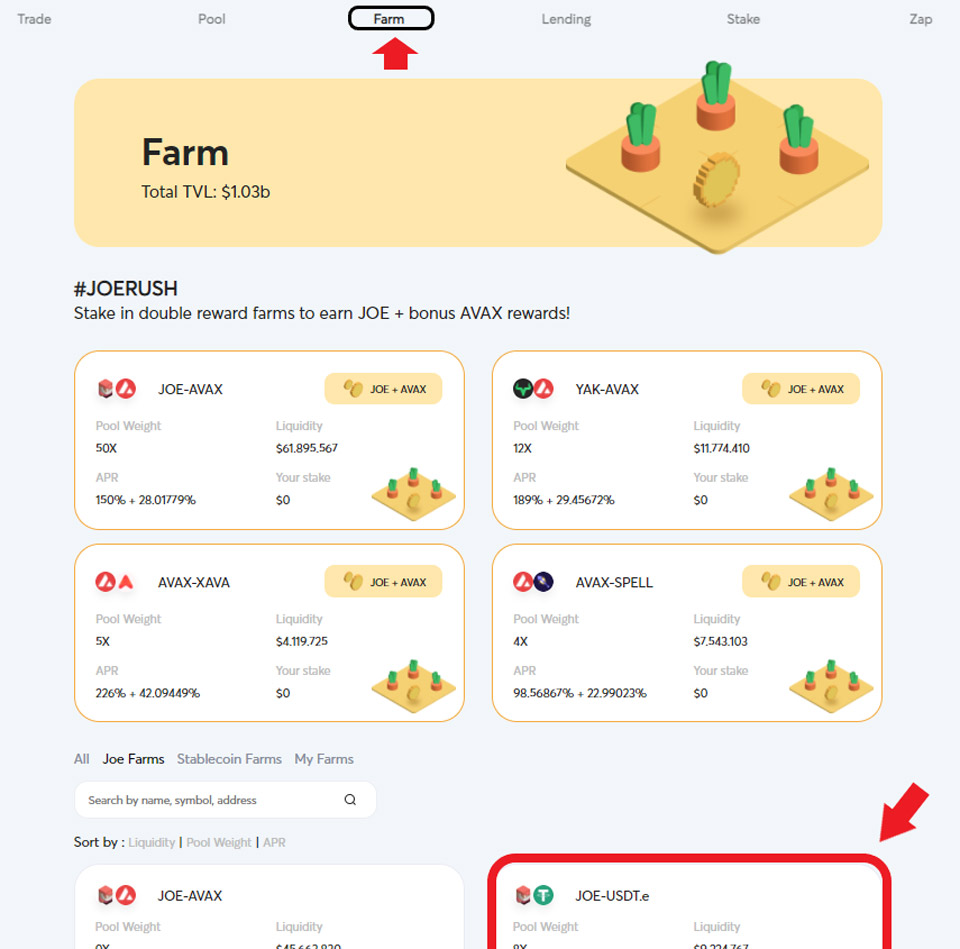

Farm manual on Trade Joe

Step one: Log in to Pool Farm as follows

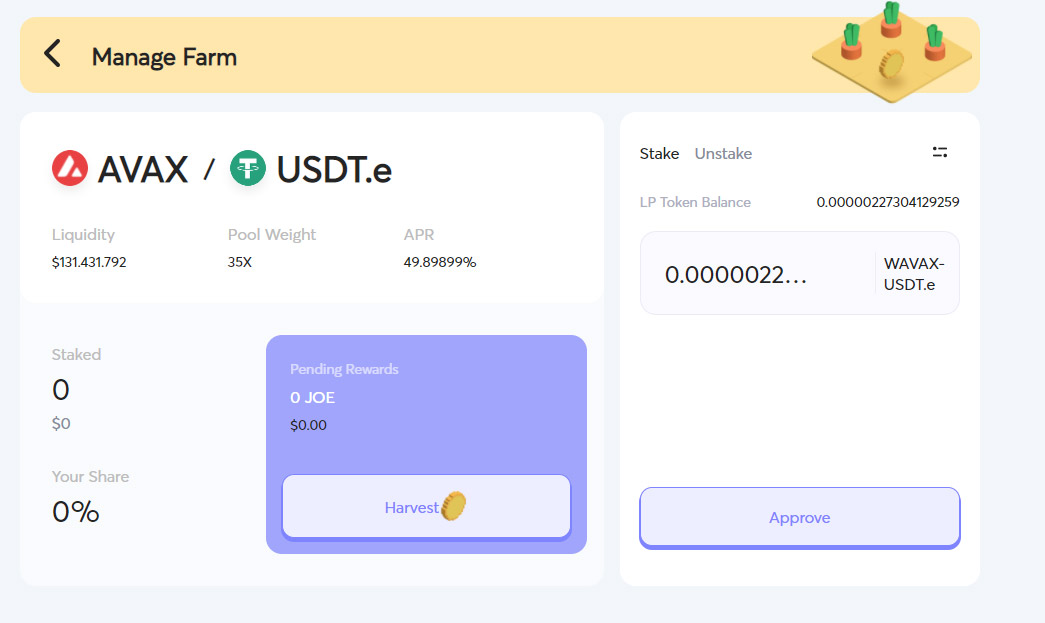

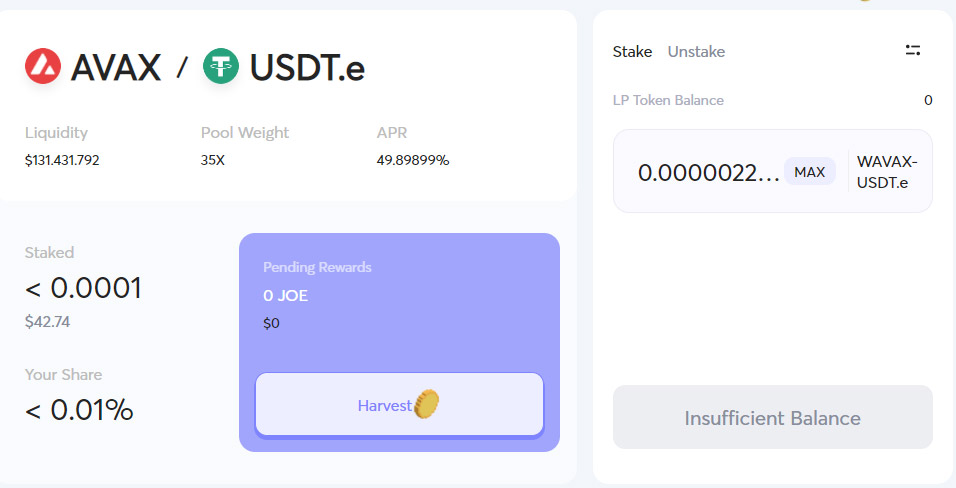

Step two: Select AVAX / USDT pool.e. Then click “Approve”. Authenticate to metamask.

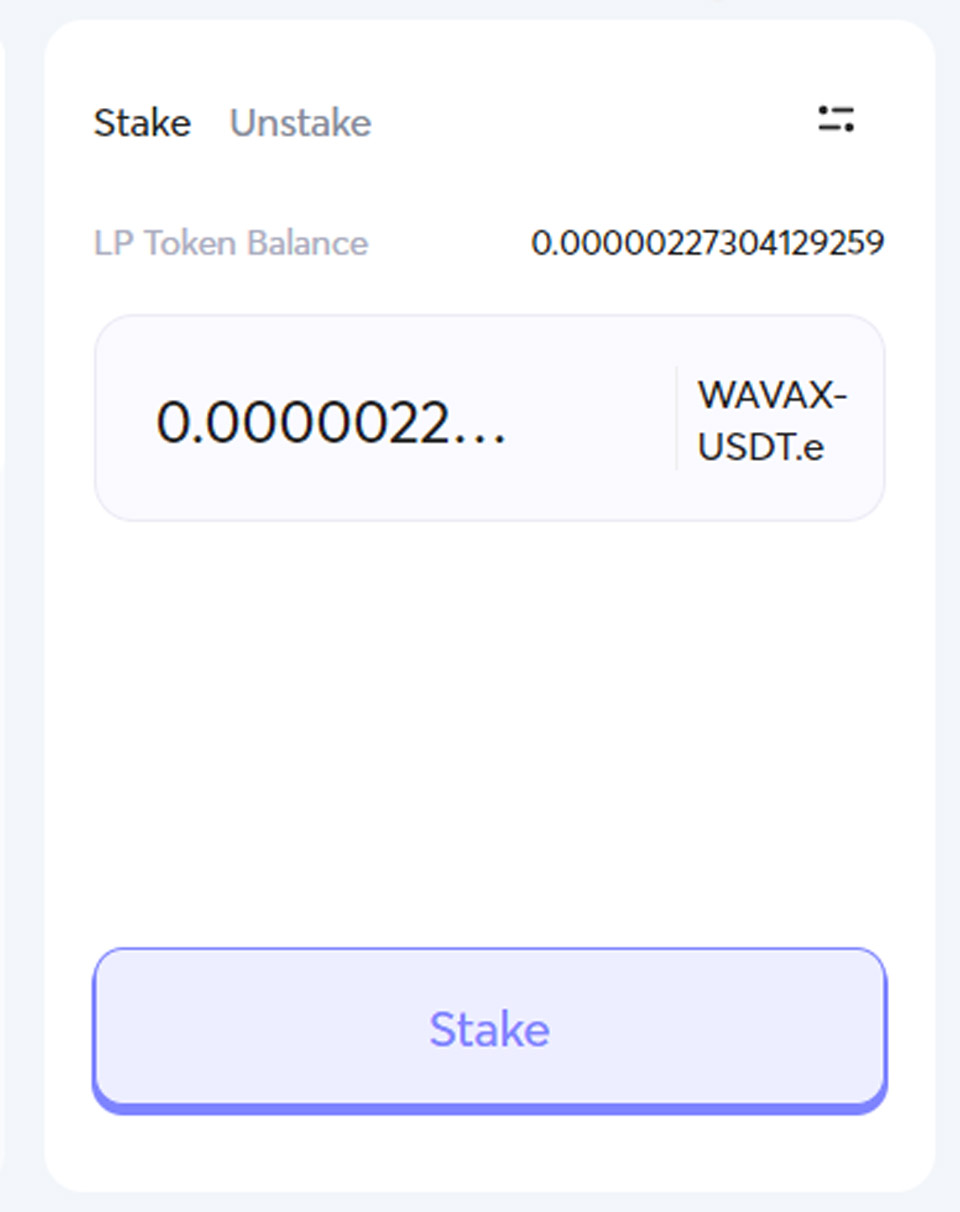

Step three: Then, click “Next”Pole” place into perform. And also login to metamask once more

After the bet it will demonstrate the stake worth in the pool

More info on the avalanche network

The potential of Tr1ader Joe, ought to I invest in JOE?

Above is a standard manual to trading, offering liquidity, and farming on Trader Joe. Currently, Trader Joe’s TVL has reached $ four billion. Considered an spectacular quantity with a DeFi platform on Avalanche. All info in the report is info compiled by Coinlive and does not constitute investment assistance. Coinlive is not accountable for any direct and indirect hazards. Good luck!