Ethereum’s Lido Finance (LIDO) staking platform raised $ 70 million from investment giant Andreessen Horowitz (a16z), marking the protocol’s very first funding round because May 2021.

The A16z spokesperson stated the fund’s investment in Lido is set to more help the adoption of staking remedies for Ethereum two..

Happy to share it @ a16z invested $ 70 million @LidoFinanza, 1 of the best methods to stake ETH and other PoS assets, and we utilised Lido to stake a portion of our ETH holdings on the Beacon chain. More from @DarenMatsuoka & @_PorterSmith: https://t.co/vc2tzDJ3mS

– cdixon.eth (@cdixon) March 3, 2022

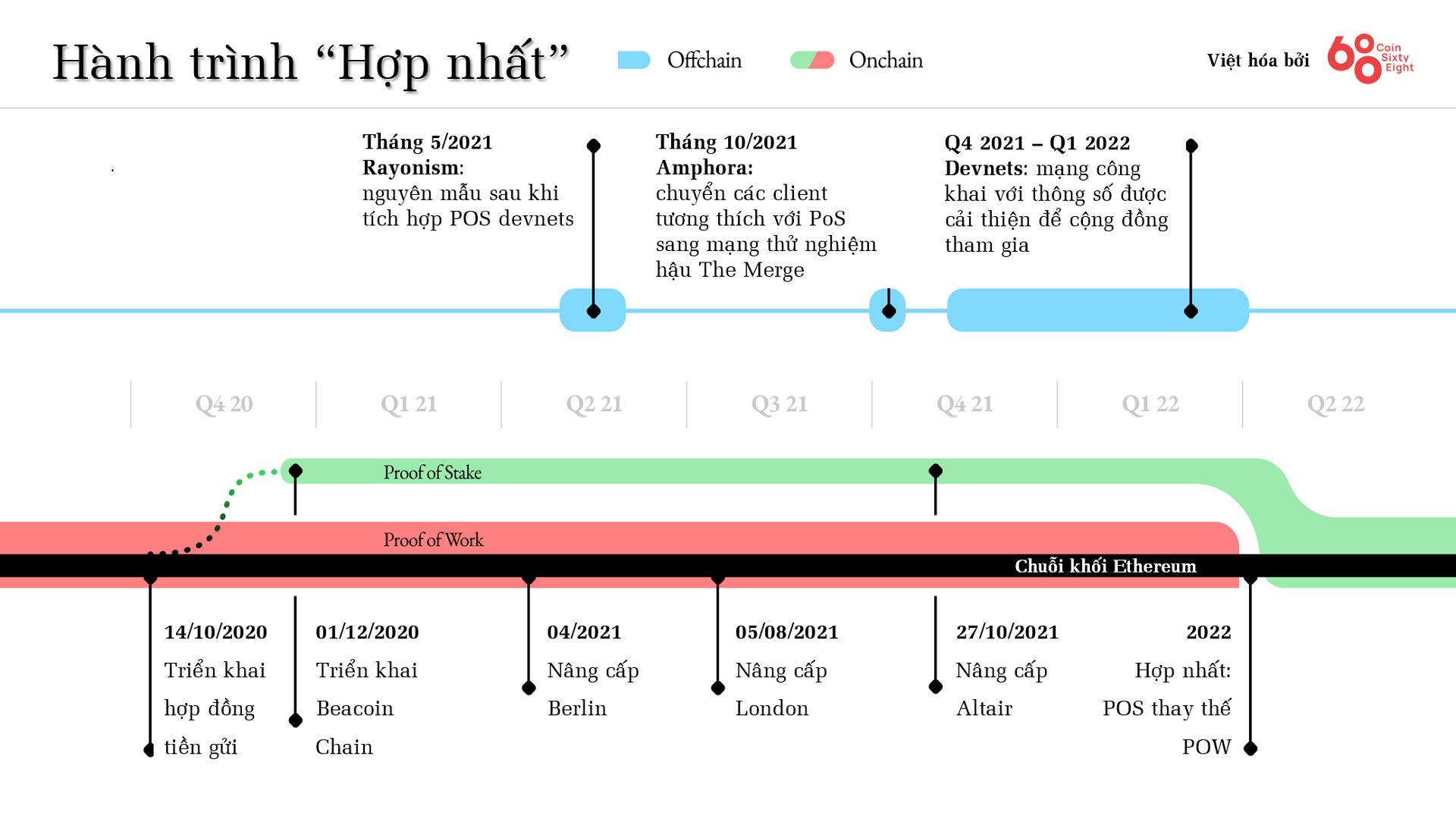

Ethereum two. will mark a substantial adjust in the network consensus algorithm by introducing the adoption of the Proof-of-Stake (PoS) mechanism and a quantity of other updates that could enhance scalability and cut down costs. The consolidation procedure in the direction of PoS, termed “The Merge”, is even now on track, anticipated in the 2nd or third quarter of this 12 months.

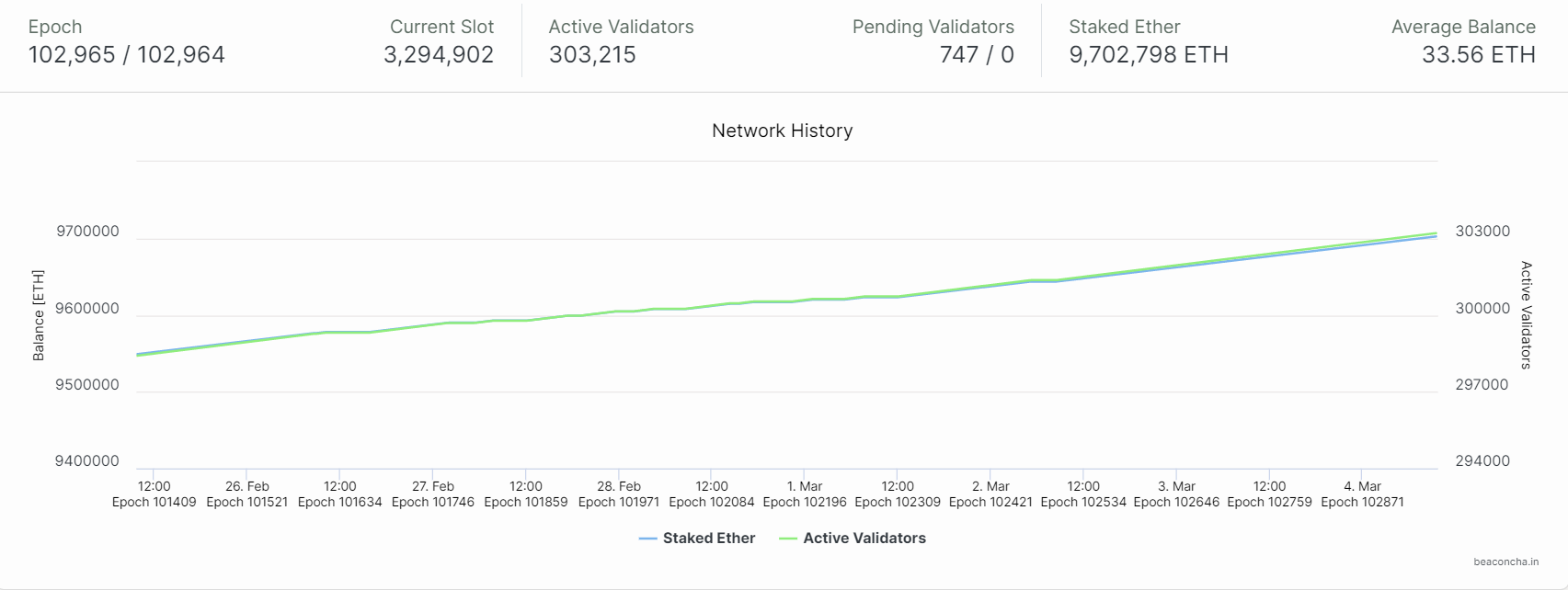

In addition to investing in Lido, a16z also stated they are participating in portion of their holdings in ETH on Beacon Chain, the Ethereum two. mainnet launched in December 2020 through Lido. The investment fund says its partnership with Lido will also aid clear away a lot of of the operational problems institutional traders encounter. Beacon Chain just lately registered its 300,000th validator, in accordance to the newest information. As of press time, almost 9.seven million ETH has been staked with a complete worth of in excess of $ 27.one billion.

Although terms like Eth1 and Eth2 are even now broadly utilised in the cryptocurrency sector, the Ethereum Foundation announced in January that it would phase out the terms. Instead, the identify immediately after the trademark critique will be utilized as “enforcement level” and “consent level” respectively.

What’s specific is that Lido’s very first funding round ended a prolonged time in the past, about a 12 months in the past in May 2021. At the time, Lido raised $ 73 million led by the Paradigm investment fund. In addition, many other main gamers this kind of as Three Arrows Capital, Alameda Research and Digital Currency Group also participated in this funding round.

Since the Ether staking procedure presents substantial obstacles to operating a node. To turn into a complete validator, a consumer ought to be capable to wager at least 32 ETH. Basically, Lido will be the crucial to solving this difficulty.

Founded in 2020, Lido Finance delivers a liquid staking resolution for Ethereum two., making it possible for consumers to stake their ETH in a versatile and available way. With Lido, consumers can wager any volume of ETH they very own and earn rewards even if the stake is not massive. Furthermore, the protocol has just lately been undergoing some notable developments when it comes to supporting a lot of other tokens, this kind of as the addition of Kusama (KSM) on February 18th.

The Lido for Kusama has arrived on Moonriver ️

Bet your KSM with Lido for every day rewards and to use your staked assets in the Kusama DeFi area.

Find out extra right here: https://t.co/BOqLg6oFAv

– Lido (@LidoFinance) February 18, 2022

To be capable to deepen and assess the particular probable of the Lido, we refer you to the video beneath:

What’s specific is that Lido’s very first funding round ended a prolonged time in the past, about a 12 months in the past in May 2021. At the time, Lido raised $ 73 million led by the Paradigm investment fund. In addition, many other main gamers this kind of as Three Arrows Capital, Alameda Research and Digital Currency Group also participated in this funding round.

Synthetic currency 68

Maybe you are interested: