[ad_1]

Leading DeFi marketplace, Aave, has announced ideas to launch a new edition of its platform that will be available to institutional traders as early as July.

A panel discussion on Blockworks’ “Next Steps in the DeFi Space” featured Aave founder and CEO Stani Kulechov, Fireblocks co-founder and CEO Michael Shaulov, and Galaxy Digital CEO Mike Novogratz.

What are the institutions like? #DeFi and what are some of the issues that await us? Our CEO, Michael Shaulov with @novogratz (@GalaxyDigitalHQ) is @StaniKulechov (@AaveAave). Moderated by @ RebeccaRettig1. @Blockworks_ https://t.co/5ZdnShbBik

– Fireblocks (@FireblocksHQ) June 28, 2021

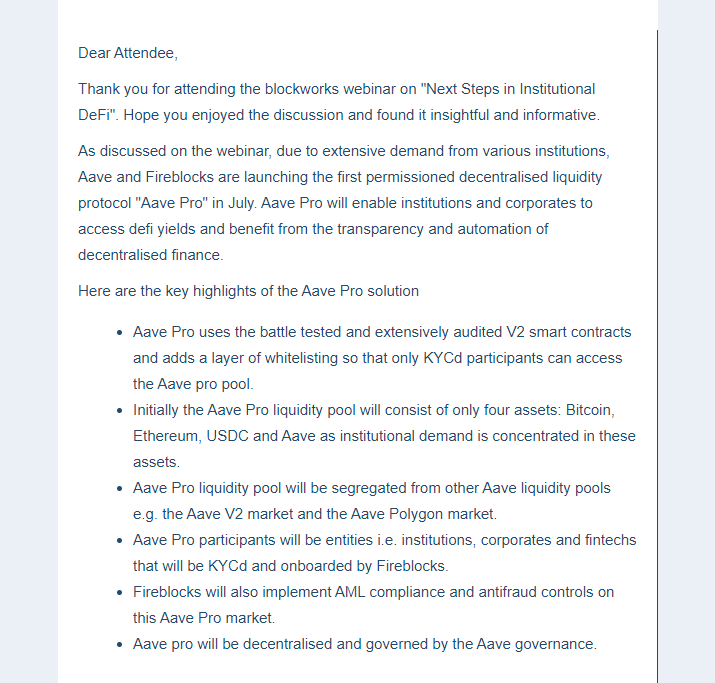

During the discussion there was an picture that unveiled that Aave’s new merchandise, known as Aave Pro, which it ideas to launch this month to meet widespread demand from several organizations. The platform will be launched in partnership with a cryptocurrency custodian and support supplier, Fireblock.

At launch, Aave Pro it will only help 4 core assets BTC, ETH, AAVE is USDC. The platform will include a degree of whitelisting to V2 intelligent contracts to guarantee that only institutions, businesses and fintechs pass consumer verification. Fireblock can only accessibility Aave Pro. Fireblocks will also be tasked with implementing anti-revenue laundering and anti-fraud controls for Aave Pro.

Aave’s new campaign was teased earlier in May, Kulechov initial unveiled that Aave was making a permission pool for organizations. The power of the platform this time all around is supplying a new “path” for institutions to initiate a deep interaction with decentralized finance.

Aave Pro This is not Fireblocks’ initial foray into assisting massive institutional traders get into DeFi. At the starting of 2020, Fireblock it has also partnered with Compound to launch equivalent companies.

However, Aave’s place is pretty unique from the rest of DeFi, this will be an essential milestone for Aave, the vibrant star in the sky of DeFi, to be in a position to market the development of the complete market and the platform itself. .

Synthetic currency 68

Maybe you are interested:

.

[ad_2]