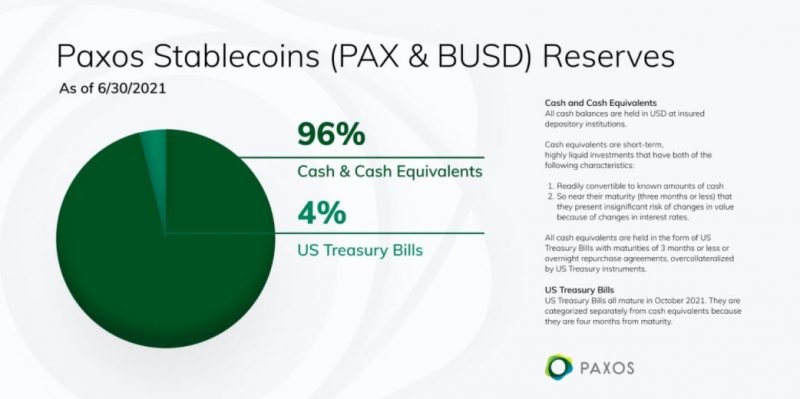

On July 21, Paxos uncovered that its stablecoin duo, Paxos Standard (PAX) and Binance USD (BUSD), are backed by 96% funds.

This contrasts with current reviews from important stablecoin businesses Tether and Circle, a comparison that Paxos targeted on in its evaluation.

This can be witnessed as an overview of Paxos’ rivals in the rising stablecoin ecosystem. USDT and USDC are the biggest stablecoins by complete present provide in the cryptocurrency industry.

While the distribution of the PAX and BUSD stablecoins, somewhere around 96% of reserves are held in funds and equivalents, although four% are invested in US Treasury payments as of June 30th.

The disclosure of the corporation comes the day just after Circle, the 2nd biggest USDC stablecoin issuer, uncovered its supporting assets. And Tether, the biggest USDT stablecoin issuer, followed suit in May.

Circle announces the escrow mechanism behind the USDC stablecoin

In current instances, traders have been calling for higher transparency from stablecoin issuers, although regulators have warned that the reduction of self confidence in stablecoins could destabilize the cryptocurrency industry and possibly even spread to Wall Street.

Synthetic currency 68

Maybe you are interested:

.