Venture capital in the cryptocurrency business almost doubled from final yr, but not long ago the figure dropped 38.two%. Have lots of large gamers “withdrawn” from cryptocurrencies or simply just “frozen” temporarily?

This decline is taken for granted, in correlation with the latest unsatisfactory industry surroundings, the “bloody” large brother has brought with it a series of altcoin “baths”.

.@Morgan Stanley states that the quantity of venture capital cryptocurrency operations peaked in December 2021. If the business matched other sectors, exercise could decline by up to 50% by the finish of the yr.

Of @ willcanny99https://t.co/OsMzlqSzfm– CoinDesk (@CoinDesk) May 31, 2022

According to new information published by Dove metricsthe complete quantity of cryptocurrency money dropped 38.two% in the previous month alone, with investment worth shrinking from $ six.eight billion in April to $ four.seven billion.

Data on the distribution of investments Shows VCs are primarily pouring revenue into infrastructure platforms (21%), decentralized finance start off-ups – DeFi (14%), centralized finance tasks – CeFi and NFT (13%).

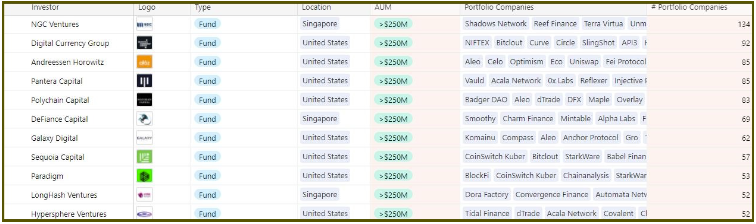

The figures over display that VCs are pouring their capital relatively securely, focusing on core technologies that certainly brings innovation to the cryptocurrency business rather of higher-chance tasks. According to a report, the United States is household to the biggest quantity of venture capital money, followed by Singapore and Hong Kong statistical Other.

Despite the unpredictable consequences that LUNA-UST has left behind and the present industry circumstance, Venture capital nevertheless seems to be rather lively. JPMorgan as soon as claimed that the Collapse of the terrestrial ecosystem it does not have an impact on the VC considerably. Because cryptocurrency, blockchain, Web3 or DeFi are a extended advancement journey, not a day or two.

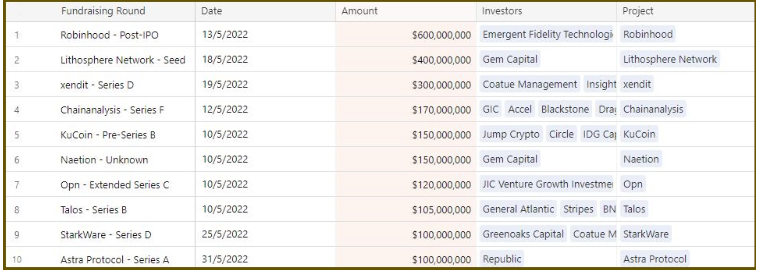

Sam Bankman-Fried, founder and CEO of FTX Exchange, invested $ 650 million purchased Robinhood shares, equal to seven.six% of the company’s shares. Project Chainalysis’ blockchain intelligence was paid out $ 170 million, doubling the company’s valuation to $ eight.six billion. KuCoin raised $ 150 million in the Series B round, valuing the corporation at $ ten billion.

The listing of large names in the cryptocurrency village keeps screaming Andressen Horowitz when a16z just announced a $ four.five billion fund for the incubation of Web3 start off-ups just days just after announcing a $ 600 million fund for the advancement of the game business, bringing the complete price range committed to a16z cryptocurrencies and blockchains at more than $ seven.six billion.

Synthetic currency 68

Maybe you are interested: