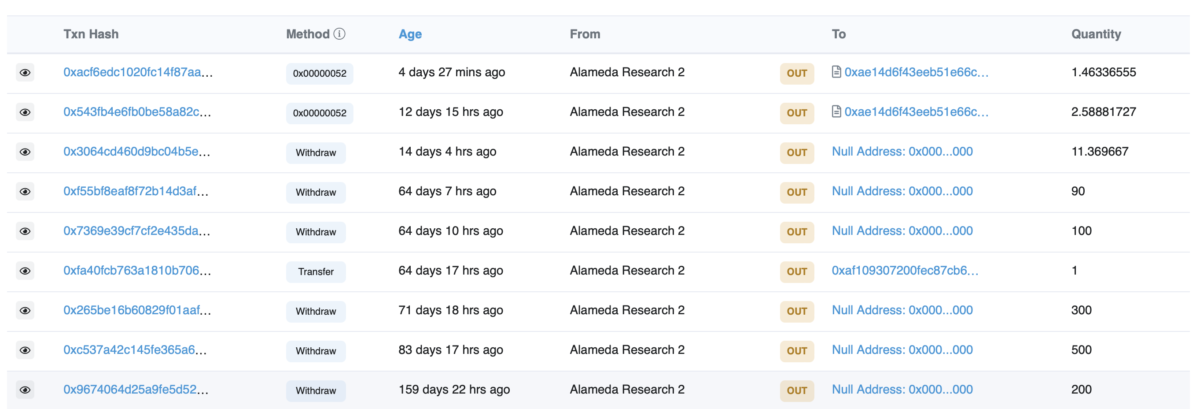

Alameda liquidators just misplaced $72,000 on lending platform Aave. This is the consequence following these positions have been “accidentally” liquidated all through the recovery of the assets in favor of the creditors.

As a outcome, these liquidators are trying to shut out the place but withdraw the collateral to start with, placing the place at threat of liquidation. The information exhibits that, inside 9 days, the place was liquidated up to two occasions with complete assets of four.05 wBTC, a token that represents BTC on Aave’s platform.

At existing, the over assets are quite complicated to recover from creditors. Note, the wallet deal with over is only marked as connected to Alameda on the Etherscan platform.

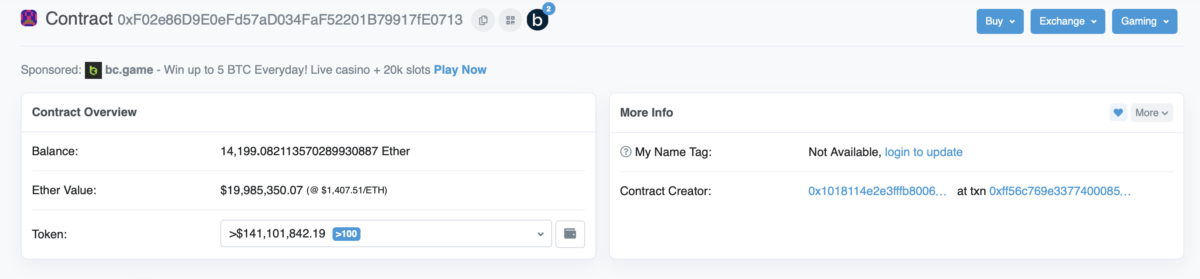

The assets of these wallets have been moved into a single wallet and are managed by several signatures (multi-sig). At the time of creating, this multi-signature wallet holds $19.six million in Ether and $140 million in multi-tokens on the Ethereum network.

The liquidators failed nonetheless yet again and had been unable to withdraw a significant volume of LDO from 1 of the over wallets, due to lack of awareness that the token was even now in the vest. They created 9 failed trades ahead of becoming ready to withdraw a tiny volume.

In the previous two weeks, roughly USD one.four million has been transferred from numerous Alameda-connected wallets to this multi-sig wallet. Previously, a wallet connected to the Deribit exchange also transferred eleven,350 Ether ($15.9 million) to this wallet.

The liquidators are collecting tokens following shedding about $one.seven million in final December’s assault. This volume of token is speedily transferred by the attacker to mixing solutions to get rid of the trace.

Synthetic currency68

Maybe you are interested: