On Friday, November 15, Bitcoin Dominance (BTC) — a metric that tracks the cryptocurrency’s share of the overall market — forecast a 65% increase. However, this scenario did not play out as Bitcoin price failed to retest the $93,000 level, suggesting that the altcoin cycle may have arrived.

This stagnation appears to have created an opportunity for altcoins, which have lagged far behind BTC. The pressing question now is whether Bitcoin Dominance will continue to decline as altcoin prices soar.

Bitcoin Steps Back Amid Market Desire

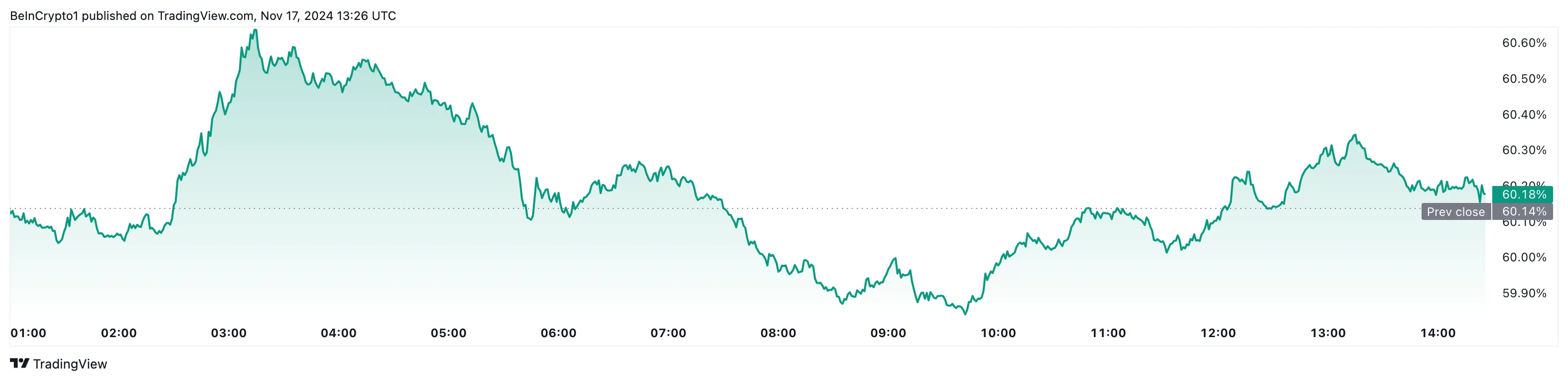

At the time of writing, Bitcoin Dominance has dropped to 60%. This decline contrasts with some analysts’ expectations that Bitcoin price could rise to $100,000 in the next few days.

According to TinTucBitcoin’s findings, this drop may also be related to an increase in the performance of altcoins. A few days ago, the altcoin season index was 33. Today, according to data from Blockchaincenterthis index increased to 39.

This increase suggests that many altcoins in the top 50 are outperforming Bitcoin (BTC). Tokens such as Bonk (BONK) and Ripple (XRP) have maintained their growth momentum, contributing to the increase in altcoin market capitalization and the decline in Bitcoin Dominance.

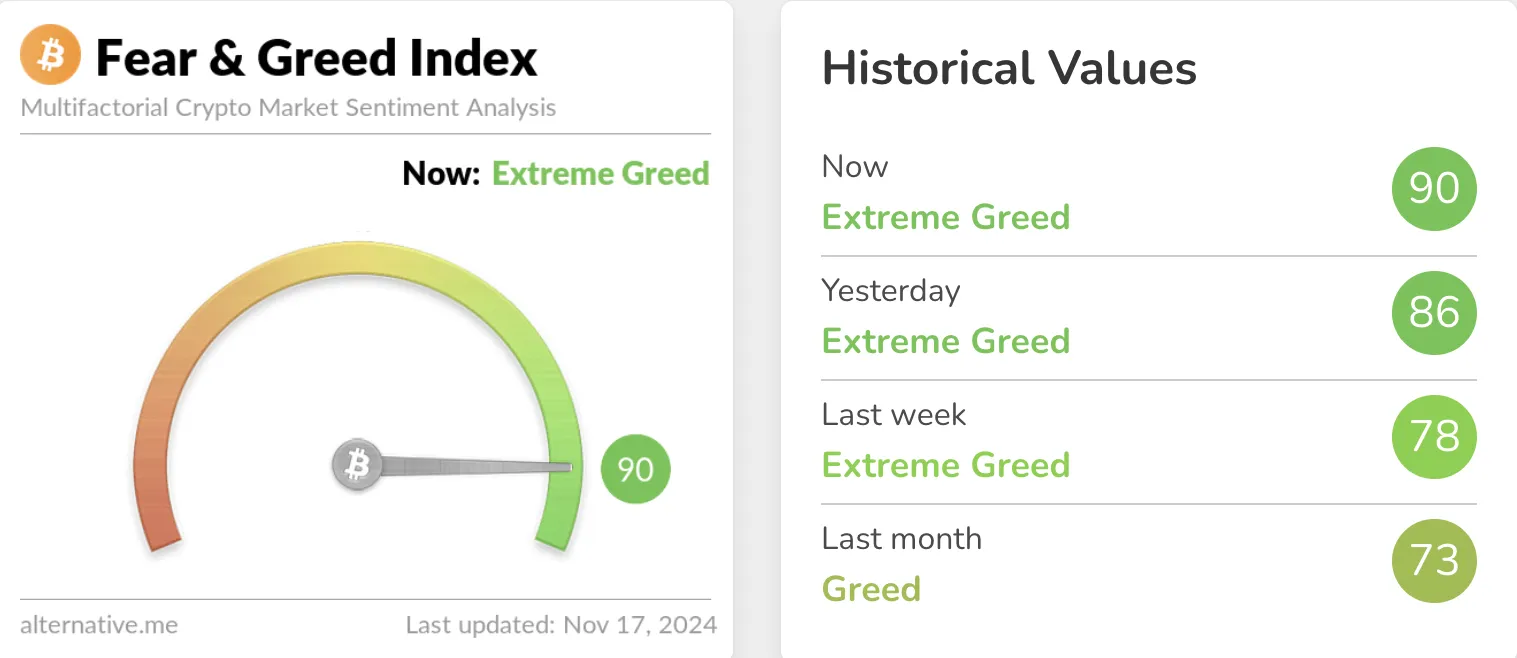

Furthermore, the market’s extreme appetite will likely impact Bitcoin’s direction. Currently, the Crypto Fear and Greed Index, which primarily measures Bitcoin sentiment, has hit a staggering ‘Extreme Desire’ level of 90.

‘Extreme Fears’ often indicate increased investor anxiety, which can create potential buying opportunities. Conversely, when investors become too greedy, it usually means that the market may be approaching a correction.

Therefore, considering the current situation, there is a high possibility that Bitcoin price may need a correction. This is also consistent with the opinion of analyst Rekt Capital. According to him, altcoins may soon break out as Bitcoin Dominance decreases.

“Bitcoin Dominance — We are seeing the impact of the best-case scenario in full swing. It’s Altcoin season. BTC’s 57.68% retracement is opening up this Altcoin window. Continued decline will pave the way for altcoins to break out,” Rekt Capital share on X (formerly Twitter).

Altcoin Looking Toward New Highs

Meanwhile, TOTAL2, the total market capitalization of the top 125 altcoins including Ethereum (ETH), has reached $1.19 trillion. The last time this value was reached was in June.

Based on the daily chart, TOTAL2 reached this level due to strong interest in altcoins and a breakout from a descending triangle. A descending triangle is often seen as a bearish pattern. However, it could also indicate a bullish reversal if the price breaks out in the opposite direction, which has happened to the altcoin’s market capitalization.

If this trend accelerates, altcoin season could begin. But for that to happen, Bitcoin Dominance needs to continue to decline, and the altcoin seasonal index must move closer to 75 from 39.

If that happens, TOTAL2 could increase to $1.27 trillion. However, if Bitcoin prices return to historical highs, the altcoin season cycle may be delayed, and this prediction may no longer be accurate.