Glassnode’s hottest weekly information showed lengthy-phrase Bitcoin holders are at their multi-12 months highs, building several gains for BTC’s approaching development.

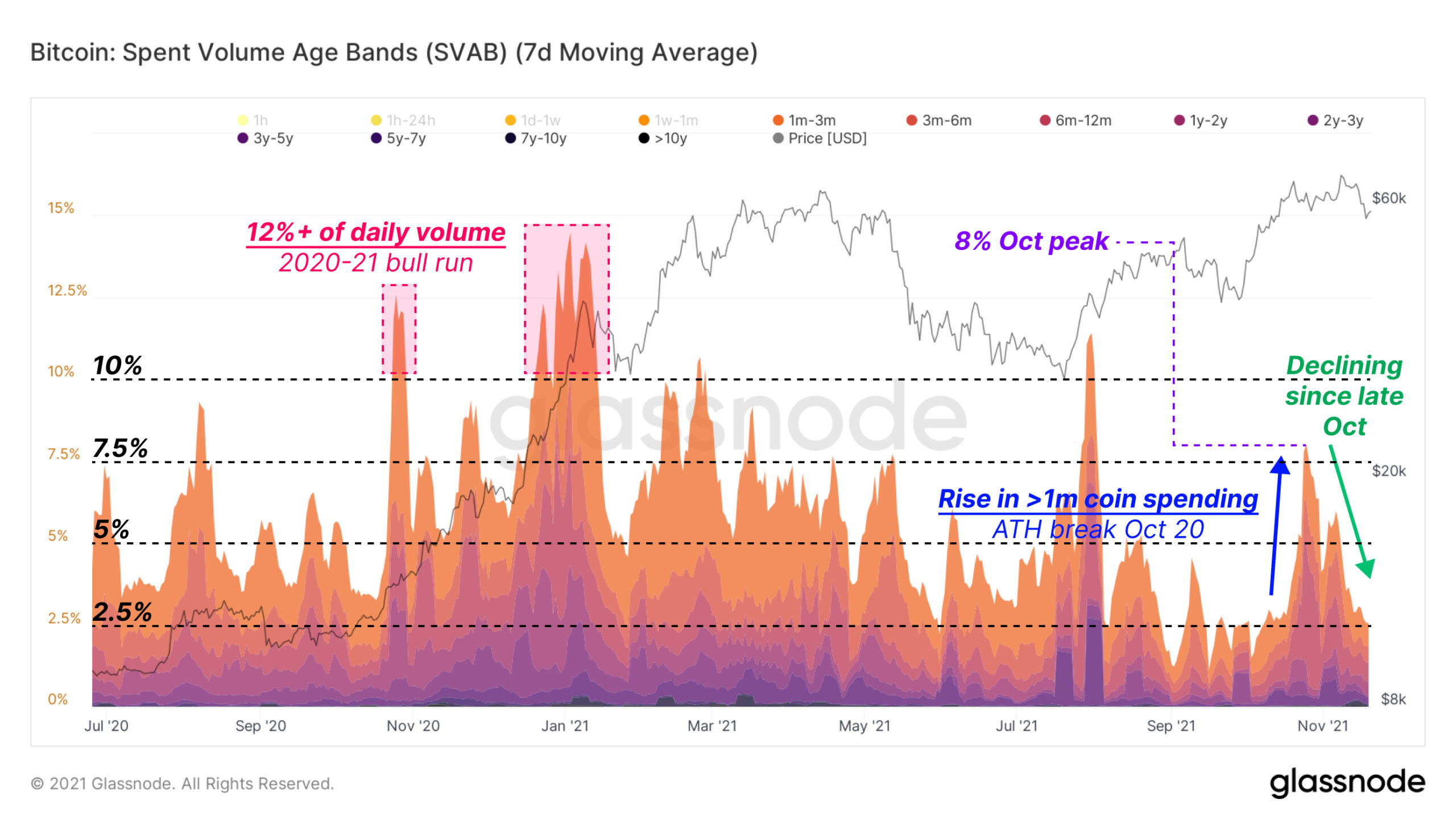

The evaluation dives into the Volume Spent Age Range (SVAB), which is applied to figure out the age of the coins that dominate the flows on the chain. This metric can be applied to figure out when to initiate a revenue-creating or accumulation procedure.

Consistent investing of coins older than one particular month commencing in November 2020 and ending April by means of May 2021. The SVAB index has now returned to two.five% everyday volume from its peak with an all-time large of BTC in October.

This implies that lengthy-phrase holders are lowering their investing to proceed incorporating Bitcoin to their positions, without the need of leaving the marketplace. Typically, the third greatest Bitcoin whale in the globe “bottom fishing” three,677 BTC in just four days was “trackable” by the local community in the middle of final week.

– See additional: Only twelve.9% of the provide of Bitcoin (BTC) remained on exchanges – what is this signal?

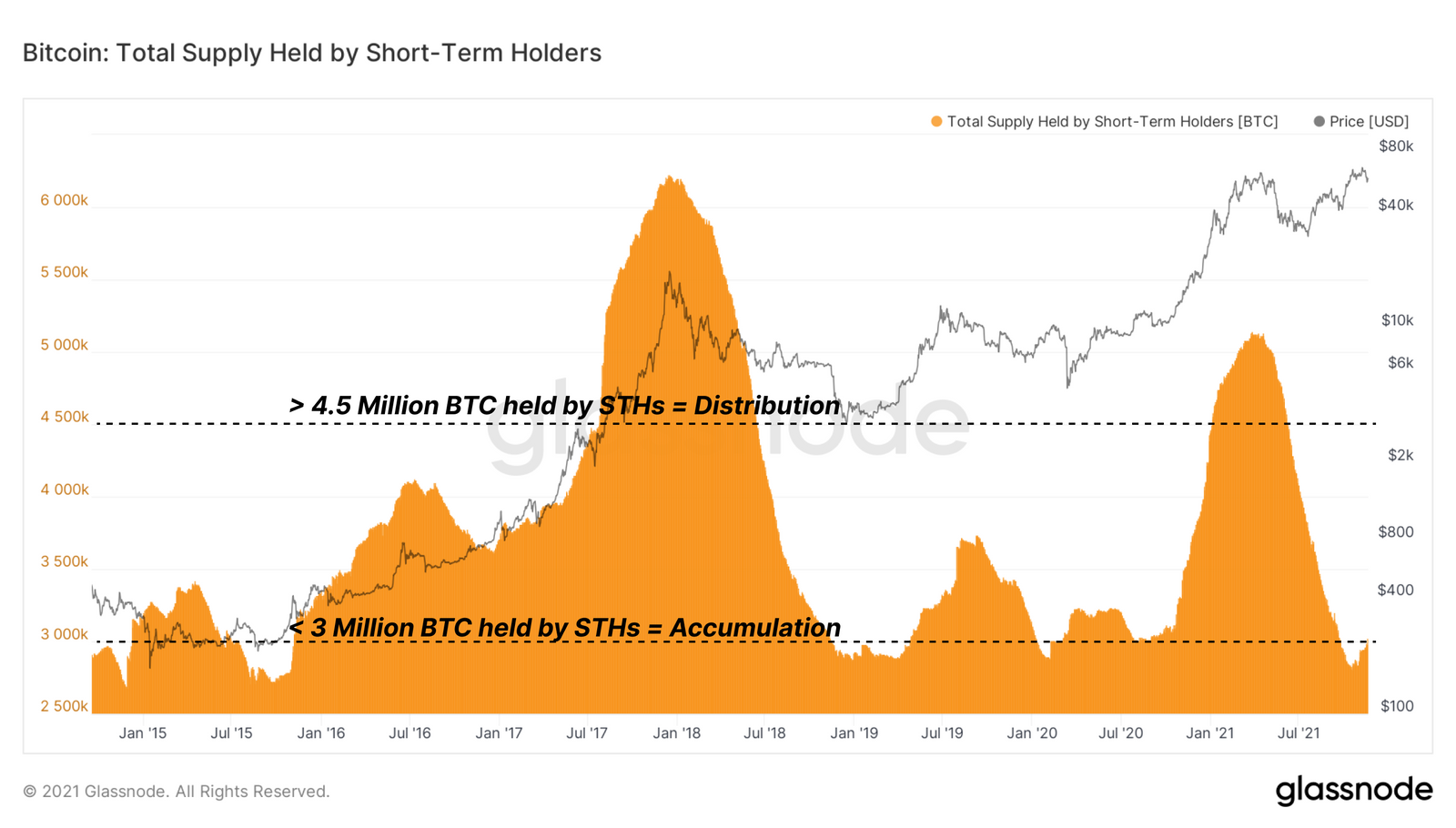

At the similar time, the complete brief-phrase vendor provide (STH) is at a multi-12 months very low, beneath three million BTC, pushing LTH provide to a multi-12 months record. Although brief-phrase holders have been offering at highs and also breaking at lows above the previous week, the marketplace has but to turn into overly saturated with revenue-taking.

Typically, a very low provide of STH usually takes place at the finish of a bear marketplace cycle and at the starting of a bull marketplace, soon after a lengthy time period of accumulation. Recording a very low give of STH as the value of Bitcoin is hovering close to $ 60,000 soon after its sudden plunge to $ 56,000 is a rather exceptional situation.

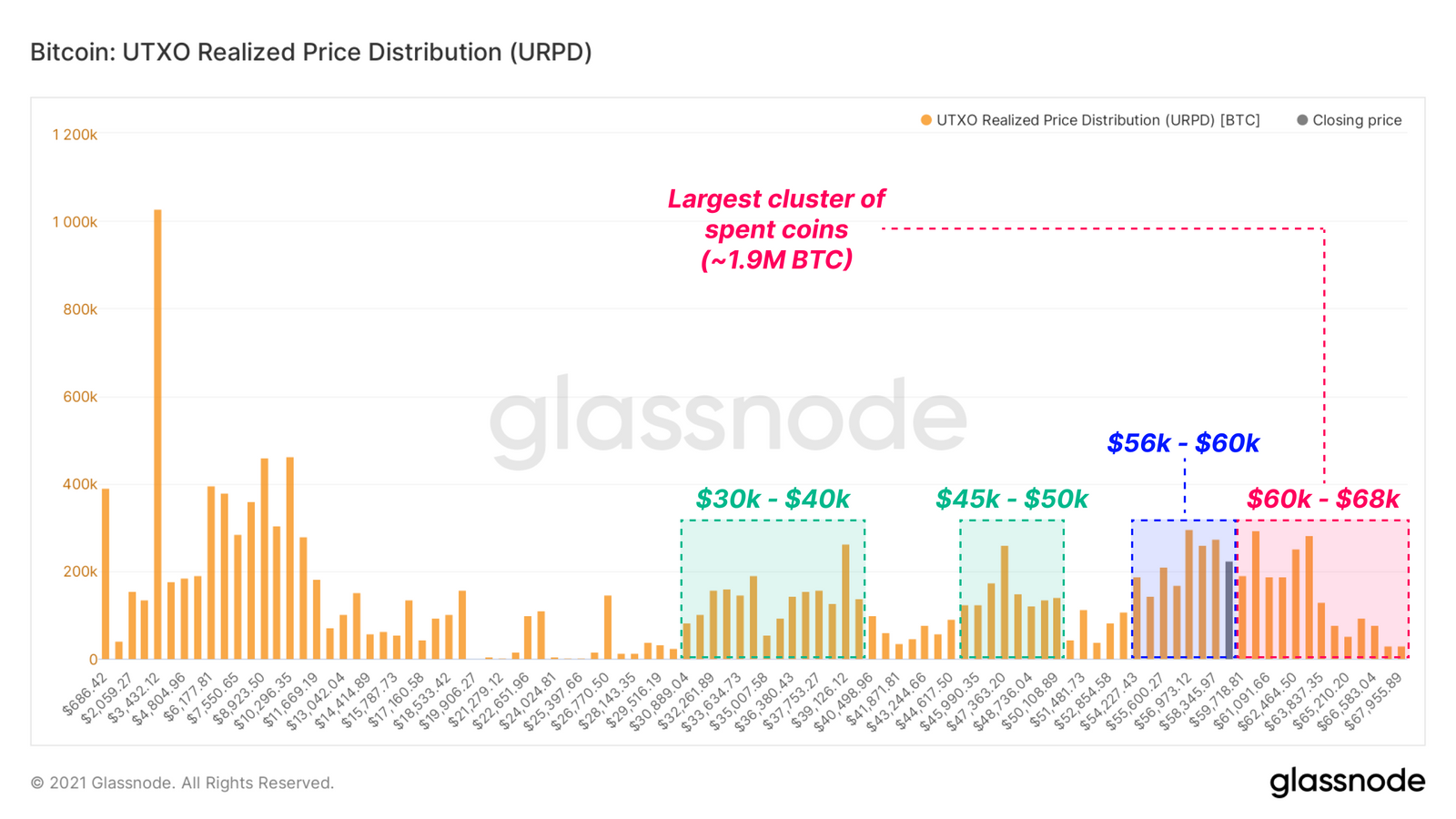

However, even Bitcoin (BTC) has just been on a roller coaster phase due to the information that the Fed chairman has been reconfirmed this morning. Additionally, the UTXO Actual Price Distribution (URPD) signifies the value at which Bitcoin is presently trading, i.e. just about every bar demonstrates the quantity of out there BTC that final moved inside of the specified value group.

There have been several value groups from several vital tiers during 2021, the greatest of which was one.9 million BTC which jumped from $ 60,000 to $ 68,000. The over give could generate resistance in the coming weeks if most traders attempt to lessen their losses.

The actuality is that regardless of Bitcoin falling 18% from its ATH to $ 69,000, adoption and accumulation are even now ongoing. As evidenced by this, the amount of BTC addresses with non-zero balances has grown to an all-time large, surpassing 38.65 million addresses, signaling that the order has begun to type by retail traders.

According to Glassnode, even however Bitcoin’s value not long ago returned above ten% from its large stage, the amount of non-zero addresses on the network is even now gradually growing, hitting a new all-time large, surpassing 38.65 million. pic.twitter.com/qvN3c6Dt1O

– Wu Blockchain (@WuBlockchain) November 22, 2021

Synthetic currency 68

Maybe you are interested: