[ad_1]

The $40,000 BTC price shows a reasonable entry point, the Bitcoin to stablecoin ratio oscillator suggests to investors.

MicroStrategy may be smarter than ever to “buy when the price drops” Bitcoin as a historically “perfect” indicator that tells traders when to buy.

In a tweet on June 15, popular analyst Cole Garner flagged bullish signals for Bitcoin and stablecoin rate oscillators.

Buy the Dip or the whale?

After MicroStrategy announced plans to raise another $1.5 billion, the proceeds can be used entirely to buy Bitcoin, supporting BTC/USD at $40,000.

The move follows praise from both Elon Musk and investor Paul Tudor Jones, who the latter now favors a 5% BTC position against 1% previously.

For now, the Bitcoin-to-stablecoin ratio oscillator predicts a reasonable buying opportunity, even at the new highs just made a few hours ago.

The oscillator measures the number of Bitcoins on exchanges against the number of stablecoins. According to Garner, when the rate’s moving average enters the lower bound, shown in green on the accompanying chart, it’s time to buy into the BTC/USD pair.

Since 2019, this indicator has not once failed to catch up with Bitcoin’s uptrend. Garner commented:

“A perfect BTFD hit rate since 2019 and it just gave another buy signal.”

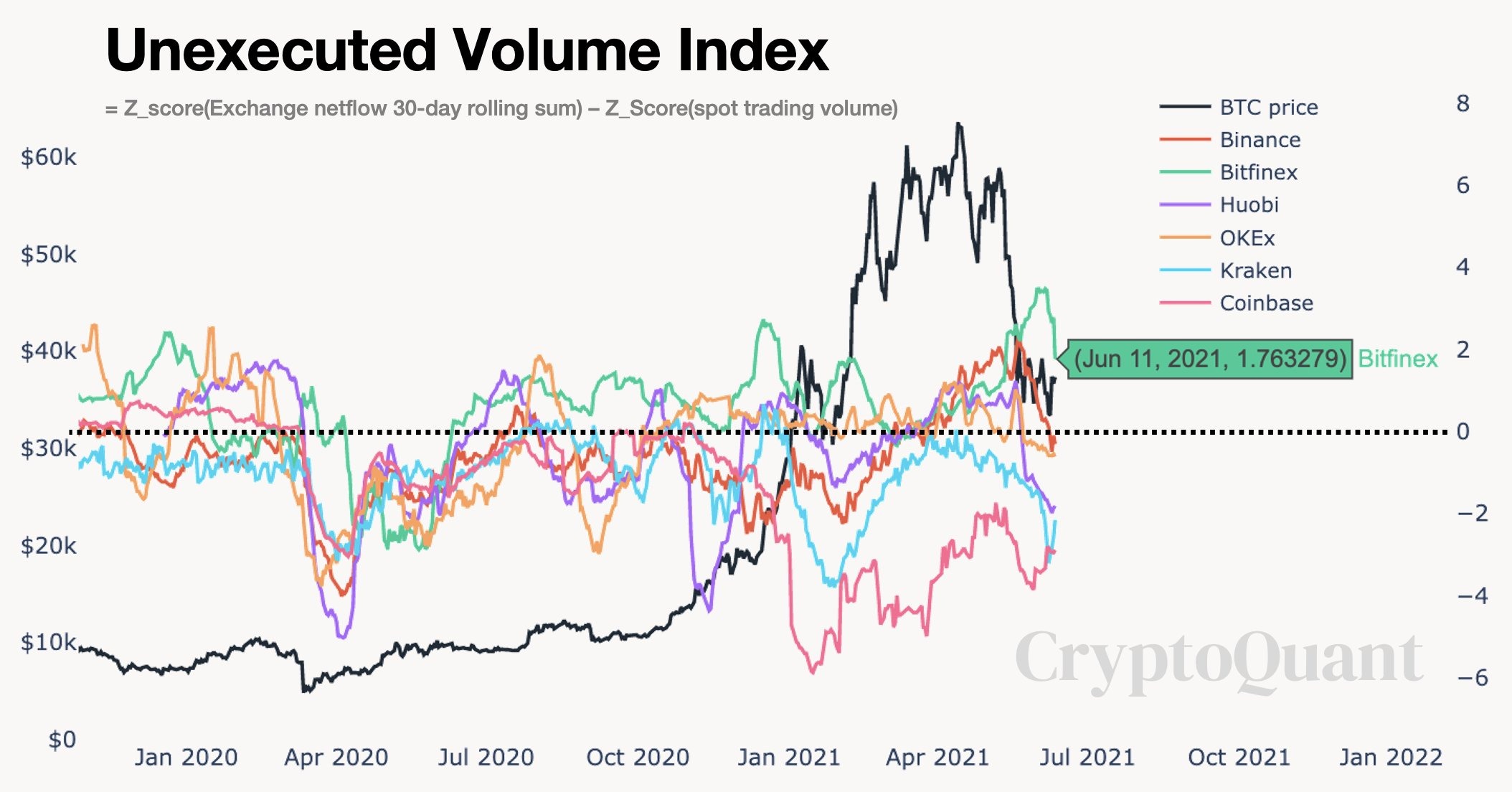

Mr. Ki Young Ju, CEO of on-chain monitoring resource CryptoQuant, the company that produces the indicator, however, sounded the alarm about a possible new sell-off this week. This could come from Bitfinex, he said, where a whale has accumulated a substantial short position.

“If dumping happens again, it could come from Bifinex. Most exchanges have digested most of the $BTC inflow after the plunge. Except for Bitfinex. All eyes are on the Finex whale.”

Trader’s eyes “MicroStrategy fractal”

Meanwhile, MicroStrategy committing more money to Bitcoin could be positive enough news to boost the market. As noted by Filbfilb, co-founder of the Decentrader trading suite, MicroStrategy purchases have an odd timing when it comes to higher BTC spot rates.

He told subscribers to his Telegram trading channel on Friday that this is more of a “fractal” than a casual relationship.

CEO Michael Saylor continues to speak out about Bitcoin amid fundraising announcements, earning a significant foothold on social media.

“If you invest 5% of your portfolio in bitcoin, you have made the decision to invest 95% of your portfolio in assets that will be “destroyed” by bitcoin.”

Synthetic

Maybe you are interested:

[ad_2]