Anchor Protocol (ANC) The worth of the ANC token has improved by just about 300% following a series of great information and assistance from the Earth Ecosystem (LUNA).

Anchor Protocol (ANC) is a DeFi protocol that acts as a financial institution in the Earth ecosystem, making it possible for customers to deposit UST and acquire curiosity up to twenty% / yr.

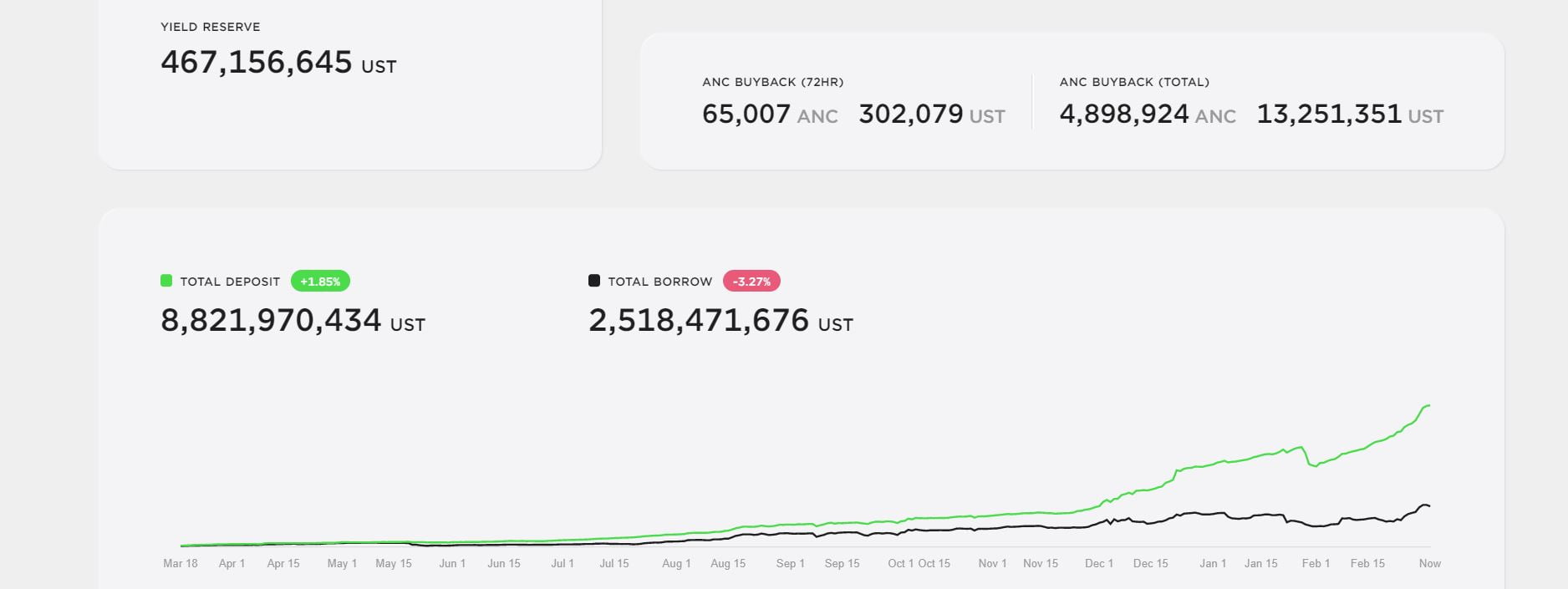

Due to the desirable curiosity price, a lot of people today have massively deposited UST into the undertaking in hopes of creating passive revenue, whilst Anchor’s amount of borrowers is pretty minimal. As a consequence, the undertaking fund was swiftly sucked into having to pay curiosity to lenders, often as small as $ six million.

Terra then assisted Anchor by approving a proposal to allocate 450 million UST stablecoins to the project’s money on Feb.19, Coinlive reported.

However, the disparity amongst loans and loans on Anchor has not been resolved and has worsened additional. At the time of creating, the worth of the Anchor loans exceeded $ eight.eight billion, extra than four occasions the $ two.five billion loan sum. Although the Anchor fund is nevertheless up to $ 467 million correct now, but with the oversupply condition, the undertaking will quickly be in a state of treasury exhaustion.

To resolve this condition, the Anchor neighborhood proposes to make the lending model on Anchor equivalent to Ethereum’s Curve Finance (CRV).

our workforce just submitted a veANC tokenomics proposal to the Anchor forums. I would really like to hear the ideas of the neighborhood. go over @anchor_protocoI https://t.co/yp8qpG7cD4

– Retrograde (@retrogrademoney) February 17, 2022

As a consequence, Anchor will enable customers to block ANC tokens for one-four many years and acquire veANC tokens. This veANC token will then be employed to vote for the payment of collateral to be borrowed on Anchor this kind of as bLUNA and bETH, consequently building a economic incentive for borrowers. VeANC holders will also acquire ANC staking awards and a portion of the project’s income.

Since the over proposal has the prospective to flip Anchor into a curve on Earth, a substantial amount of traders have hoarded ANC so that they can later on lock it into veANC. This momentum has assisted the ANC rate just about triple in the previous two weeks, hitting a new all-time large of $ five.six on April three, regardless of the latest correction in the cryptocurrency industry.

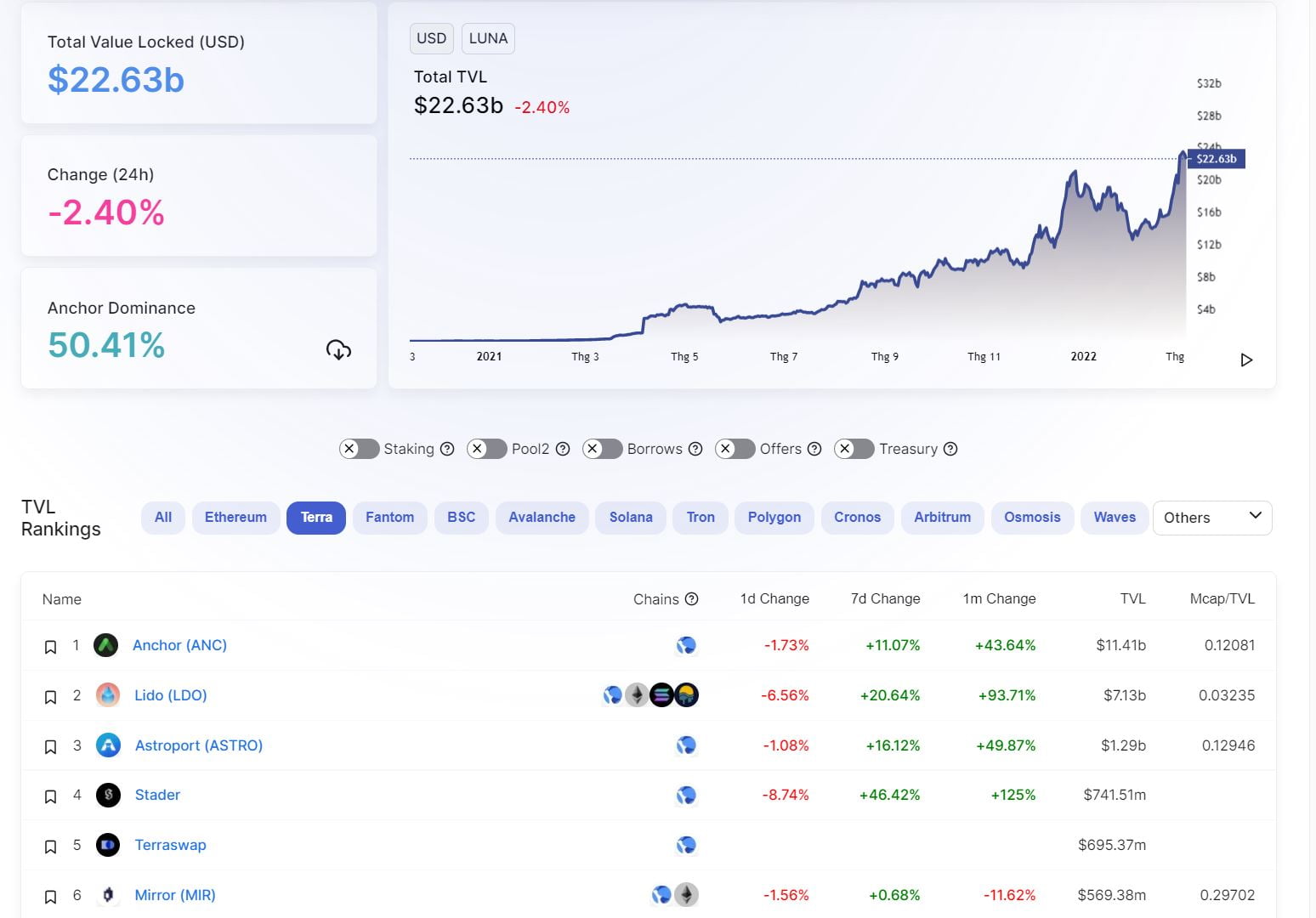

Anchor’s reputation also assists Terra sustain its place as the 2nd-greatest blockchain by crucial worth (TVL) in the cryptocurrency market. Anchor’s TVL now accounts for extra than half of the $ 22.63 billion TVL of the total Earth ecosystem.

The rate of the LUNA token also just rallied to $ 97.29 – shut to the ATH peak at $ 103.60 – in the 2nd half of February 2022 thanks to the Anchor “pillar” and the information that Luna Foundation Guard has set up a fund. of $ one billion investment. Bitcoin in assistance of the UST stablecoin.

Synthetic currency 68

Maybe you are interested: