After a bit of speaking and returning to DeFi, Andre Cronje has just created new moves on Fantom, this time as a answer to liquidate and shell out off the excellent debt with the fUSD stablecoin.

On his Twitter webpage, Andre Cronje posted a weblog explaining how to settle excellent loans with fUSD and announced the interface for end users to migrate to the new platform.

fUSD migration and liquidations https://t.co/vj4UAagaoX

— Andre Cronje (@AndreCronjeTech) January 29, 2023

The fUSD v2 model launched by Andre serves as a platform for each income generation and liquidity added benefits for the Fantom ecosystem.

“We wanted to offer builders, partners and users a system that was more intuitive and easier to estimate in terms of costs. Migrating to v2 will provide an easier to process solution and lay the foundation for many systemic products,” mentioned Andre Cronje in the submit.

The developer then mentioned that the total fUSD v1 loan collateralized by FTM and sFTM will be liquidated, and the token will be unstaked and the rewards claimed in parallel.

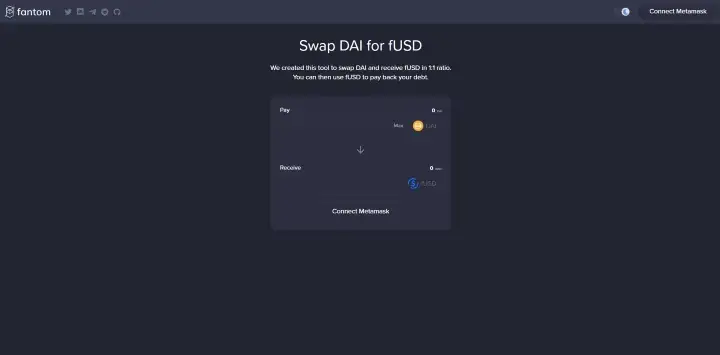

The Fantom staff also implements an interface to switch among DAI and fUSD for debt repayment.

This modify has been relatively resisted by the consumer neighborhood, as it has inconvenienced some cardholders who hold sFTMs and lend. Before that, fUSD also faced a lot of poor debt difficulties, triggering this stablecoin to depeg in the $.six area.

> See much more: fUSD, poor debts on Scream and the return of Andre Cronje?

The fUSD v1 backlog management approach exhibits that Andre and the Fantom staff are wanting to lay the bricks and establish an ecosystem close to this stablecoin.

Previously, a lending platform, Aave, also had proposals to handle poor debts on the platform right after the CRV token incident.

AIP 146 has been executed, it has permitted the compensation of the residual extra debt CRV of the Aave protocol.

The protocol leaves a handful of weeks of income on the table, but end users have misplaced zero $ and we can switch to V3 Friday which removes these dangers from a clean state.

Forward! pic.twitter.com/G2JzyPPl2U

— Marc Zeller (@lemiscate) January 25, 2023

From current updates, it can be noticed that the DeFi industry is in a “deleveraging” phase, deleveraging and addressing previous excellent debts. This could be a time period that marks a new transformation, with a lot of noteworthy credit score-connected remedies in the close to potential, primarily in the stablecoin section.

Synthetic currency68

Maybe you are interested: