[ad_1]

On December 6, Aptos (APT) boasted a market capitalization of nearly $8.25 billion. However, currently, the market capitalization has dropped to $6.36 billion, losing nearly $2 billion in just five days.

This decline coincides with anticipation surrounding the upcoming token unlock, an event that is likely to cause significant volatility for APT.

Aptos has a lot to lose with the looming supply shock

Aptos’ market capitalization surpassed the $8 billion mark as the price climbed to $15.25. To put it in context, market capitalization is calculated as the product of price and circulating supply. So when the price increases, the market capitalization also increases.

Additionally, if the price of a cryptocurrency stagnates but the number of tokens in circulation increases, the market capitalization also increases. In the case of Aptos, the decline in market capitalization can be attributed to the general market downturn, which has caused many altcoins to lose value from the heights they reached last week.

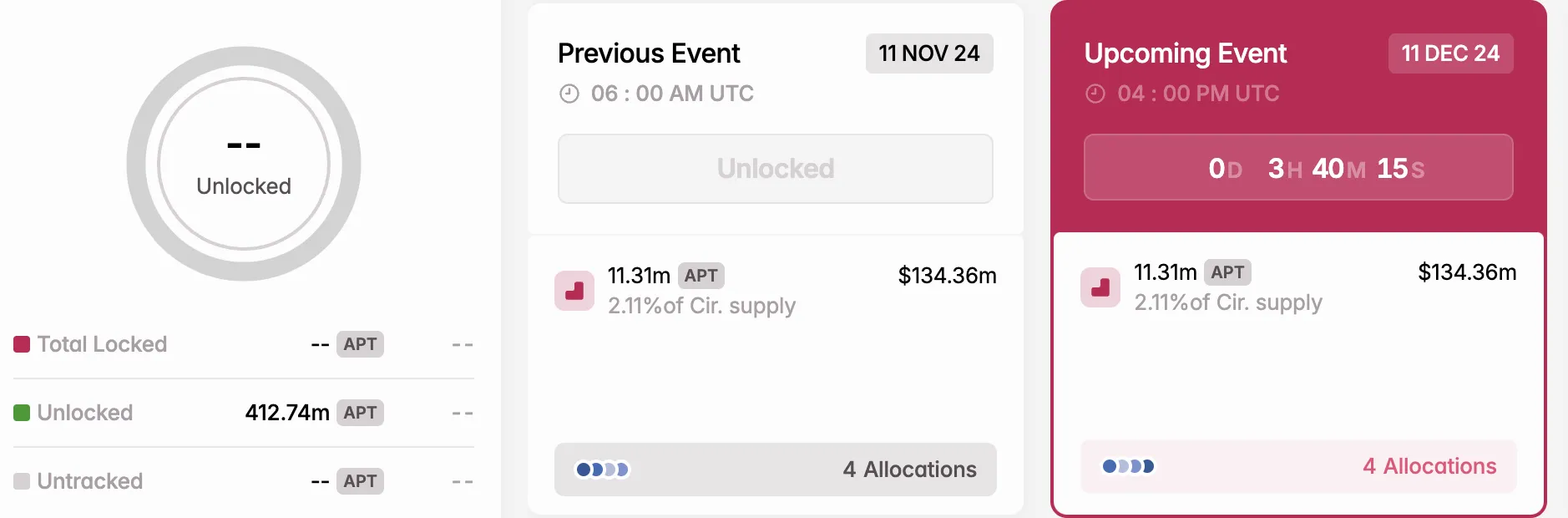

Besides, the decline may also be related to the Token unlocking scheduled to take place today. Token unlocking refers to the release of previously locked cryptocurrency tokens to the public, usually as part of a vesting calendar or promotional event.

This mechanism plays an important role in the cryptocurrency market, ensuring controlled and strategic Token distribution for effective circulation management and market stabilization. According to Tokenomist (formerly Token Unlocks), Aptos will release 2.11% of the total supply, worth $134.47 million today.

Once unlocked, this event can cause high volatility around APT. Furthermore, if buying pressure fails to counteract the upcoming supply shock, this supply shock could lead to a decline in Aptos prices.

APT price prediction: Token will slide below the 10 USD mark

A few days ago, the price of Aptos was trading in an ascending triangle. Ascending triangles typically have a bullish bias, suggesting that the uptrend may continue. However, at the time of writing, the altcoin has dropped significantly below the neck of the technical pattern, suggesting that the bullish outbreak has been neutralized.

Furthermore, Cumulative Volume Delta (CVD) has dropped into negative territory. CVD measures the difference between buying volume and selling volume. When positive, it indicates that there are more buying than selling.

On the contrary, if negative, it shows that selling pressure is increasing, which is true in the case of APT. With this position, Aptos’ price could drop to $9.65 in the short term. But if demand increases, that may not happen and the value could climb to $15.33.

General Bitcoin News

[ad_2]