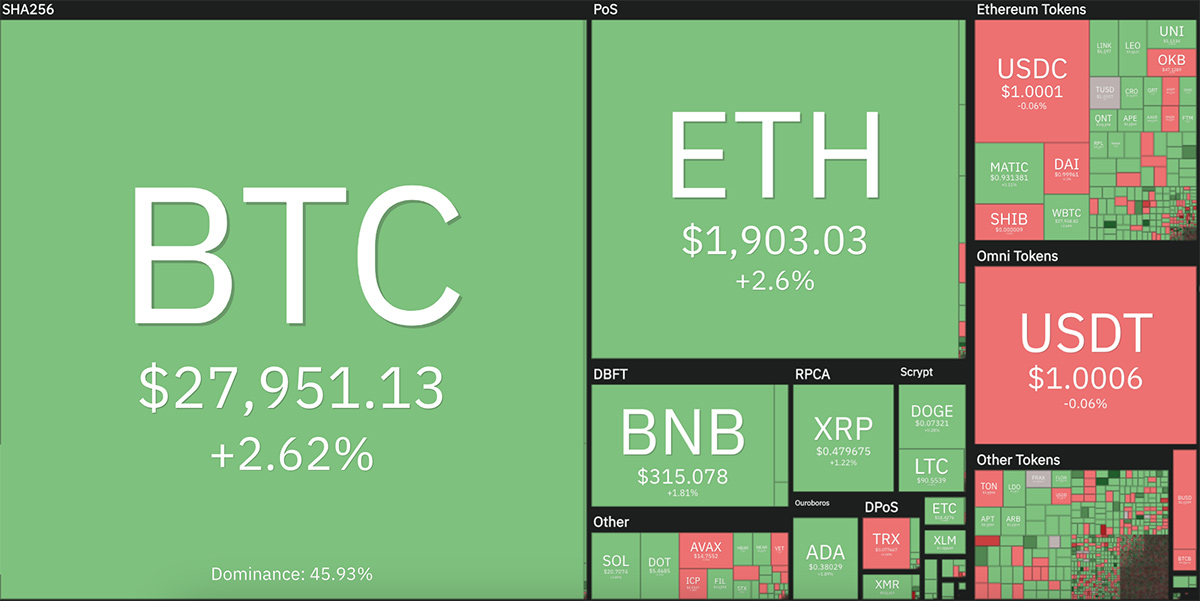

After US lawmakers reached an interim agreement on the concern of public debt, each Bitcoin and the stock industry seem set to rally. On May 27, the US averted a terrifying public debt crisis following the White House and House members agreed to an interim deal. The US stock industry rose in anticipation of the May 26 deal, and this constructive signal has also spread to the cryptocurrency industry, which is striving to recover.

Trading is not restricted to Bitcoin but a choose variety of altcoins are also exhibiting indicators of a slight uptick in the quick phrase. However, sustaining the price tag enhance at increased ranges may perhaps be tough for traders.

After the public debt agreement, traders will probable concentrate on raising curiosity prices by the US Central Bank. Hot Personal Spending Management information on May 26 raises the likelihood of a charge hike at the Fed’s June meeting. The probability of a 25 basis level charge hike elevated from 17% a week in the past to 64% on May 28, according to CME FedWatch tool.

Along with Bitcoin, which altcoins are expecting a slight uptrend in the quick phrase? Take a seem at the charts of these leading crypto assets to spot essential price tag ranges to observe.

Bitcoin Price Analysis

Bitcoin has reached the overhead resistance spot in between the twenty-day moving regular ($27,146) and the help line of the symmetrical triangle. This spot can witness a powerful struggle in between bulls and bears.

If the price tag moves down from the leading spot, the bears will carry on to try to pull the price tag in direction of the vital help at $25,250. The bulls are anticipated to be completely defensive at the $25,250 to $24,000 selection due to the fact a break under that could enhance marketing. The BTC/USDT pair is probable to drop to the $twenty,000 degree.

Conversely, if the customers break as a result of the leading barrier and push the price tag back to the triangle pattern, it will indicate powerful getting on a decline. That increases the probability of a breakout of the resistance diagonal of the triangle. The pair can climb as higher as $31,000.

On the four-hour chart, we can see that the currency pair is trading in a falling channel pattern, and the bears are striving to hold the resistance line. If the price tag reverses from the latest degree and returns to the twenty-time period moving regular, this signifies getting in bearish intervals.

After that, the bulls will carry on to test to push the price tag over the channel line. If thriving, the pair can initiate a rally to $28,400.

Conversely, if the moving averages are broken, this suggests that the currency pair could carry on midway in the falling channel for a further time.

XRP Price Analysis

XRP has formed an inverse head and shoulders reversal pattern, which will finish on a break and near over the throat line.

The twenty-day EMA ($.45) is tilting up progressively and the RSI has jumped into the constructive spot, suggesting the path of least resistance is to the upside. If the bulls push and hold worth over the throat line, the XRP/USDT pair can initiate a rally to the overhead resistance spot in between $.54 and $.58. The pattern target of the constructive setup is $.fifty five.

This constructive outlook will be negated in the close to long term if the price tag turns back from the throat line and declines under the twenty-day EMA. The pair may well then drop to the vital help close to $.forty.

The 4-hour chart exhibits that the pair is seeing an uphill battle in between the bulls and the bears close to the throat line. The growing twenty EMA and the RSI in the constructive spot display a slight benefit for the customers.

If the worth recovers from the twenty EMA, it increases the likelihood of a break over $.48. If that takes place, the pair could commence its rally. Otherwise, if the price tag turns all-around and breaks the moving averages, it will tilt the quick-phrase benefit in direction of the bears. The pair can then drop to $.44.

Arbitrum price tag examination

After Arbitrum (ARB) price tag closed over its twenty-day moving regular ($one.17) on May 28, traders have been optimistic about a prospective rally in the coin.

However, sellers are tending to exert a fantastic deal of stress at the price tag of one.two USD. If traders purchase ARB over this degree, the ARB/USDT currency pair can enhance its bullish momentum. On the other hand, if the price tag re-touches this leading spot, there could be some technical problems.

However, small resistance at the 50-day moving regular ($one.29) will be observed, but it is probable to be crossed in advance of rallying in direction of $one.36 and $one.50 respectively.

To avoid a rally, sellers require to swiftly push the price tag back under the twenty-day moving regular. If they realize success in that, the ARB/USDT pair can drop to one.06 and carry on to fall to $one.01. This is an critical spot for traders to defend as if the price tag breaks this help degree, the pair could witness a drop as deep as $.73.

On the 4-hour chart, traders pushed the price tag over the trendline of the symmetrical triangle pattern. However, the sellers are striving to avoid the price tag from going up at the price tag of one.two USD. If traders purchase into this coin not making it possible for the price tag to break out of the triangle yet again, this will enhance the prospective customers for the following price tag enhance. The target of this pattern is $one.43.

Conversely, if the price tag turns all-around and back within the triangle, this exhibits that the current breakout could be a ‘bull trap’. The sellers will test to carry the price tag back to the help trendline of the triangle.

EOS Price Analysis

EOS has fluctuated in between $.78 and $one.34 for the previous handful of months. Usually, in this kind of a significant price tag selection, traders will purchase close to help and promote close to resistance.

The EOS/USDT pair was supported at $.81 on May 25 and rose over the twenty-day moving regular ($.89) on May 28. This is the very first signal that the selection is nevertheless in spot. Traders will try to push the price tag up to the 50-day moving regular ($one) wherever the bears will be capable to generate a powerful opposition.

If the following drop finds help at the twenty-day moving regular, this will display that the bulls are in the lead. The currency pair can then rally to $one.eleven. The bears will have to push the price tag under the vital help at $.78 to display the commence of a downtrend.

The recovery is dealing with marketing over the very first resistance at $.93, but the bulls have not offered up also a great deal nevertheless. The moving averages have finished a bullish crossover and the RSI is close to the overbought zone, exhibiting that the bulls are in manage.

If customers push the price tag over $.93, the pair can then acquire bullish momentum and rally to the psyhcological degree of $one and then to $one.eleven. This constructive examination could be invalidated shortly if the price tag turns all-around and breaks down to the moving averages.

Aave price tag examination

Aave is going down in a falling channel pattern, which looks to be a constructive setting for the bulls.

After struggling close to the twenty-day moving regular ($65.50) for the previous handful of days, bulls pushed the price tag over the resistance on May 27. This signifies the commence of a bull run. perhaps.

The AAVE/USDT pair can rise very first up to the 50-day moving regular ($70) and then try to rise to the resistance line. If the line gets to be a new help degree, it could kick off a quick-phrase rally.

Conversely, if the price tag turns back from latest ranges and breaks out of the twenty-day moving regular, it will indicate demand exhaustion at increased charges. The following help is at $62.

On the 4-hour chart, an ascending triangle pattern appeared and finished on a breakout and near over $67.forty. Next, the pair may well initiate a rally in direction of the pattern’s target of $74.

Instead, if the price tag turns back from the latest ranges, it exhibits that the bears are quietly defending the $67.four degree. If the price tag drops under the moving averages, it will display that the currency pair can carry on to keep within the triangle for a shorter time. A breakout of the triangle will dent this positivity, tilting restricted forces in the route of the bears.

General Bitcoin News