Ark Invest offered 42,613 shares of Coinbase (COIN) and a hundred,739 shares Grayscale Bitcoin Confidence (GBTC) in the midst of the thriving cryptocurrency marketplace.

Ark Invest took benefit of “profit taking” on stocks as BTC noticed a sharp rise

Ark Invest took benefit of “profit taking” on stocks as BTC noticed a sharp rise

Ark Invest stated it offered 42,613 shares of Coinbase (COIN) by way of Ark’s Next Generation Internet ETF (ARKW) and Ark Fintech Innovation ETF.

Additionally, ARKW Fund also offered a hundred,739 shares of Grayscale Bitcoin Trust (GBTC). Based on Coinbase’s October 23, 2023 closing selling price of $77.21 and GBTC’s closing selling price of $24.71, the hedge fund’s income are well worth the equivalent of $five.eight million.

Cathie Wood and Ark Invest trading from nowadays ten/23 pic.twitter.com/3SilCpHQFG

— Ark Invest Daily (@ArkkDaily) October 24, 2023

Notably, CEO Cathie Wood’s selection to “take profits” from Ark Invest came as COIN and GBTC stock rates surged amid the cryptocurrency marketplace boom. Bitcoin rose to above USD 35,000 on the morning of October 24, 2023, the highest degree considering that the collapse of the LUNA/UST pair, as the probability of a Bitcoin ETF business adopted increases day by day.

In the early morning hrs of October 24, the code identify for BlackRock’s Bitcoin spot ETF was announced published on the web page of the key US securities payment processing enterprise and DTCC, continuing to increase speculation that it is only a matter of time prior to BlackRock’s proposal is authorized by the SEC.

According to the most up-to-date information, the amount of searches for the key phrase “Bitcoin ETF spot” on Google has just peaked, exhibiting significant curiosity from the public.

Ark Invest’s 21Shares fund is also awaiting approval of the Bitcoin ETF spot from the SEC for the reason that the company delayed the selection until eventually January 2024.

There are at present about twelve spot Bitcoin ETFs awaiting SEC approval. In addition to BlackRock and Ark Invest, a number of other significant Wall Street and cryptocurrency companies are also waiting for the SEC to approve their Bitcoin spot ETF proposals, which includes VanEck, Bitwise, WisdomTree, Valkyrie, Fidelity, Invesco, Global X, Hashdex, Franklin Templeton and greyscale.

Cryptocurrency ETF proposals are underneath scrutiny by the SEC. Photo: Bloomberg

Cryptocurrency ETF proposals are underneath scrutiny by the SEC. Photo: Bloomberg

The U.S. Securities and Exchange Commission, underneath the leadership of Chairman Gary Gensler, has not authorized any spot ETF proposals due to worries about the threat of marketplace manipulation and fraud in the cryptocurrency marketplace.

ETF analysts Bloomberg It is estimated that there is a substantial probability that the SEC will approve the Ethereum futures ETF very first, with a probability of approval up to 90% in October.

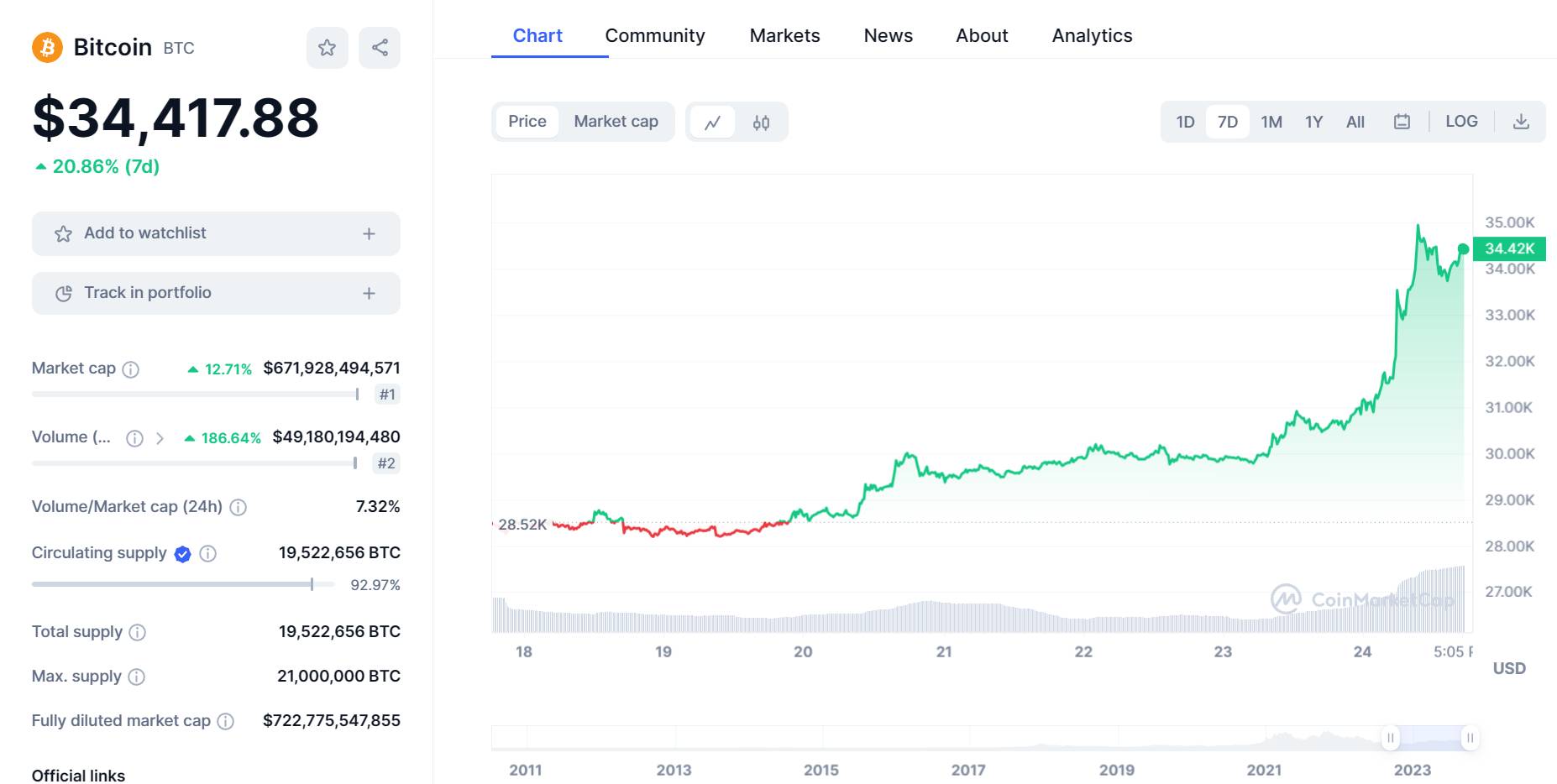

According to information from CoinMarketCap, Bitcoin is at present trading at about $34,400, reflecting an improve of extra than twenty% above the previous seven days.

7D chart of Bitcoin (BTC) on CoinMarketCap.

7D chart of Bitcoin (BTC) on CoinMarketCap.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!