Commonwealth Bank (CBA) will be the initial financial institution in Australia to offer you cryptocurrency providers to customers, in spite of the country’s not-so-open regulatory standing.

The financial institution will give its solutions and providers in partnership with Gemini and the information analytics corporation Chainalysis. Customers will have accessibility to the top rated ten well known crypto assets, together with Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTC).

We are getting the initial Australian financial institution to offer you the capacity to get, promote and hold crypto assets straight in the CommBank app. pic.twitter.com/OzX1qtvu9B

– CommBank (@CommBank) November 3, 2021

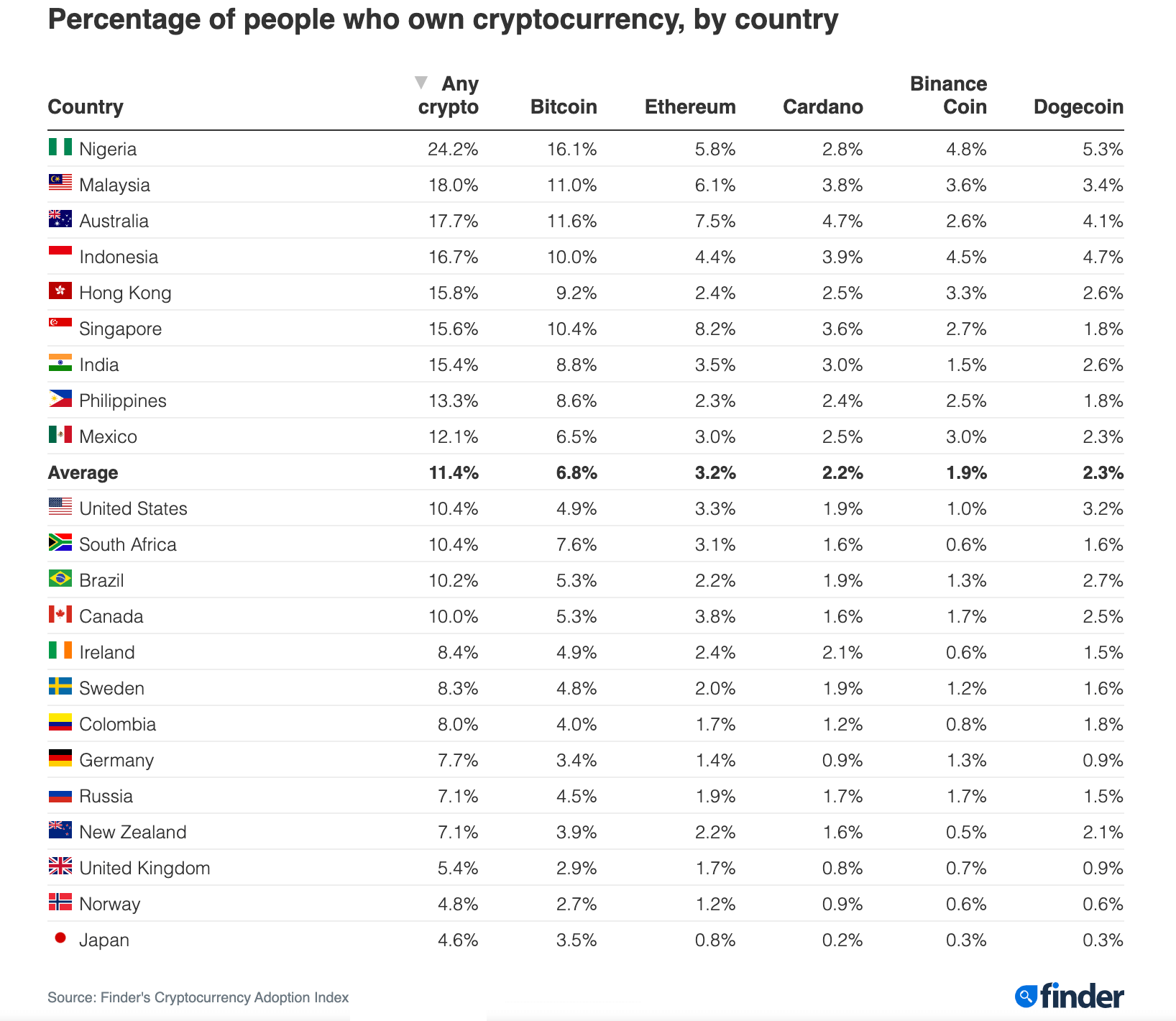

An unique partnership with the Gemini exchange enables Commonwealth Bank to integrate Gemini equipment into the banking application. The providers will start upcoming week in pilot type. Commonwealth Bank will slowly include the following attributes in the initial pilot phase. According to an October survey, Australia is the third nation in the planet to accept cryptocurrencies.

Commenting on the Commonwealth Bank’s “bold” determination, CBA CEO Matt Comyn stated the emergence and developing consumer demand for cryptocurrencies generates the two difficulties and options for the money providers business, which has observed a substantial amount of new gamers and impressive company versions in the sector.

“We believe CBAs can play an important role in the crypto space to meet the growing needs of our customers and provide capability, security and trust in a single transaction platform. Authentic translation.”

This is likely regarded as a rather sudden move by CBA for the reason that just two months in the past, the world’s top cryptocurrency exchange Binance had to quit supplying futures and some other providers due to regulatory stress in the Australian marketplace.

Synthetic currency 68

Maybe you are interested: