Robert Kiyosaki, author of the famous book Rich Dad Poor Dad, has warned that the largest stock market in history is about to crash. He predicts that expensive assets such as houses, gold, silver and Bitcoin will soon be sold at cheaper prices.

Kiyosaki’s statements come as the cryptocurrency market is undergoing a sharp correction, due to the decline in the prices of US stocks such as Nvidia and Tesla.

Robert Kiyosaki Predicts Bitcoin’s Decline

Kiyosaki took to social media to reiterate his long-standing prediction, attributing the coming collapse to decisions made during the 2008 financial crisis. He blamed leaders like the former Reserve Chairman Federalist Ben Bernanke has prioritized rescuing banks over ordinary people.

“I WARNED you. In 2013, I published Rich Dad’s Prophecy, predicting the biggest stock market crash in history. That COLLAPSE is happening,” he post.

Kiyosaki also warned that by 2025, the auto and real estate markets, restaurants, retailers, and even wine sales will collapse. He also admitted that the world is on the brink of conflict, which, he said, makes things worse.

“Be smart. Many expensive assets will be sold at a discount. I will buy more real assets with fake US dollars,” Kiyosaki quipped.

This statement follows the fact that Bitcoin has just dropped sharply in price, from over 101,700 USD on Tuesday to 95,370 USD according to current records. This represents a nearly 7% decline since the market opened on Wednesday.

Even so, Kiyosaki still expressed optimism, showing his intention to take advantage of this crash to buy more BTC.

“BITCOIN is falling in price. Good news. I keep buying Bitcoin because Bitcoin falling in price means Bitcoin is being sold at a discount. Remember ‘Buy low…and HODL.’ There are less than 2 million Bitcoins left to be mined,” he additional.

Experts Connect Bitcoin And Cryptocurrencies With Stocks

Meanwhile, experts link the cryptocurrency market correction to a decline in US stock prices. Greeks.live, a cryptocurrency options analysis platform, noted this correlation in a post on X (Twitter).

“Cryptocurrencies have seen a sharp correction as US stocks like Nvidia and Tesla have plummeted, Bitcoin has fallen below $100,000 again, and altcoins have dropped even more,” Greeks.live write.

Even so, analysts at Greeks.live remain optimistic that the bull market is here to stay. In this context, they advise investors to take advantage of the correction to buy BTC at a discounted price. If you decide to invest now, the short-term option at $100,000 is worth taking.

Eric Balchunas, senior ETF analyst at Bloomberg, shares a similar view. He pointed out a direct relationship between Bitcoin and stock market performance.

“The problem of the US stock market… No prediction, just saying that it is BTC’s poison pill. I’m still skeptical BTC can rise if stocks fall,” he write.

When asked if Bitcoin can prove resilient even if stock markets fall, Balchunas feedback that if that happens, it would represent a significant evolution from a risk asset to a safe haven. However, he still maintained skepticism.

Contributing to the debate, Adam Cochran, a cryptocurrency analyst, shared his views, noting that despite claiming that the cryptocurrency is ripe for a boom, its upside potential is constrained by a “larger economic pull.”

“Large funds don’t move out of the risk curve during recessions,” he said additional.

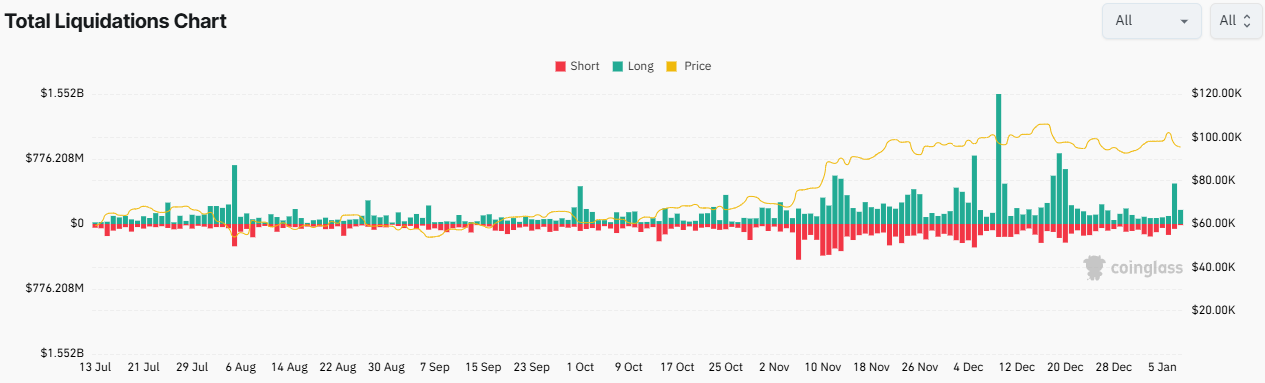

Meanwhile, Bitcoin’s current price drop has triggered widespread liquidation. According to data from Coinglass, more than 236,481 traders were liquidated in the past 24 hours, for a total liquidation of $693.52 million.

The sharp decline in Bitcoin and altcoin markets reflects a broad pessimism in market sentiment, fueled by a strengthening US dollar and ongoing stock market volatility.

The performance of cryptocurrency markets continues to raise questions about correlation with traditional financial markets. While some investors see the recent decline as an opportunity to accumulate assets at lower prices, others remain cautious due to macroeconomic uncertainties.