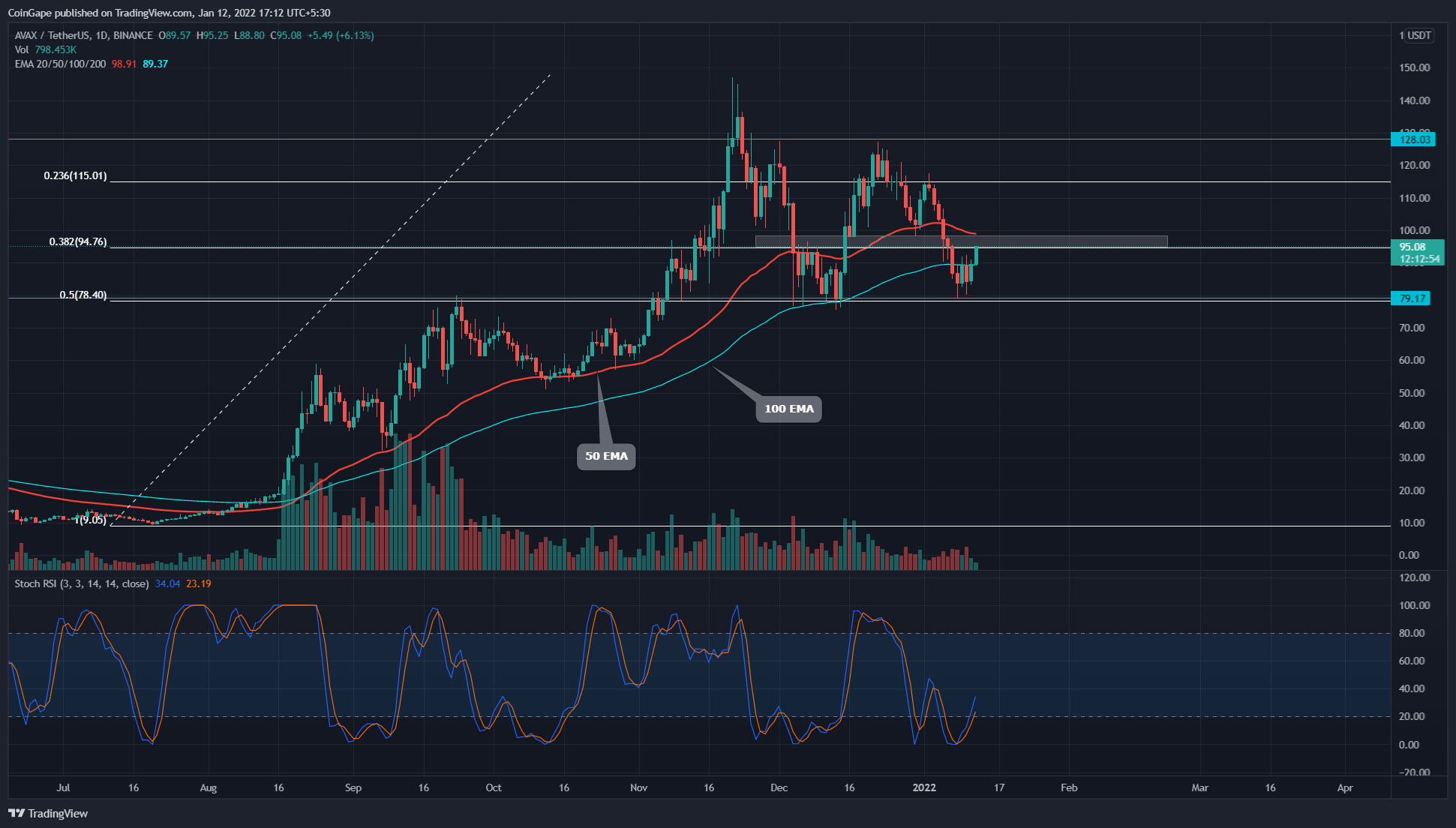

Avalanche coin (AVAX) has been dealing with a continuous assault of bears because the starting of 2022. The coin has misplaced virtually 37% from its earlier large of $128 and dropped to assistance degree. .five FIB (79.two). The technical chart displays indicators of reversal from this assistance, hoping for a rally.

Main technical factors:

- AVAX bulls reclaim the a hundred-day EMA

- Daily Stochastic RSI delivers bullish crossover of K and EAS lines

- AVAX coin’s intraday trading volume is $858.eight million, displaying a reduction of 19.two%

The supply- Tradingview

The supply- Tradingview

The final time we described an report about avalanche the coin, the pair showed an spectacular bounce, in direction of the All-TIme large resistance of $147. However, the value faced extreme provide from the midway resistance at $128. la, top to a bearish crossover.

As a consequence, the value begun to decline once more and returned to the .five Fibonacci retracement degree. The coin value invested a number of days striving to identify adequate demand strain from this assistance spot in advance of providing this slight reversal signal.

The latest bloodbath in the crypto industry has engulfed vital EMA ranges (twenty, 50, and a hundred). The value is nevertheless trading over the 200 EMA, indicating an all round bullish outlook for the coin.

The Daily-Stochastic RSI displays the K and D lines offering a bullish crossover, offering additional confirmation for a bullish reversal.

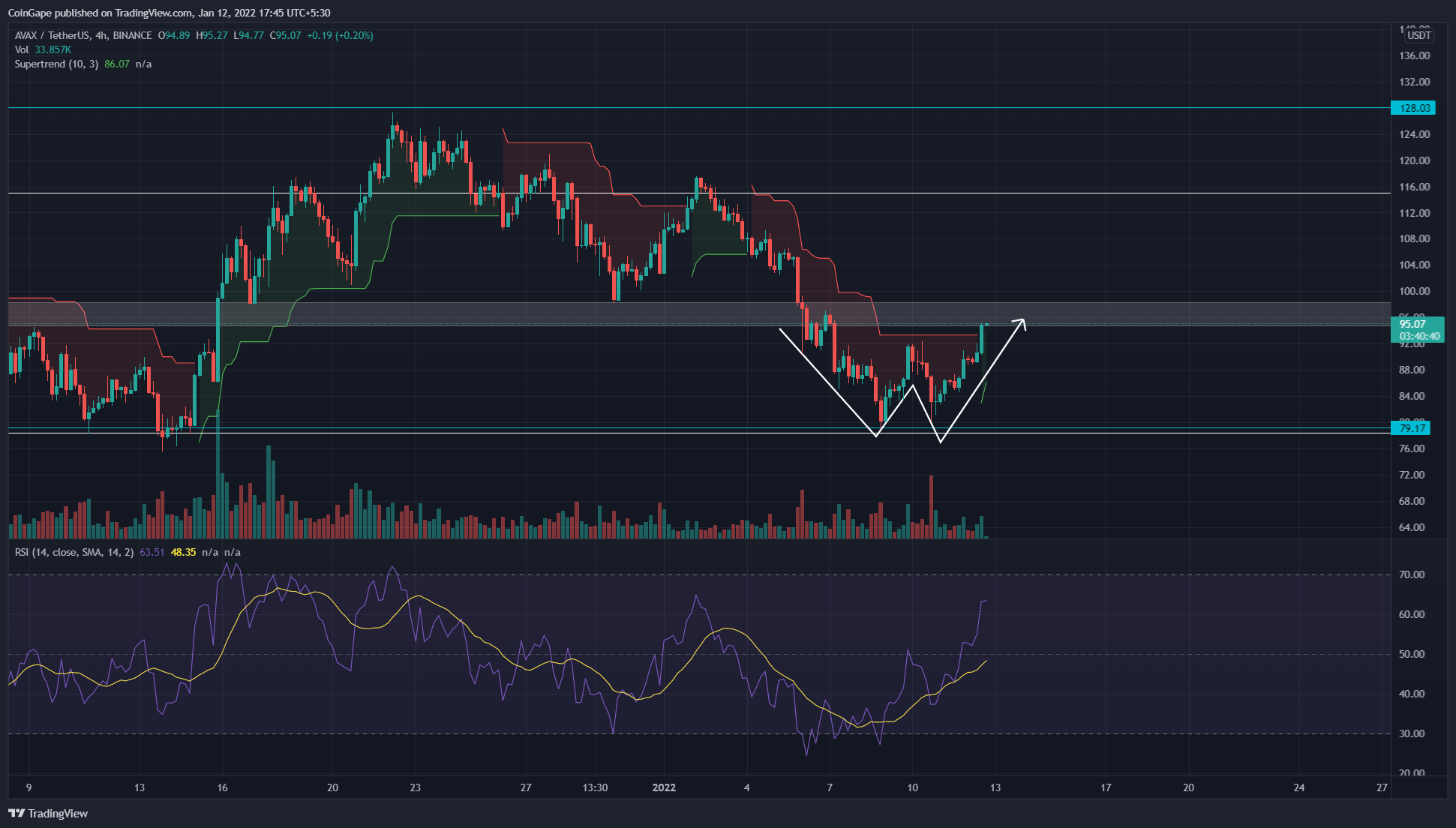

AVAX Price Shows a Double Bottom Pattern in the four-Hour Time Frame

The supply- Tradingview

The supply- Tradingview

The AVAX coin formed a double bottom from the $79.two bottom. The coin value is rather shut to the resistance neckline of $98.two. Once the value displays a decisive breakout and sustainability over this degree, crypto traders can search for lengthy-phrase options.

The Relative Strength Index (63) displays a prominent pump towards the value action, indicating a increasing underlying bullish bias for the coin.

The Supertrend indicator turns green as value displays a regular rally in this decrease timeframe chart.

- Resistance ranges- $98.two and $117

- Support degree- $86 and $79.two