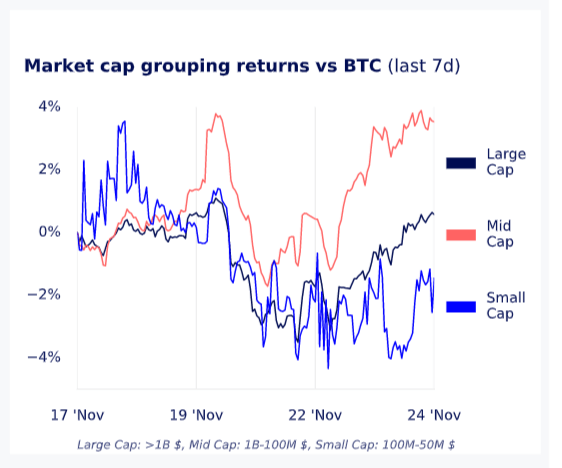

Over the previous 7 days, the altcoins regular cap has outperformed big- and smaller-cap tokens by some margin towards Bitcoin.

As a outcome, Bitcoin dominance has dropped to forty% from a higher of 45% on Nov.

Projects with a marketplace cap above $one billion are regarded big-cap, although mid-cap are people with a marketplace cap involving $a hundred million and $one billion. Small cap are tasks beneath $a hundred million but above $50 million.

The Glassnode chart under exhibits the development of the upper marketplace cap groups towards Bitcoin. Mid-cap providers have acquired practically four% towards Bitcoin, although big-cap providers have remained neutral and smaller-cap providers have misplaced about two%.

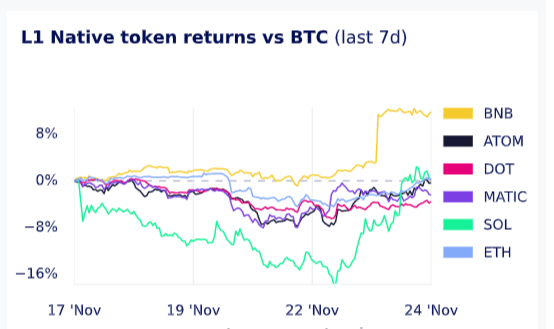

With a marketplace cap of practically $50 billion, BNB Chain is regarded a big-cap token. Among the fairly neutral returns for L1s above the previous 7 days, BNB has considerably outperformed the marketplace towards Bitcoin. BNB has rallied all around 14% towards Bitcoin just after its value rally on Nov.

Since October 23, BNB has acquired 31% towards Bitcoin and twelve% in USD terms. Furthermore, BNB’s marketplace dominance hit an all-time higher on November 23 when it accounted for far more than six% of the complete marketplace capitalization of the crypto marketplace.