Coinbase, the largest cryptocurrency exchange in the United States, is considering offering Tokenized shares of COIN stocks to domestic users through the Ethereum Layer-2 network, Base.

The move could combine traditional stocks with blockchain technology, putting Coinbase at the forefront of financial innovation.

Regulatory clarity is key for Coinbase’s launch of tokenized shares in the United States

Jesse Pollak, Base’s lead developer, revealed that Coinbase is still in the early stages of exploring this initiative. He admits that regulatory compliance is the main obstacle.

Pollak emphasized that Coinbase is committed to addressing these challenges to ensure safe and legal deployment of Tokenized assets.

“We are in the exploratory phase and working to understand what needs to be unlocked from a regulatory standpoint to bring assets like COIN to Base in a safe, compliant and forward-looking manner,” Pollak stated.

Currently, Tokenized COIN shares are only available to international users through decentralized platforms. Pollak stated that expanding this access within the United States depends on clearer regulatory guidance. Furthermore, such advances could open up blockchain-based financial systems to a wider audience.

Meanwhile, Pollak suggested that tokenized COIN shares could be the first of many similar products on the Base network. Over the past year, the Ethereum Layer-2 network has quickly attracted attention and become a significant player in the industry, with total value locked (TVL) surpassing $3.84 billion.

Pollak expressed confidence in the platform’s potential to reach $1 trillion in assets under management. According to him, this will strengthen Base’s role as a hub for next-generation financial solutions.

“We’re going to put $1 trillion in assets into Base and it’s going to happen faster than people think,” Pollak added.

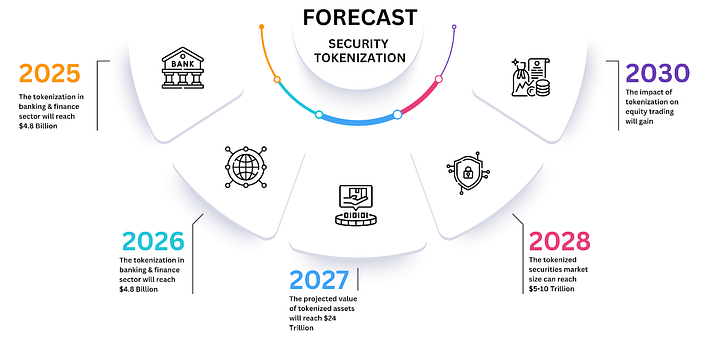

Meanwhile, Coinbase’s move towards Tokenization is not surprising, as the industry has grown rapidly over the past year. Industry leaders, including Bitwise CEO Hunter Horsley, believe that tokenization can reshape equity markets by creating a more inclusive capital markets system.

Horsley emphasized that Tokenization could allow small businesses to access equity markets without the large scale traditionally required for public offerings.

“Currently, there are approximately 4,600 companies in the United States that have access to the public equity markets. NAICs estimate there are more than 200,000 companies in the United States with revenues over $10 million. Not every company wants to go public, of course, but many simply can’t because of the scale requirements. Tokenization brings a new, democratized capital market system,” Horsley stated.

Indeed, Coinbase is the first publicly listed cryptocurrency exchange in the United States, with a market capitalization of approximately $70 billion. Austin Campbell, an adjunct professor at Columbia Business School, recently praise company for its key role in combating what he called excessive regulatory control of the cryptocurrency industry in the United States.