The Swiss branch of the Spanish banking giant, Banco Bilbao Vizcaya Argentaria (BBVA), has just expanded its cryptocurrency providing with the announcement of including Ethereum (ETH) to the bank’s wallet.

BBVA Switzerland created Bitcoin trading and custody providers obtainable to all of its personal banking customers in June. With the move to welcome Ethereum, BBVA Switzerland has develop into the country’s very first standard financial institution. Europe brings ETH to its services.

🇨🇭 BBVA Suiza from a new phase with the incorporación de los #ether a la cartera de inversiones de sus clientes. ? pic.twitter.com/dlW7l4H32S

– BBVA (@bbva) December 13, 2021

“We have decided to add Ether to the bank’s cryptocurrency portfolio alongside Bitcoin, as they are the protocols that attract the most interest of investors, providing all the guarantees of regulatory compliance.”

The financial institution has exposed its intention to carry on expanding its cryptocurrency portfolio in the coming months, with the aim of producing it less complicated for its customers to invest in the globe of cryptocurrencies.

The announcement adds that expanding into new nations or distinct client lines will rely on whether or not the market place meets the ideal deadlines, demands and legal ailments. Alfonso Gómez, CEO of BBVA, mentioned:

“The implementation of Bitcoin with Ethereum allowed BBVA Switzerland to test the functioning of the service, increase security and, most importantly, find that investors have a significant desire for the cryptoasset as a way to diversify their portfolios, despite their volatility and high risk. “

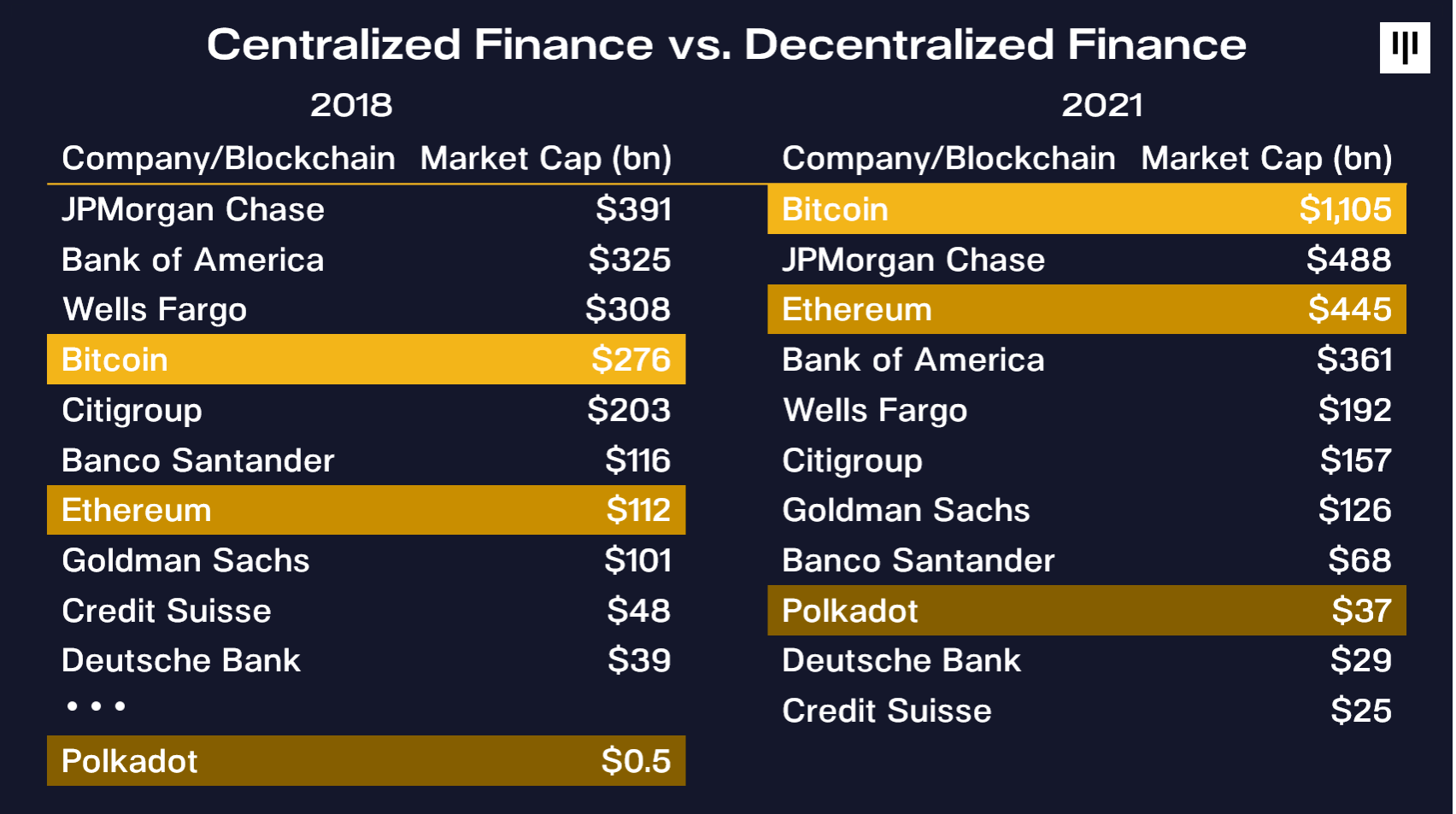

Interestingly ample, the hold of centralized monetary firms in excess of the world’s population is waning. Ethereum, the greatest DeFi finance platform, is at this time really worth far more than any financial institution except JP Morgan Chase.

Currently, BBVA’s Swiss customers and customers with new generation accounts can track Bitcoin and Ethereum along with other standard investments on the BBVA app. New Gen is BBVA’s one hundred% cryptocurrency investment account, available with an preliminary deposit of ten,000 USD, obtainable to residents of the European Union, Mexico, Colombia, Argentina, Peru and Chile, with each other. to other spots.

Synthetic Currency 68

Maybe you are interested: