While most of the market place focuses on Bitcoin’s selling price motion, a significantly bigger dilemma would seem to go unnoticed.

The centralization of Ethereum has been 1 of the hottest subjects in the crypto business because the network’s move to Proof-of-Stake, with several critics warning of the dangers of a cryptocurrency that has Such a large market place cap relies on only a handful of centralized validators.

Since the coveted mining ban in China, the centralization of the Bitcoin network has mainly disappeared from mainstream discussions and has come to be the target of a niche group in the mining sector.

However, Bitcoin’s centralization is an problem that worries the total market place, primarily now that only two mining pools make the bulk of its blocks.

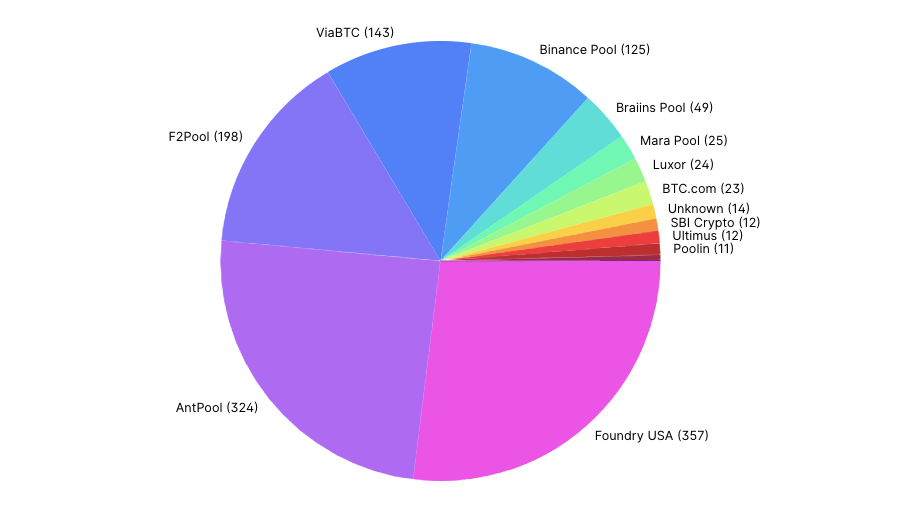

CryptoSlate looked at Bitcoin’s worldwide hash fee distribution and discovered that much more than half of it came from Foundry United states and Antpool.

The two pools have mined much more than a quarter of a Bitcoin block in the previous 10 days just about every. Since mid-December, Foundry United states have mined 357 blocks, when Antpool mined 325. Foundry’s block output accounts for 26.98% of the network, when Antpool is accountable for pretty much 24.five% of complete manufacturing. block volume.

Antpool has been at the forefront of Bitcoin mining for several many years and has generated pretty much 14% of the blocks mined in the previous 3 many years. On the other hand, Foundry is a comparatively new identify in the mining sector. However, it has rapidly risen to come to be 1 of the top rated 10 pools by hash fee, accounting for three.two% of blocks mined in excess of the previous yr.

A closer search at Antpool and the Foundry United states reveals alarming ranges of centralization — and a network of interconnected providers that correctly personal half of the network.

Foundry — DCG’s Giant Miner

It took significantly less than two many years for the Foundry United states to come to be a force to be reckoned with in the Bitcoin mining room. The mining pool is owned and operated by the Foundry of the exact same identify, a organization underneath the Digital Currency Group (DCG) create in 2019.

By the finish of summer season 2020, Foundry was currently 1 of the biggest Bitcoin miners in North America. In addition to mining, the organization also offers financing and products procurement. At the finish of 2020, Foundry aided acquire half of the Bitcoin mining hardware shipped to North America.

Foundry’s huge achievement as a direct purchaser of products and miners is the consequence of DCG’s influence in the crypto business.

The venture capital company is 1 of the space’s biggest and most energetic traders, supporting in excess of 160 crypto providers in in excess of thirty nations. of DCG investment portfolio is the registry of the most significant gamers in the business — Blockchain.com, Blockstream, Chainalysis, Circle, Coinbase, CoinDesk, Genesis, Grayscale, Kraken, Ledger, Lightning Community, Ripple, Silvergate, and so forth.

Foundry is its wholly owned subsidiary that acts as a 1-end store for all of these companies’ mining wants. Foundry Usa’s quickly expanding hash fee led some to speculate that DCG providers are contractually obligated to do all of their mining via the Foundry pool. However, it is vital to note that neither DCG nor any of the providers in their portfolio endorse this.

The mining ban enacted in China final yr also aided.

Forced to move away from China’s abundant and low-priced hydroelectricity, miners are wanting for choice spots that provide at least component of their revenue and a friendlier regulatory surroundings.

The United States is noticed as a great relocation web page, offering miners a assortment of spots and vitality sources. And there is definitely no harm in possessing a big mining pool like Foundry United states on their doorstep.

Antpool — Bitmain Monopoly

Founded in 2014, Antpool is 1 of the oldest energetic mining pools on the market place. Regularly accounting for much more than a quarter of the worldwide hash fee, Antpool has pretty much in no way left the top rated ten biggest mining pools.

The team’s achievement is its flawless vertical integration — it really is owned and operated by Bitmain, the world’s biggest producer of mining hardware. The organization behind the Antminer chain has offered its staff with the most current and most effective Bitcoin hashing equipment, assisting the staff remain successful even for the duration of the coldest crypto winter.

Bitmain’s influence on the worldwide crypto market place has led several to speculate that the organization is forcing its significant customers to mine with Antpool. With the two Bitmain and Antpool based mostly in China, several are also anxious about the country’s influence on Bitcoin’s this kind of big hash fee.

Companyization of Cryptocurrency Mining

It is vital to note that pool mining is diverse from personal mining. Unlike a single miner, a pool represents the shared hash fee of a number of machines owned by diverse entities.

Miner or hash machine owners divide the revenue produced by the mining pool in accordance to the dimension of their contribution.

Foundry United states possessing a quarter of the Bitcoin hash fee does not indicate DCG owns each machine that generates it.

However, Foundry offers the basis and roof for its customers’ mining operations. The company’s weaknesses could shake up a considerable portion of the Bitcoin network and depart 1000’s of miners and smaller sized machines on their personal if it ever goes down.

The exact same can be utilized to Antpool.

The fee of centralization that these two entities impose on the business gets even better just wanting past Bitcoin. Antpool has pool for other cryptocurrencies — Litecoin (LTC), ZCash (ZEC), Bitcoin Hard money (BCH), Ethereum Traditional (And several some others) and Dash (Sprint), just to identify a number of.

Foundry offers business enterprise place a bet supports Ethereum (ETH), Solana (SOL), Polkadot (POT), Avalanche (AVAX) and Universe (ATOM). The organization did not disclose the variety of assets it manages.