Binance is accountable for pretty much all Bitcoin (BTC) spot trading — with far more than 98% of transactions going by the centralized exchange in between February 18 and 19.

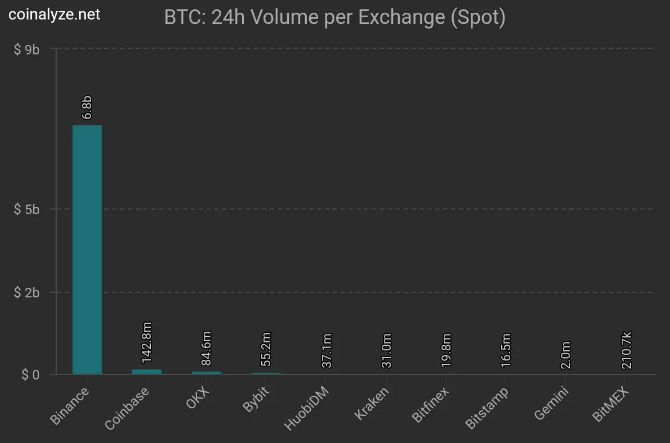

According to information from Coinalyze, Binance’s $six.eight billion well worth of trading volume dominates the other people in the marketplace — a trend that has only grown because the crash of FTX.

Binance has been gathering far more marketplace share by escalating spot BTC trading — more than five% development because January 2023. Additionally, Binance’s share of spot volume has steadily improved more than the previous yr — at this time accounts for virtually one hundred% marketplace share.

Binance’s accomplishment in dominating the BTC trading marketplace can be attributed to its transaction-no cost policy. However, this also leaves the exchange vulnerable to bots that can get benefit of the process. In contrast, exchanges like Coinbase charge about $five-seven for transactions, creating it much less vulnerable to bot attacks.

In terms of each day trading volume, Binance stays the clear leader in the total spot trading marketplace, reaching more than $21 billion, according to to CoinMarketCap. Coinbase is the only other exchange with more than $one billion in each day transactions, with a trading volume of $one.four billion.

The Binance publish that accounts for more than 98% of complete Bitcoin spot trading volume appeared very first on CryptoSlate.

General Bitcoin News