- Major addresses executed massive BR token liquidity withdrawals.

- Experts suggest it appears to be coordinated market manipulation.

- Community criticism targets potential market manipulation strategies.

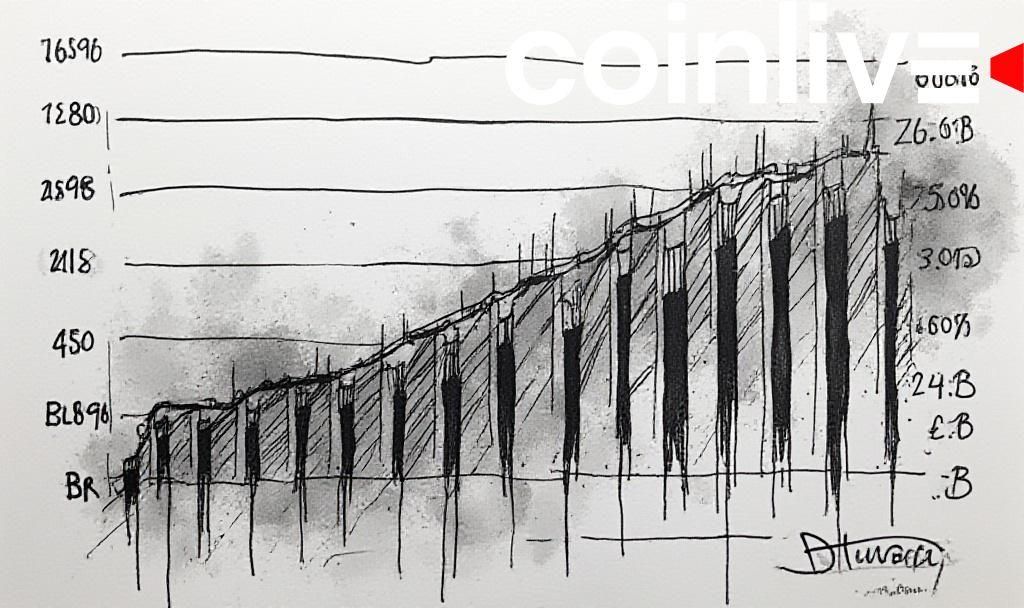

BR, Binance Alpha’s major token, experienced a dramatic 50% price decline following $47.59M in liquidity withdrawals by 26 addresses.

The event highlights vulnerabilities in cryptocurrency platforms, prompting community concerns about possible market manipulation strategies.

In a coordinated action on Binance Alpha, 26 addresses withdrew $47.59 million in BR token liquidity, causing a major price crash of over 50%. Notably, Binance’s project team had no abnormal involvement during the incident.

No suspicious activity by the project team was noted during the crash. Instead, newly created addresses seemed involved, implying a single-source action, according to analyst @ai_9684xtpa.

The BR crash severely impacted market stability, with liquidity falling from over $60 million to $14.56 million. Users noted sudden liquidity shifts, questioning Binance Alpha’s safeguards against such volatile actions.

The crash indicates vulnerabilities in decentralized finance, raising regulatory scrutiny. Industry players express concerns over the potential for coordinated market manipulation impacting investor trust.

Historically, this mirrors previous Binance Alpha incidents. Expert analysis postulates further regulatory oversight could mitigate similar market disruptions. As the market evolves, such events may lead to increased transparency demands.

The recent BR crash does not seem like the behavior of the project team… This wave of large-scale volume manipulation is more likely aimed at getting a contract/spot… the main liquidity address of the project team still holds $4.685 million in liquidity, and the last operation was on July 7, with no actions taken during the crash period. – Ai Yi, On-Chain Analyst, Twitter source