Data displays that Bitcoin trading volume on Binance has not long ago declined as FUD all around the exchange has spread, even though exercise has elevated on other platforms.

The spot marketplace excluding Binance noticed a 52% raise in Bitcoin trading volume final week

According to information from this week’s Arcane Research report, seven-day regular volume presently stands at all around $757 million on exchanges other than Binance. The pertinent metric right here is “daily trading volume,” which measures the complete quantity of Bitcoin traded on Bitwise ten exchanges on any provided day.

Bitwise ten exchanges are clearly not all exchanges in this sector, but the information from them are regarded to be the most reputable of the accessible platforms and their volume trends as very well. can be regarded as a acceptable approximation to the total spot marketplace.

When each day trading volume is substantial, it signifies that there is a massive quantity of motion going on on spot exchanges appropriate now, indicating that traders are energetic in the marketplace. college. On the other hand, a minimal worth signifies that BTC does not observe considerably trading exercise at the second.

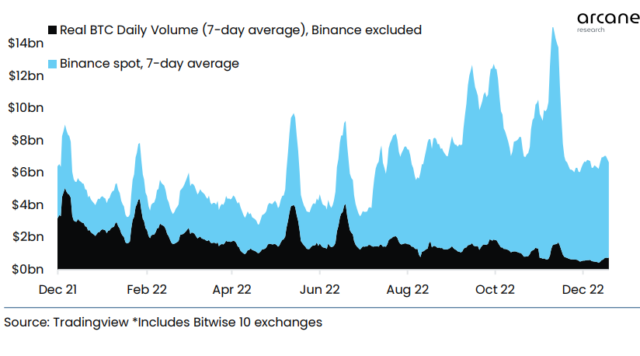

Here is a chart exhibiting the trend of the seven-day regular each day Bitcoin trading volume above the previous 12 months:

Looks like Binance even now occupies an particularly massive share of the complete volumes | Source: Arcane Research's Ahead of the Curve - December twenty

As you can see in the chart, the seven-day regular Bitcoin trading volume information on Binance and on other exchanges are displayed individually. The cause behind this is that just after the elimination of Binance charges, a massive quantity of wash trading started off taking spot on the platform as substantial volume trading tactics grew to become feasible. As a outcome, the crypto exchange was capable to get a big share of the complete volume for itself.

Just a week in the past, 91.five% of spot volume was dominated by Binance. Since then, nevertheless, the exchange’s exercise has declined due to controversies like the Proof-of-Reserves scenario that have planted FUD in investors’ minds. Now, the exchange dominance is all around 88.seven%.

While volume on Binance has dropped, the rest of the marketplace has grown by 52%, as the seven-day regular of the metric is now $757 million across these exchanges (up from $498 million) final week), the highest degree given that November 19.

BTC Price

At the time of creating, the Bitcoin selling price hovers all around $sixteen,800, down six% in the final week.

The worth of the crypto appears to have been consolidating sideways not long ago | Source: BTCUSD on TradingView

Featured photos from Kanchanara on Unsplash.com, charts from TradingView.com, Arcane Research