Chicago derivatives exchange Mercantile Exchange Group (CME) has turn out to be the foremost futures exchange reflecting the increasing demand for cryptocurrency trading from huge common fiscal institutions.

Binance has been “overtaken” by CME in terms of futures trading volume

Binance has been “overtaken” by CME in terms of futures trading volume

Wow, the real flip no one talks about:

CME just floated Binance for the largest share of open interest on Bitcoin futures.

Bittersweet: Soon there will be more dresses than hoodies here.

(h/t @VidiellaLaura) pic.twitter.com/SIPRLMlFcy

— Will (@WClementeIII) November 9, 2023

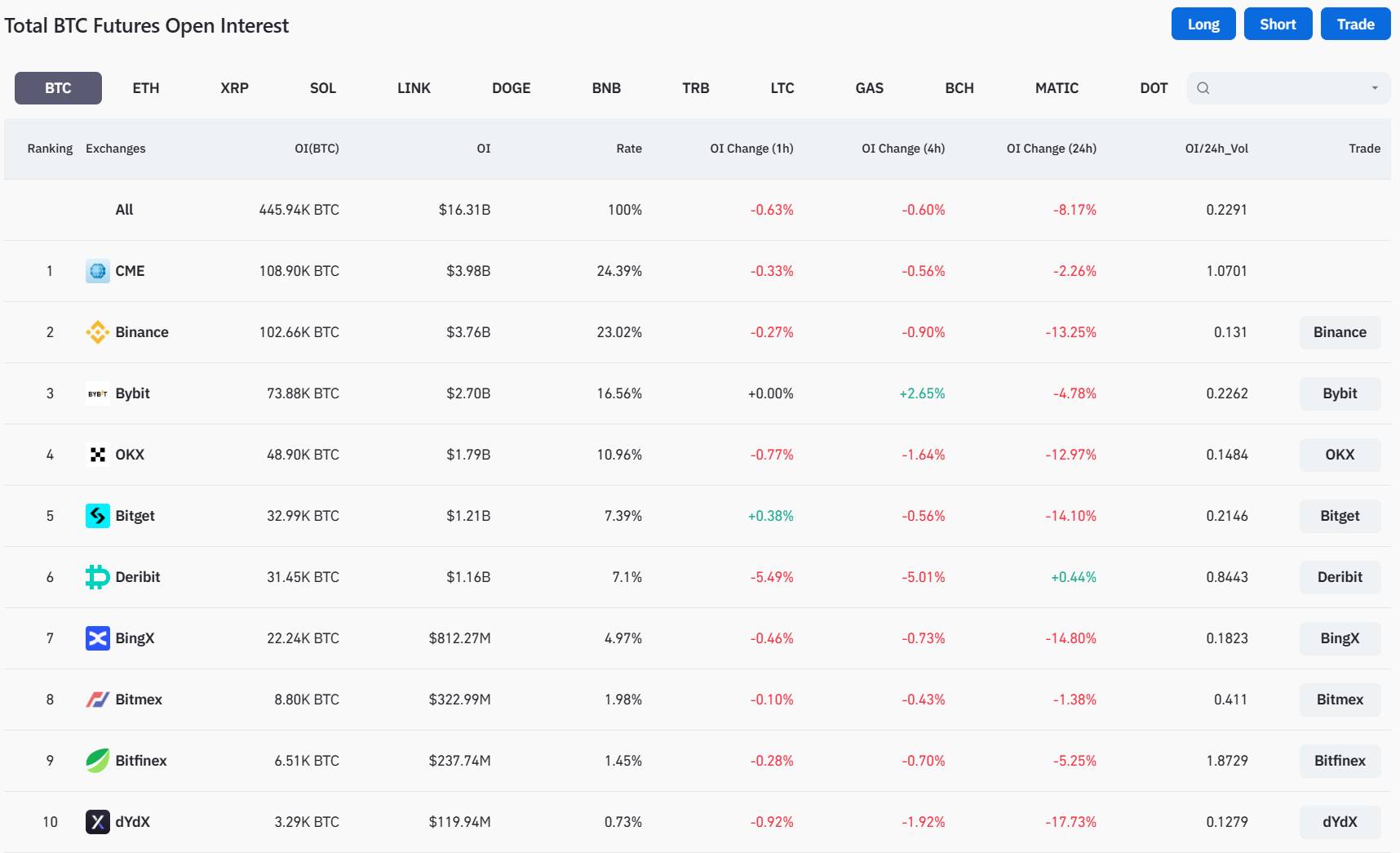

Data from CoinGlass exhibits that CME ranks very first amid derivatives exchanges with Open Interest (OI) of around $three.98 billion, at instances this amount reached $four.07 billion, equivalent to an maximize of around four% in the final 24 hrs and represents 24.39% of the market place share. Meanwhile, OI on Binance was around $three.eight billion, down seven.eight% above the similar time period.

CME ranks very first amid derivatives exchanges with Open Interest of around $three.98 billion. Photo: CoinGlass

CME ranks very first amid derivatives exchanges with Open Interest of around $three.98 billion. Photo: CoinGlass

The ranking adjust comes as the cryptocurrency market place suffered a huge liquidation amid wild selling price fluctuations on the evening of November 9, 2023, forcing 147,993 traders to liquidate their positions with a complete liquidation sum of 435.68 million USD.

This was also recorded by CoinGlass information as the greatest liquidation in the final three months, considering that August 17, 2023, when the worth of Bitcoin plummeted from USD 29,000 to USD 25,000 due to the billionaire’s aerospace business SpaceX. Billionaire Elon Musk offered USD 373 million in Bitcoin, with USD one billion in derivative orders liquidating in the cryptocurrency market place.

The evening of November 9, 2023 was the greatest liquidation in the final three months, considering that the $one billion liquidation on August 17, 2023. Photo: CoinGlass

The evening of November 9, 2023 was the greatest liquidation in the final three months, considering that the $one billion liquidation on August 17, 2023. Photo: CoinGlass

ECM it is deemed a gateway for huge organizations in the United States to enter and achieve publicity to the cryptocurrency market place. CME launched the very first BTC futures contract in December 2017 and the ETH futures contract in February 2021. By 2022, the exchange has expanded its offering including Micro BTC contracts, Micro ETH, Euro Bitcoin/Ether futures and crypto derivatives immediately to the platform.

CME’s rise to the leading place is a indicator of the increasing demand for cryptocurrency trading as huge common US institutions enter the market place. Major fiscal institutions’ publicity to cryptocurrencies through derivatives has been well-liked considering that the very first number of months of its launch as a excellent resolution to attempt to hedge selling price possibility. Their Bitcoin spot.

David Lawant, director of study at trading platform FalconX, stated:

“CME is a platform utilized virtually solely by huge common fiscal institutions, which exhibits that this purchaser group’s curiosity in cryptocurrency is particularly large.

CME has held the bulk of market place share for a lot of 2023, but the powerful gains in current weeks have come as the market place will get enthusiastic about Bitcoin spot ETF information.”

As reported by Coinlive, Bitcoin (BTC) had a new large in 2023 on November 9, growing from USD 34,800 to USD 37,972 on Binance, when there have been quite a few new developments on the prospect of a Bitcoin spot ETF accredited by the US Securities Commission (SEC) . This is the highest selling price considering that the starting of May 2022, i.e. ahead of the collapse of the LUNA-UST group.

Parallel to the king of the cryptocurrency Bitcoin, the queen of Ethereum (ETH) also jumped over $two,000 when BlackRock confirmed the creation of the ETH Ethereum spot fund. The fund will have the official identify iShares Ethereum Trust, listed and supported for trading on the Nasdaq stock exchange. The custodian of ETH for the fund will be cryptocurrency exchange Coinbase. This is the 2nd spot ETF supplying designed by BlackRock for cryptocurrencies, following the iShares Bitcoin Trust.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!