Binance, the biggest cryptocurrency exchange in the globe, is seeing a record quantity of withdrawals of Bitcoin, Ethereum and stablecoin following the collapse of FTX.

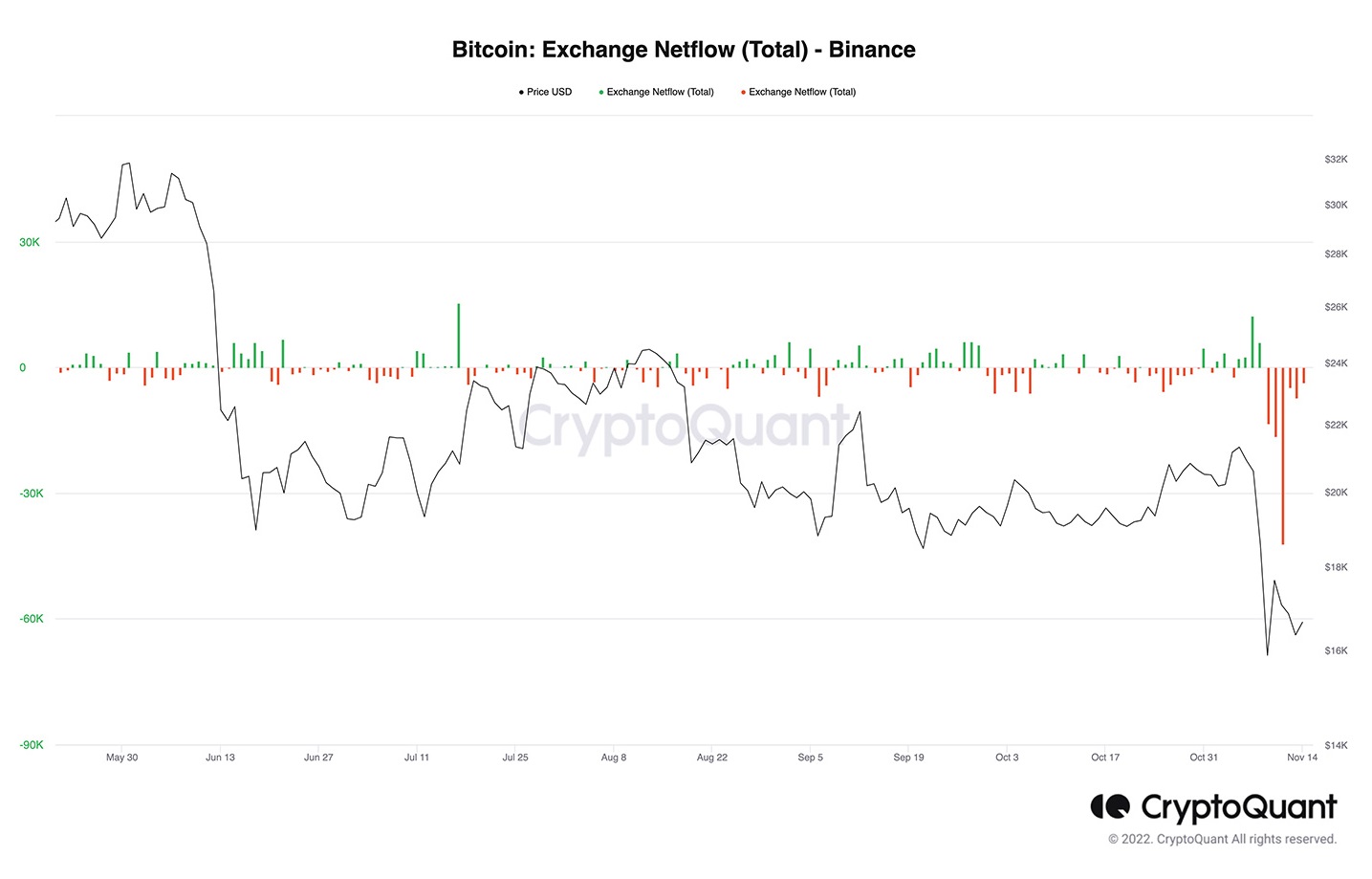

According to information from CryptoQuant, there had been 81,712 Bitcoins ($one.35 billion), or much more than 15% of the roughly 500,000 Bitcoins on the Binance exchange, withdrawn from the platform in the previous six days. Additionally, 125,026 Ether ($155 million) and $one.14 billion in stablecoins had been also withdrawn from Binance in the course of this time period.

Responding to the AMA on the evening of November 14, Binance CEO Changpeng Zhao identified as for calm and mentioned that a “slight” boost in withdrawal charges is regular when the all round marketplace worth falls.

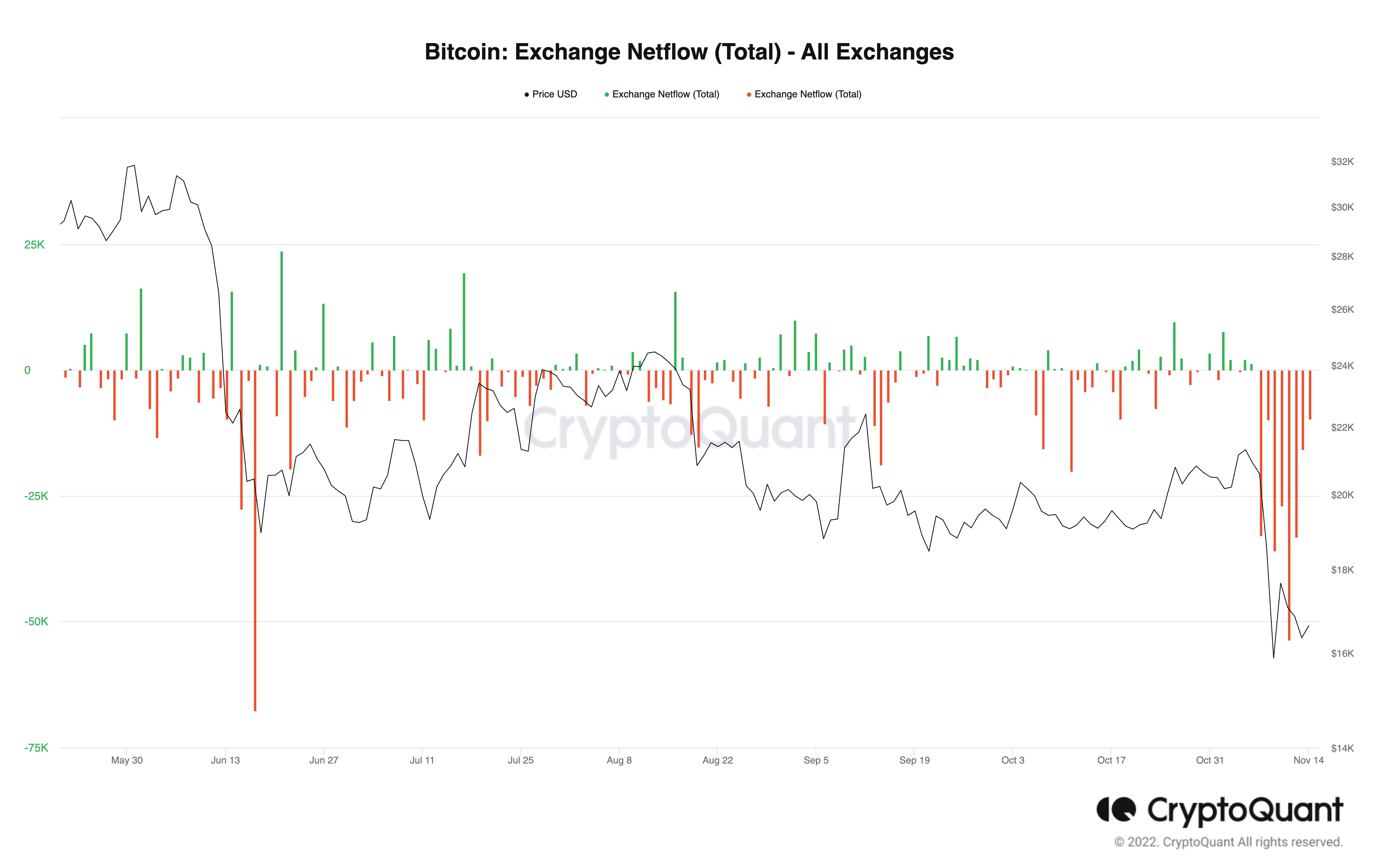

User withdrawals are the standing quo for the complete business, in accordance to Coinglass, practically 200,000 Bitcoins have been withdrawn from exchanges in the previous 7 days, bringing the degree of bitcoins held on exchanges to one.88 million. Other cryptocurrency exchanges this kind of as Coinbase (COIN), Gemini and Kraken have also proven comparable deficits to Binance.

The large consumer withdrawal is mentioned to be a outcome of the collapse of FTX, a single of the biggest exchanges on the planet, which filed for bankruptcy final week. Taken from an report by CoinDesk speculate on the money wellness of FTX subsidiary Alameda Research. The story broke out when Binance’s CEO announced he would promote all of his FTT holdings. Customers right away experimented with to withdraw revenue from FTX, the organization did not reply in time and led to a liquidity crisis, owning to declare bankruptcy in just five days.

The crisis has also spread to other platforms this kind of as Gate.io, Crypto.com, and Huobi immediately after all of these exchanges had been located to have “shady” transactions underneath allegations of “beautifying the books”.

Synthetic currency 68

Maybe you are interested: