Cryptocurrency trading platform Binance was stated to have transferred $one.eight billion in collateral to other events in 2022, but this has been denied by the exchange.

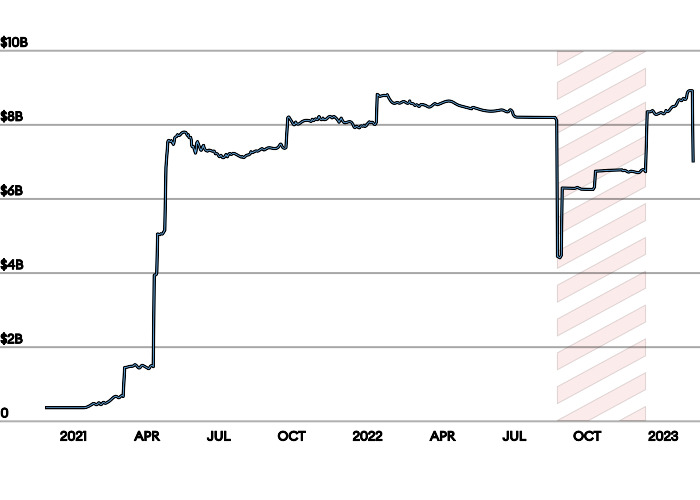

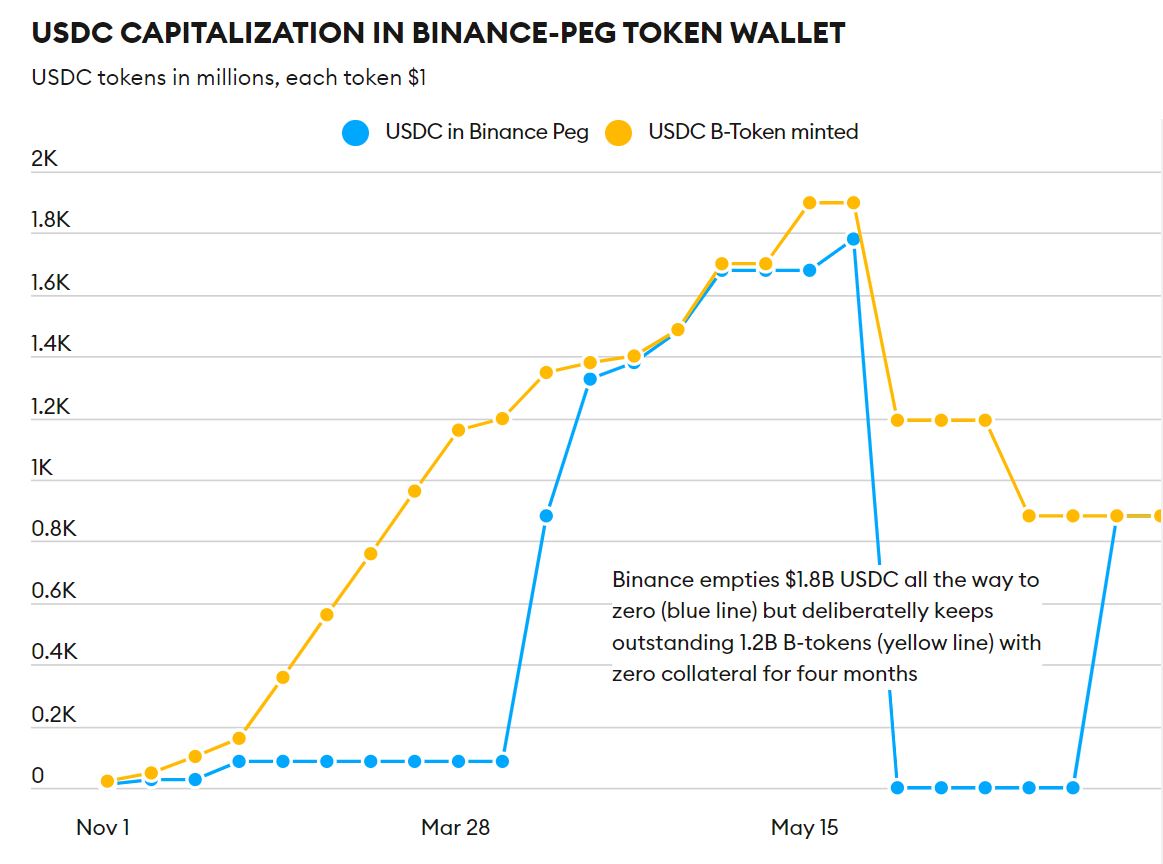

According to sources of Forbesthe Binance exchange in 2022 had a second exactly where it failed to absolutely help the $one.eight billion in derivative tokens issued by the platform.

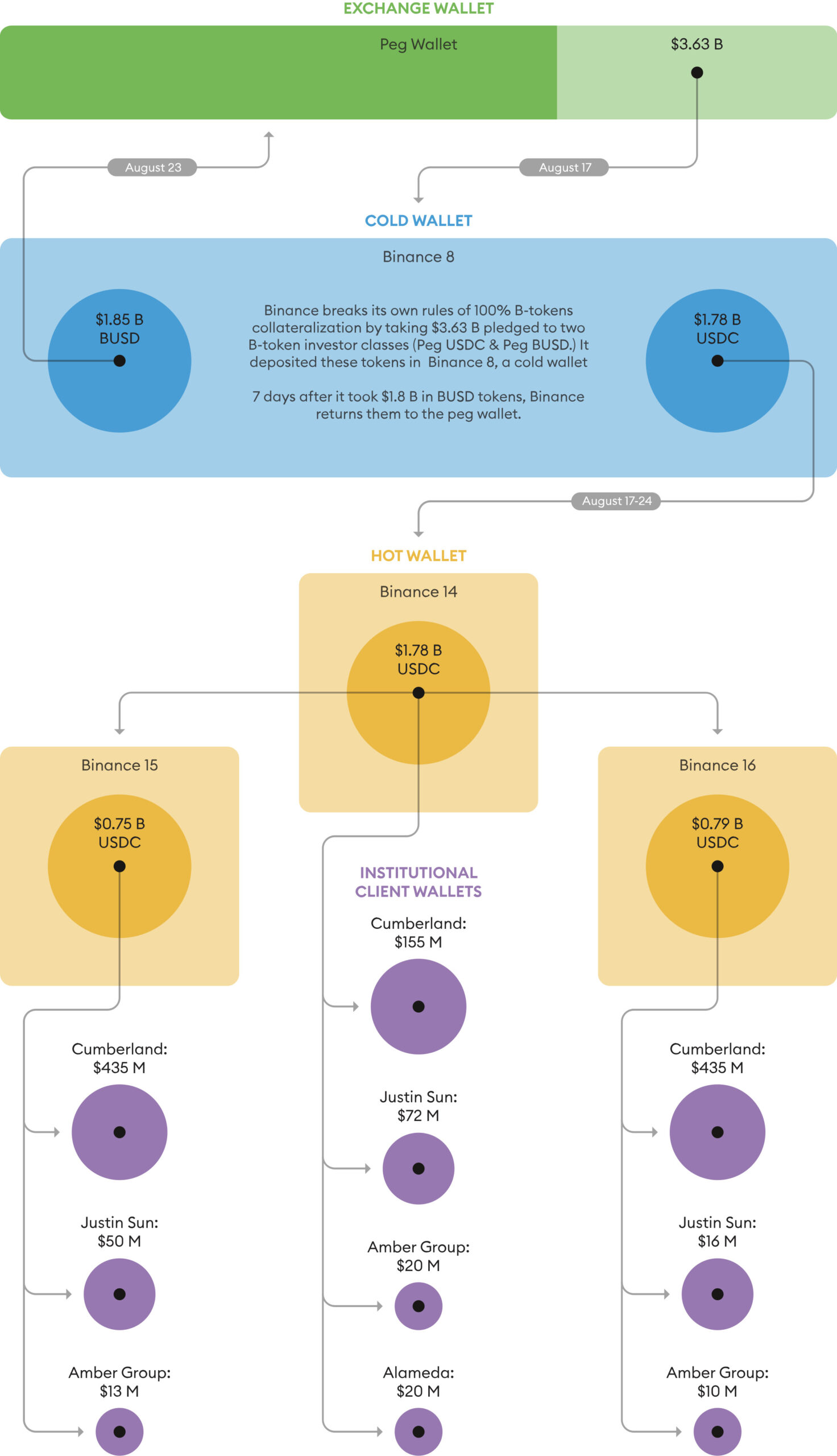

Specifically, the supply stated that Binance circulated $one.eight billion of collateral for the USDC edition of the stablecoin issued on BNB Chain to investment money this kind of as Alameda Research, Amber Group and Cumberland without having notifying clients. The time to record this condition is from mid-August 2022 to early December 2022, which is ideal just after the 3AC-Celsius – Voyager liquidity crisis came just after the quick collapse of FTX.

The short article also claims that Binance has transferred one.one billion USDC to Cumberland, a Chicago (USA)-based mostly investment fund, in buy to convert it into Binance’s stablecoin BUSD to enhance market place share towards USDC.

During the USDC outflow time period, Binance has not still burned USDC issued on BNB Chain, which means they had been not absolutely securitized.

Binance Chief Strategy Officer Patrick Hillman confirmed Forbes that it is usual and unproblematic for the exchange to consistently transfer money amongst wallets, pledging not to combine consumer money and usually sustaining appropriate accounting information.

A Binance spokesperson also issued a statement relating to the short article Forbes as follows:

“Transactions that arec referred to as the inner wallet management of the exchange. While Binance has previously acknowledged that there was an error in the collateral management of Binance’s reissued tokens, it by no means impacted users’ money. Our collateral management method is program and can be verified by blockchain information.”

In January 2023, Binance admitted to sustaining consumer deposits with collateral for derivative tokens in the exact same wallet and pledged to make improvements to repair it. The exchange was also located in 2021 for not sustaining ample money to ensure the worth of the BUSD stablecoin.

Binance has constantly come to be the target of legal attacks in latest many years, the most recent getting the SEC and the New York government to “touch” the BUSD stablecoin.

Synthetic currency68

Maybe you are interested: