The biggest cryptocurrency exchange on the planet Binance has knowledgeable a significant consumer withdrawal amounting to $831 million in the previous 24 hrs.

Binance continues to encounter a surge in withdrawals

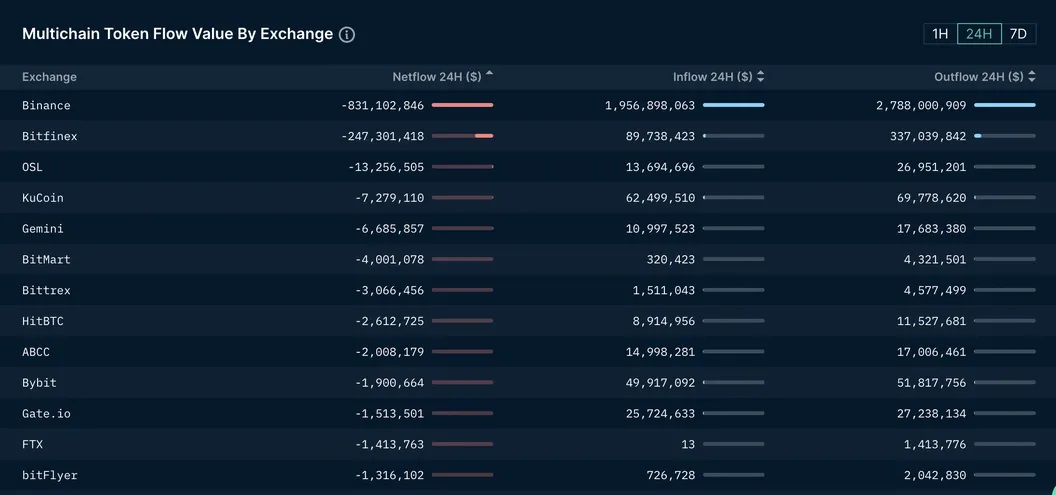

Per blockchain information unit nansenthere have been roughly $831 million of “leaks” from Binance in the previous 24 hrs.

Specifically, end users withdrew roughly $two.eight billion in digital assets the former day, nicely over the $two billion in deposits in the exact same frame.

This is also the biggest sum of revenue outdoors of Binance due to the fact final November when FTX went bankrupt and the minute FUD circled the floor in December 2022. At that time, net movement (Netflow), the distinction among the sum of assets getting into/depositing (Inflow) and leaving/withdrawing (Outflow) from Binance it reached $902 million in 24 hrs.

Now, panic continues to prevail between traders right after the crackdown on the stablecoin Binance USD (BUSD) issued by Binance in partnership with Paxos due to the fact 2019.

As Coinlive reported, the New York Department of Financial Services ordered Paxos to prevent printing new BUSDs, right after the US Securities and Exchange Commission (SEC) sent a recognize getting ready to prosecute the stablecoin as a “masked titles”. Originally referred to as Binance, BUSD is at the moment the third-biggest stablecoin by marketplace capitalization, accounting for 35% of complete trading volume on the world’s biggest cryptocurrency exchange.

Binance’s reserves are the moment yet again “tested”.

The regulatory action is severely hurting the exchange as BUSD is the biggest asset in Binance’s reserves (at about $13.four billion) right after Tether’s USDT, Nansen mused. This stake represents 22% of the $60 billion in assets on Binance.

$three billion of BNB accounts for virtually five% of the exchange’s complete assets, despite the fact that Arkham Intelligence estimates the figure to be substantially increased, maybe as large as $six.9 billion.

As typical, the Binance boss not too long ago stored posting that the controversy surrounding FUD, but FUD is just like “clouds blowing wind”, implying that every thing will return to the previous trajectory quickly.

FUD is short-term. pic.twitter.com/O2ntcjn2HJ

—CZ Binance (@cz_binance) February 14, 2023

Additionally, there is a stream that the recent crackdown is paving the way for key stablecoins to re-create a new buy.

Since the FTX bankruptcy, Binance has been at the forefront of supplying proof of consumer assets and launching an marketplace-broad motion. Binance claims to normally assure the security of a lot more than $70 billion of client assets. In response to a query about the debt audit report, Binance CEO Changpeng Zhao stated that the exchange “owes nothing to anyone.”

However, until finally the finish of 2022, Binance was hit with a string of poor information, when there have been allegations of revenue laundering and sanctions violations by US authorities. Prior to this information, quite a few individuals from big institutions have been rushed to withdraw their money, primary to the BUSD getting depegged and Binance halting USDC withdrawals due to lack of liquidity. However, later on appearing in an AMA, Mr. Zhao even now calmly stated that this is a ordinary marketplace response, Binance is even now financially sturdy to deal with any detrimental developments.

Thanks to the outstanding recovery of the cryptocurrency marketplace in January 2023, the sum of revenue deposited on Binance elevated substantially and returned to the degree of early December. Binance CEO at the time stated that the “test by fire” for Binance. Binance is completed and as a outcome the biggest cryptocurrency exchange in the globe is even now standing.

Synthetic currency68

Maybe you are interested: