Binance continues to raise its dominance and industry share in the cryptocurrency trading area thanks to investor self-confidence in spite of the legal siege.

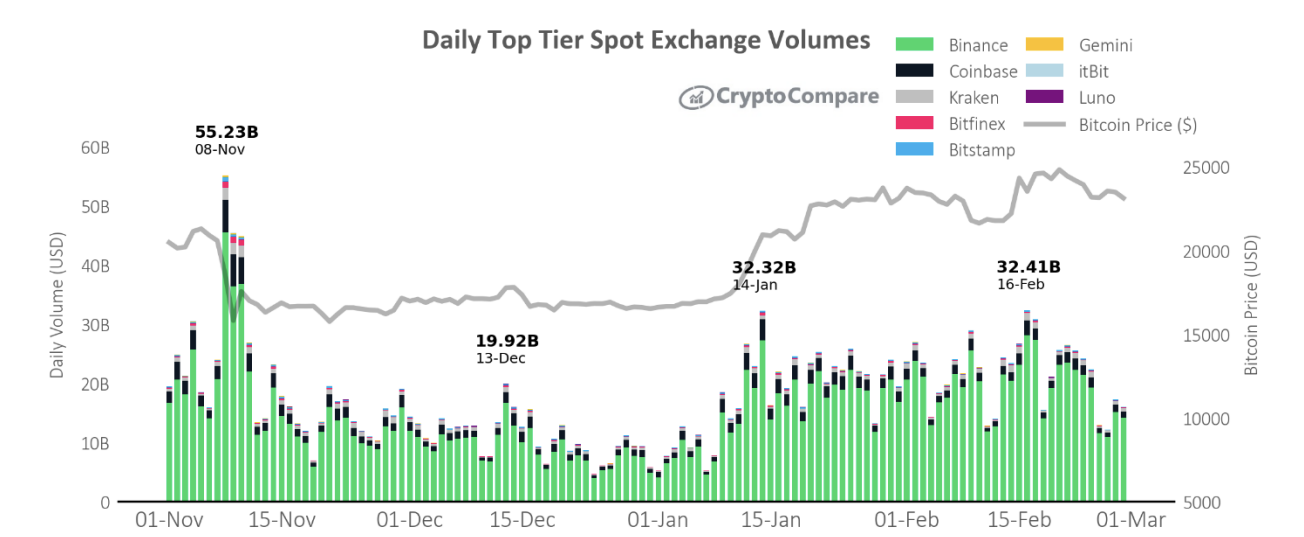

According to the statistics of CryptoCompareThe world’s biggest cryptocurrency exchange by volume, Binance, had a fourth consecutive month of gaining industry share in the spot section.

Specifically, Binance’s spot industry share greater from 59.four% in January to 61.eight% in February 2023, with a complete volume of $540 billion for the month. Since November 2022, Binance’s spot industry share has greater to 13.seven% following the collapse of rival platform FTX.

Following Binance in terms of trading volume in February 2023 was Coinbase with just $39.9 billion, down 29% from the former month, whilst Kraken was third with $19.three billion, down eleven%. .

Despite the adverse information that continued to hit the #one cryptocurrency exchange in the industry in the initial two months of 2023, from stablecoin BUSD accused of currently being a safety by the US SEC, to Voyager’s Binance.US acquisition denied by the US SEC .New York government protests, Binance admits it misplaced a banking companion to take care of USD transactions or previous token securitization blunders even now appear unlikely to shake investor self-confidence in Binance.

Analyst Jacob Joseph of CryptoCompare comment:

“Despite the criticisms Binance has acquired in the previous, traders in the industry even now select this location to shop their assets since it is regarded the safest. Binance also has ample liquidity, therefore limiting the chance of slippage whilst trading, and supports a broad selection of valuable trading pairs and providers.”

In terms of derivatives trading, Binance also dominated the futures industry share, accounting for 62.9% of the complete trading volume. The OKX and Bybit exchanges stick to with a industry share of 14% and 13.three% respectively.

Synthetic currency68

Maybe you are interested: