According to the most current report, Bitcoin adoption amongst merchants is anticipated to enhance by 50% in the subsequent 3 many years. This end result is from a survey manufactured by Ripple and the Faster Payments Council, with the participation of 300 payment leaders in 45 nations.

Growing Interest in Bitcoin Payments Globally

The report signifies that blockchain technological innovation has emerged as an different to expensive payment methods in current many years. Transaction volumes have improved appreciably in the crypto business, with more than five.five million end users paying out in crypto in the United States alone by 2023.

The major 4 use circumstances for crypto payments incorporate remittances, cross-border B2B payments, card payments, and digital payments. Remittances make up the bulk of this, with foreign staff applying cryptocurrencies to stay away from large transaction charges when sending funds dwelling to their households.

Related readings: Xapo Bank Becomes First Lender to Allow Almost Instant Bitcoin Payments

Additionally, the increasing adoption of Bitcoin payments by PayPal and Stipe has also boosted adoption appreciably. In addition to Bitcoin, stablecoins like USDT and USDC have viewed sizeable adoption due to their very low volatility. It is regarded that applying stablecoins for cross-border payments is 80% much less expensive than standard payment approaches.

About 97% of respondents to the survey feel that cryptocurrency payments will perform a main position in quicker payments inside the subsequent 3 many years. More than half of the leaders surveyed anticipate most merchants to accept crypto payments throughout this time period.

Middle East prospects the adoption race

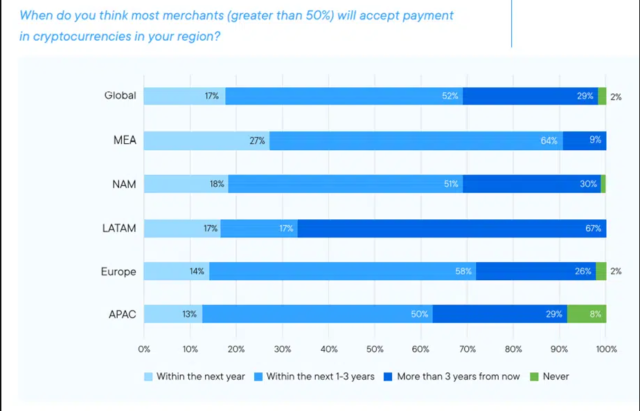

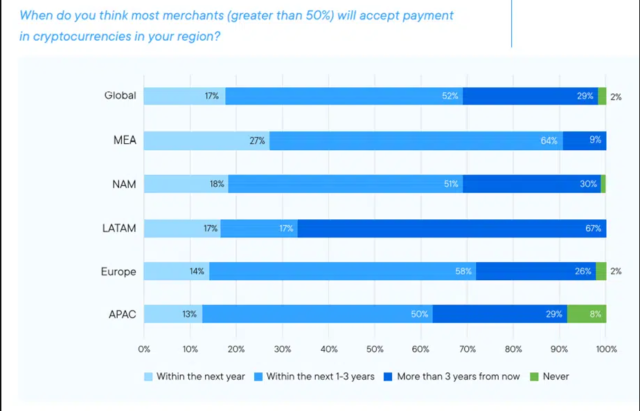

According to information from Ripple and FPC, most payment organizations feel that merchants globally will use extra cryptocurrencies in the close to phrase. As viewed in the chart beneath, the survey effects present that 64% of representatives of payment organizations in the Middle East feel that more than 50% of merchants will start out accepting crypto payments inside 3 many years. subsequent.

Europe follows with 58%, North America 51% and Africa 51%. In contrast, about 17% of Latin American representatives feel that adoption will consider spot throughout this time period. This is in spite of the increasing adoption fee in the LatAm area in between formal and informal companies.

The situation of regulation was also mentioned in the Ripple and FPC survey. For the bulk of payment companies consulted (89%), the lack of clear regulation in the crypto-asset sector is a “barrier” to the use of blockchain technological innovation as a usually means of payment. maths.

However, it ought to be remembered that in current months there has been progress in regulating the cryptocurrency sector in a amount of nations. Countries like Venezuela and El Salvador have established a complete regulatory framework for crypto assets.

Related readings: Ripple will quickly appeal if it loses to the SEC, says Chief Legal Officer

Additionally, nations across the globe, this kind of as South Africa, Brazil and Singapore, are creating progress in their rules. The survey established that companies’ “optimism” about this industry could satisfy a “growing appetite” for “broader access and inclusion of financial services.”

It also highlights that other payment approaches based mostly on blockchain technological innovation, this kind of as central financial institution digital currency (CBDC), will make improvements to the international payment technique.

Featured picture from Unsplash.com chart from Ripple/FPC and TradingView.com.

According to the most current report, Bitcoin adoption amongst merchants is anticipated to enhance by 50% in the subsequent 3 many years. This end result is from a survey manufactured by Ripple and the Faster Payments Council, with the participation of 300 payment leaders in 45 nations.

Growing Interest in Bitcoin Payments Globally

The report signifies that blockchain technological innovation has emerged as an different to expensive payment methods in current many years. Transaction volumes have improved appreciably in the crypto business, with more than five.five million end users paying out in crypto in the United States alone by 2023.

The major 4 use circumstances for crypto payments incorporate remittances, cross-border B2B payments, card payments, and digital payments. Remittances make up the bulk of this, with foreign staff applying cryptocurrencies to stay away from large transaction charges when sending funds dwelling to their households.

Related readings: Xapo Bank Becomes First Lender to Allow Almost Instant Bitcoin Payments

Additionally, the increasing adoption of Bitcoin payments by PayPal and Stipe has also boosted adoption appreciably. In addition to Bitcoin, stablecoins like USDT and USDC have viewed sizeable adoption due to their very low volatility. It is regarded that applying stablecoins for cross-border payments is 80% much less expensive than standard payment approaches.

About 97% of respondents to the survey feel that cryptocurrency payments will perform a main position in quicker payments inside the subsequent 3 many years. More than half of the leaders surveyed anticipate most merchants to accept crypto payments throughout this time period.

Middle East prospects the adoption race

According to information from Ripple and FPC, most payment organizations feel that merchants globally will use extra cryptocurrencies in the close to phrase. As viewed in the chart beneath, the survey effects present that 64% of representatives of payment organizations in the Middle East feel that more than 50% of merchants will start out accepting crypto payments inside 3 many years. subsequent.

Europe follows with 58%, North America 51% and Africa 51%. In contrast, about 17% of Latin American representatives feel that adoption will consider spot throughout this time period. This is in spite of the increasing adoption fee in the LatAm area in between formal and informal companies.

The situation of regulation was also mentioned in the Ripple and FPC survey. For the bulk of payment companies consulted (89%), the lack of clear regulation in the crypto-asset sector is a “barrier” to the use of blockchain technological innovation as a usually means of payment. maths.

However, it ought to be remembered that in current months there has been progress in regulating the cryptocurrency sector in a amount of nations. Countries like Venezuela and El Salvador have established a complete regulatory framework for crypto assets.

Related readings: Ripple will quickly appeal if it loses to the SEC, says Chief Legal Officer

Additionally, nations across the globe, this kind of as South Africa, Brazil and Singapore, are creating progress in their rules. The survey established that companies’ “optimism” about this industry could satisfy a “growing appetite” for “broader access and inclusion of financial services.”

It also highlights that other payment approaches based mostly on blockchain technological innovation, this kind of as central financial institution digital currency (CBDC), will make improvements to the international payment technique.

Featured picture from Unsplash.com chart from Ripple/FPC and TradingView.com.