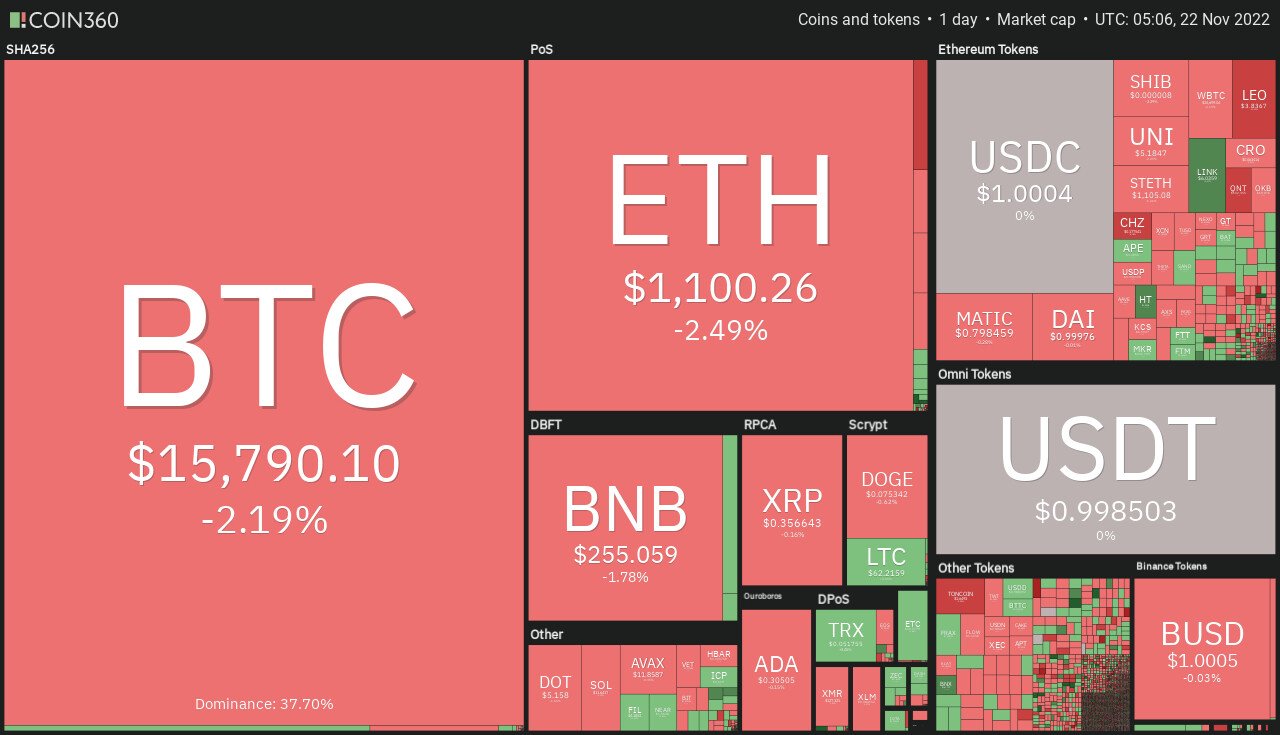

Bitcoin hit a two-yr minimal on Tuesday morning in Asian trading as traders minimize rates on most cryptocurrencies in excess of fears that the failure of crypto exchange FTX.com eleven November could lead to the insolvency of other enterprises that have relations with the exchange.

Ethereum, the 2nd most worthwhile cryptocurrency, trades bearishly, dropping to $one,one hundred behind Bitcoin.

The capitalization of the international crypto marketplace fell .75% to $786 billion the preceding day, with big cryptocurrencies trading flat as of early Nov. 22, in contrast, the complete. Cryptocurrency marketplace volume elevated 21% in the final 24 hrs to $66.85 billion.

The complete volume in DeFi is $four.31 billion, representing six% of the complete 24-hour volume in the crypto marketplace. The complete volume of all stablecoins is $63 billion, which is 94% of the complete 24-hour volume of the crypto marketplace.

Let’s get a search at the top rated 24 hour altcoin gainers and losers.

Top Altcoins Rise and Fall

Huobi Token (HT), ImmutableX (IMX) and ApeCoin (APE) are 3 of the top rated one hundred coins that have elevated in worth in the previous 24 hrs. The HT selling price has elevated by a lot more than ten% to $four.85, the IMX selling price has elevated by a lot more than five% to $.4045, and the APE selling price has elevated by virtually four%.

UNUS SED LEO (LEO), Chiliz (CHZ) and Chain (XCN) are 3 of the top rated one hundred coins that have misplaced worth in the final 24 hrs. LEO has misplaced in excess of 13% to trade at $.1930. CHZ has dropped a lot more than seven% in the previous 24 hrs to $.1785.

Bitcoin Drops to Two-Year Low Amid FTX Crash Fears

Fearing a repeat of the crash of stablecoin Terra-Luna in May, which also brought on other enterprises to collapse, traders worry the probability of a lot more bankruptcies between traders. the corporation associated to the FTX exchange is now insolvent.

The monetary wellbeing of crypto investment financial institution Genesis Global Trading, which is managed by the venture arm of Digital Currency Group, is acquiring a great deal of focus in the crypto marketplace exposed by the corporation. with the now defunct FTX exchange.

In the wake of current occasions, our traders should really know that the security and protection of the holdings underlying Grayscale digital asset merchandise are unaffected.

— Grayscale (@Grayscale) November 16, 2022

According to its most current quarterly report by way of the finish of September, Genesis Global Capital, the company’s brokerage arm, has about $two.eight billion in deposits and has temporarily halted withdrawals.

Genesis Global Trading, primarily based in New York, explained the move by citing “unusual withdrawal requests” that drained Genesis Capital’s readily available capital.

This raised issues that the company’s monetary issues could spread as a consequence of the collapse of FTX.

Genesis cites “abnormal withdrawal requests” as motive for FREEZING withdrawals.

Yeah, anyone is receiving off exchange. Smart consumer. But will virtually definitely indicate a lot more collapsecies.

GET OFF ASAP wherever you can. IMO Binance and https://t.co/3XoIFRMnmL are NOT harmless.

— Meet Kevin (@genuineMeetKevin) November 16, 2022

Genesis announced by means of Twitter on November sixteen that it has retained “the best advisors in the field to review all options.”

As a consequence, growing FUD amounts are driving the crypto marketplace down.

Bitcoin Price

The recent Bitcoin selling price is $15,817 and the 24-hour trading volume is $33 billion. In the previous 24 hrs, Bitcoin has dropped one.99%.

With a dwell marketplace cap of $303 billion, CoinMarketCap is at the moment at the top rated.

It has a complete sum of 21,000,000 BTC and a circulating provide of 19,213,900 BTC.

Bitcoin’s technical outlook stays bearish, as it breached the reduce finish of the sideways trading selection of $sixteen,000 to $17,000. A bearish breakout of this selection is probably to spark a different marketing bias until finally the subsequent assistance at $15,250 is reached.

The BTC/USD pair is probably to come across assistance at a double bottom at $15,650 en route to $15,250. On the four-hour timeframe, Bitcoin has formed a descending triangle pattern, which typically signifies the probability of a bearish breakout.

Further down, a break of $15,250 could enable a lot more marketing until finally $14,850. Bitcoin is at the moment dealing with quick resistance close to the $sixteen,250 degree, and a break over this degree could get BTC to the subsequent resistance location at $17,150.

Ethereum Price

The recent selling price of Ethereum is $one,101, with a 24-hour trading volume of $13 billion. In the previous 24 hrs, Ethereum has misplaced a lot more than two%. With a dwell marketplace cap of $134 billion, CoinMarketCap is at the moment 2nd. It has a circulating provide of 122,373,866 ETH.

Ethereum is attempting to regain the $one,one hundred degree on the four-hour chart. ETH/USD has broken out of the reduce edge of the symmetrical triangle, indicating the probability of a continuation of the solid downtrend.

On the downside, the 50-day moving typical is extending the critical resistance at $1215 and will virtually definitely act as critical resistance under the previously breached triple bottom.

A near under this degree could send ETH into the $one,075 or $one,000 assistance location.