[ad_1]

Among all crypto derivatives, perpetual futures have emerged as the favored device for market place speculation. Bitcoin traders use this device to hedge hazards and gather a funding charge premium.

Perpetual futures or perpetual swaps are from time to time referred to as futures contracts with no expiration date. Holders of the perpetual contract can purchase or promote the underlying asset at an unspecified time in the potential. The value of the contract stays the exact same as the spot charge of the underlying asset on the contract opening date.

To continue to keep the contract’s value near to the spot value as time goes on, exchanges employ a mechanism termed crypto-funding ratios. The funding charge is a modest percentage of the worth of a place that should be paid or obtained from a counterparty periodically, generally each handful of hrs.

A optimistic funding charge signifies that the value of the perpetual contract is increased than the spot charge, indicating increased demand. When demand is higher, the purchase (purchase) contract pays a funding charge to the promote (promote) contract, incentivizing opposing positions and bringing the value of the contract closer to the spot charge.

When the funding charge is detrimental, the brief contracts will spend the funding charges on the lengthy contracts, once more pushing the value of the contract closer to the spot charge.

Given the dimension of the two expiring and perpetual futures markets, a comparison of the two can reveal broader market place sentiment when it comes to potential value movements.

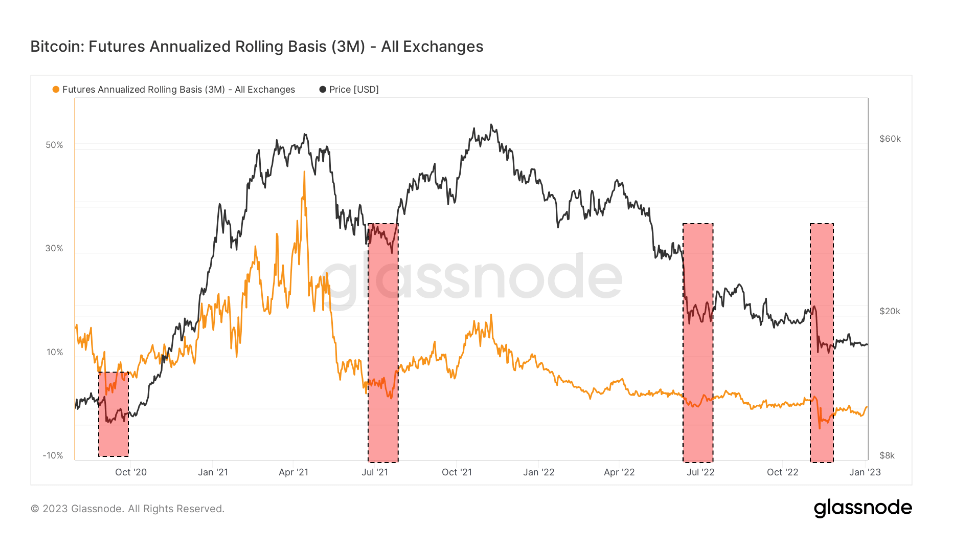

The Bitcoin Annual three-Month Futures Contract Facility compares the yearly charge of return out there in income and physical exercise trades in between the three-month expiring futures and the perpetual funding charge.

CryptoSlate’s evaluation of this metric exhibits that the basis of the perpetual futures contract is drastically extra volatile than the basis of the expiring futures contract. The distinction in between the two is a end result of the enhanced want for leverage in the market place. Traders appear to be seeking for a monetary instrument that tracks spot market place value indexes extra closely and perpetual futures contracts that flawlessly suit their demands.

Periods in which the basis of a perpetual futures contract traded beneath the basis of a three-month futures expiration have occurred just after a sharp drop in value. Major possibility-mitigation occasions this kind of as a bull market place correction or a prolonged bear decline frequently end result in a decline in the perpetual futures contract base.

On the other hand, the perpetual futures basis is trading increased than the three month expiring futures basis indicating a higher demand for leverage in the market place. This produces an oversupply of promote-side contracts that prospects to a drop in costs, as traders act speedily for higher funding charge spreads.

A search at the chart over exhibits that the two Bitcoin expiring futures and perpetual swaps are trading in a backward state throughout the FTX crash.

Backwardation is a state in which the value of a futures contract is decrease than the spot value of the underlying asset. It takes place when demand for an asset is increased than demand for contracts that mature in the coming months.

As this kind of, a pullback is a rather unusual sight in the derivatives market place. During the FTX crash, expiring futures traded on an yearly basis of -.three%, though perpetual swaps traded on an yearly basis of -two.five%.

The only very similar retrograde intervals had been recorded in September 2020, summer season 2021 just after China’s mining ban, and July 2020. These had been intervals of intense volatility and had been dominated by brief sale purchase. All of these retracements see the market place hedging to the downside and getting ready for additional declines.

However, just after each and every retracement time period, there is a rally in value. The bullish action begun in October 2020 and peaked in April 2021. July 2021 was in the red and was followed by a rally that extended into December 2021. Terra’s collapse. in June 2022 noticed a late summer season rally that lasted until eventually the finish of September.

The vertical value drop induced by the crash of FTX has brought about a backwardness that seems uncanny to previously recorded time intervals. If historical patterns repeat, the market place could see optimistic value action in the coming months.

At the time of creating, Bitcoin is ranked #one by market place cap and BTC value is go up one.06% in the final 24 hrs. BTC has a market place cap of 325.89 billion USD with a 24-hour trading volume of twelve.84 billion USD. Looking for extra details >

Enable Bitcoin-Chain Analysis

Market Summary

At press time, the international crypto market place is valued at 823.22 billion USD with 24 hour volume 26.36 billion USD. Bitcoin dominance is at present at 39.59%. Looking for extra details >

[ad_2]