- Bitcoin faces volatility near the $104,000 CME gap.

- Market experts predict a possible reversal.

- Analysts emphasize the bullish cycle remains intact.

Bitcoin is currently facing volatility with speculation around filling another CME futures gap, attracting attention from analysts anticipating potential price movements and market reactions.

The potential gap fill could impact Bitcoin’s price and related assets, with implications for market trends, volatility, and investment strategies.

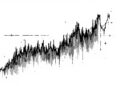

The cryptocurrency market is currently experiencing heightened volatility as Bitcoin approaches an unfilled CME (Chicago Mercantile Exchange) gap near $104,000. Analysts and traders closely monitor its potential to impact Bitcoin’s immediate price trajectory.

Crypto analyst Michaël van de Poppe highlights increased trading volumes and negative market sentiment, suggesting a potential bottom nearing. Conversely, trader @YazanXBT remains optimistic about a rise to $145,000 before any downturn.

The current CME gap serves as a potential short-term focus, with analysts pointing to over 67% of such gaps filling within 48 hours. Bitcoin’s price remains above $106,000, facing resistance around $106,500–$107,500.

The derivatives market shows a 4% futures premium, indicating hesitancy for leveraged longs, while a 6% options skew suggests near-term bearish sentiment. Liquidations of $270 million heighten traders’ caution.

On-chain data indicates an increase in short-term holder inflows, hinting at additional selling pressure and potential volatility. Concerns about the $92,000 CME gap persist, but experts anticipate no immediate crash to this level.

Analysts underline the ongoing uptrend, linked to Bitcoin’s historical 4-year cycle. They assert that market movements align with past trends, suggesting current fluctuations are part of broader bullish development. Crypto analyst Michaël van de Poppe noted, “Trading volumes are increasing near current levels while market sentiment is negative, but multiple signals indicate BTC may be nearing a bottom; a close of the Bitcoin CME futures gap tomorrow followed by a reversal next week would support this view, and the analyst reiterates the 4-year cycle remains intact.” More insights can be found from Crypto Mich.