- Bitcoin enters bear market, exceeding 20% drop from its peak.

- Institutional involvement complicating typical market patterns.

- Liquidity issues and weak demand indicating further volatility.

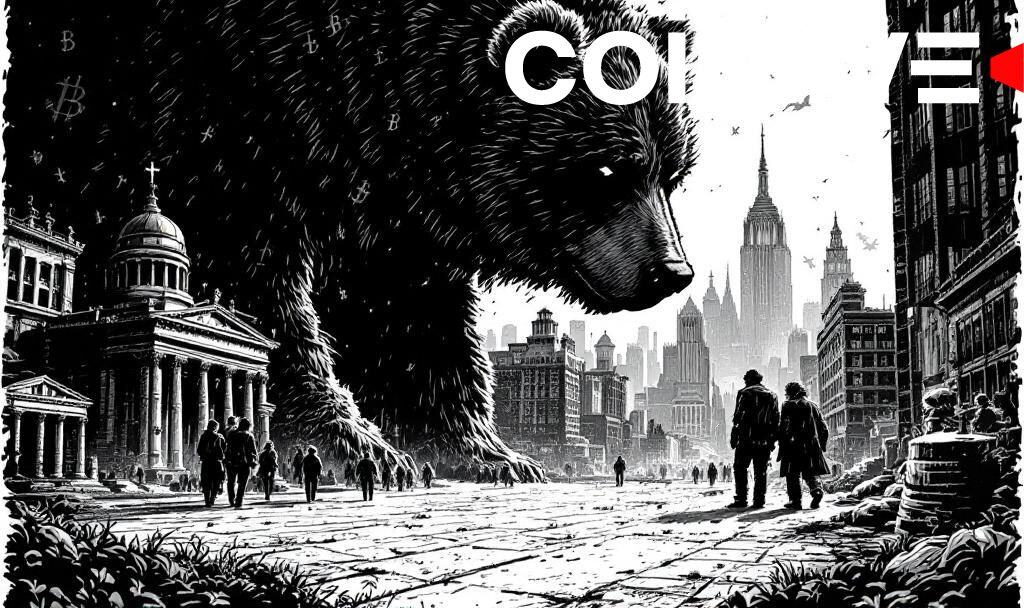

Bitcoin has entered a bear market, dropping over 20% from its October 2025 peak, causing significant financial impacts and raising concerns among institutional and retail investors.

This downturn, with over $600 billion wiped from market value, signals increased volatility and cautious institutional response, impacting major cryptocurrencies like ETH, SOL, DOGE, and XRP.

Bitcoin Enters Bear Market, Falling Over 20% Since Peak

Bitcoin has officially entered a bear market after dropping over 20% since October 2025, when its price peaked. Market observers have noted the slide to below $94,000, erasing more than $600 billion in market value.

Analysts and institutions

Analysts and institutions including Capital Markets Commentator Kobeissi Letter have highlighted this downturn. Despite no official statements from Bitcoin core developers, the industry’s stakeholders are closely monitoring liquidity trends and inflows. Kobeissi Letter shared, “Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th.” source

The market effects

The market effects include significant impacts on BTC, ETH, and other major cryptocurrencies. XRP bucks the trend with a minor increase. The institutional response is cautious, with ETF inflows stalling and derivatives liquidations intensifying. Over $640 million in BTC derivatives were liquidated in just 24 hours, highlighting leverage unwinds. Weak demand and volatile trading characterize the environment, with exchange reserves slightly up, signaling increased sell pressure.

Institutional Adoption’s Role

Institutional adoption’s role in this bear market suggests a shift from isolated retail-driven cycles. Historical precedents show post-halving patterns, but 2025 presents added complexities. On-chain indicators do not yet signal a price floor. Potential outcomes could include increased focus on liquidity management and speculative trading restraint. Historical comparisons to 2018 and 2022 highlight similar patterns, though recovery trends may adjust due to the weight of institutional participation.