- Bitcoin price drops under $99,000 amid liquidity issues.

- Market facing macro pressures with increased volatility.

- Institutional sentiment cautious, anticipating potential downturn.

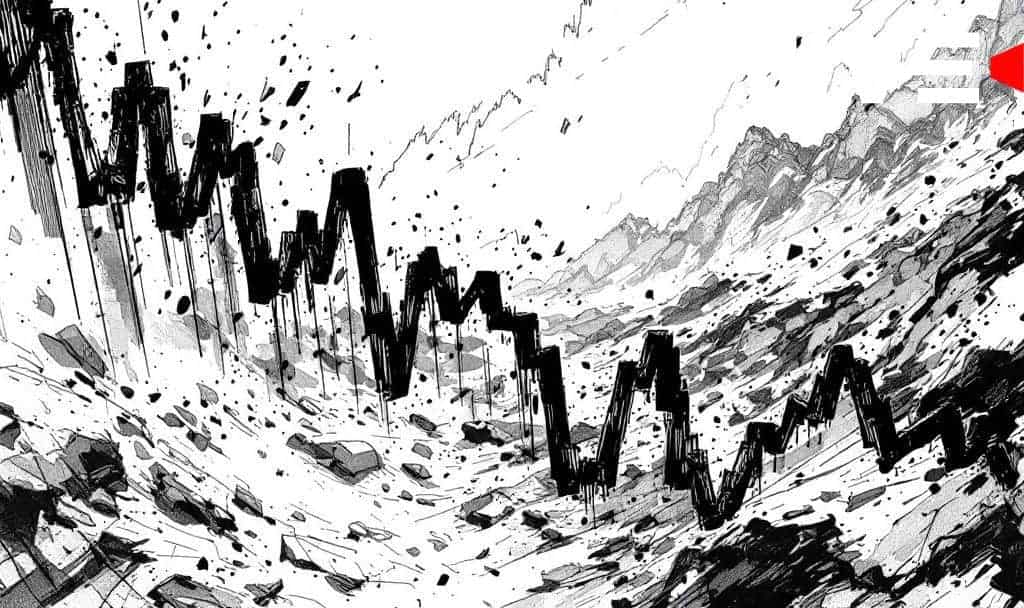

Bitcoin has fallen below $99,000 as of November 14, 2025, causing market fluctuations and concern among investors and industry leaders globally.

The decline highlights macroeconomic stresses affecting cryptocurrencies, with heightened liquidity issues and volatility impacting investor strategies.

Bitcoin’s Price Drop and Market Volatility

Bitcoin’s price has dropped below $99,000, marking a significant moment for the cryptocurrency market. This decline is influenced by macro liquidity tightening, with several factors contributing to the downward pressure on prices.

Key figures like Cathie Wood and Julio Martinez have pointed to a liquidity squeeze and market structure shifts. The combined effects of macroeconomic uncertainty and heavy liquidations are reshaping the current landscape.

Markets are facing a liquidity squeeze. The Fed’s QT and Treasury cash hoarding are simultaneously draining liquidity. SOFR above the policy rate signals stress. Macro uncertainty is hitting risky assets hard. – Cathie Wood, CEO, Ark Invest

Impact on Crypto Market and Data Analysis

The drop has impacted major currencies including Ethereum and Solana, reflecting broader market turmoil. On-chain data highlights significant liquidations and outflows from exchanges, indicating investor caution and repositioning amid volatility.

These movements suggest heightened risk in the crypto sector, echoing past events when Bitcoin faced similar downturns. Stablecoin supplies and DeFi protocols have also seen notable reactions, showing market-wide effects.

Investors’ Outlook and Historical Trends

Investors and exchanges are bracing for ongoing fluctuations, with major DeFi participations indicating strain. Significant withdrawals signal a reserved stance among crypto holders, reflecting on persistent macroeconomic pressures.

Historical trends suggest potential further declines in Bitcoin’s value if liquidity pressures persist. Analysts anticipate leaning on regulatory clarity to provide market relief, though the immediate path remains uncertain under current conditions.