Bitcoin recently experienced a significant drop on Monday, falling to a two-month low of $89,000. However, this drop did not come as a shock, as the cryptocurrency quickly recovered.

Rising optimism from both small and large investors has fueled this recovery, showing the market’s resilience.

Bitcoin Investors Are Optimistic

ETF inflows have returned to Bitcoin after a slow start to 2025. Over the past week, inflows into Bitcoin reached $1.7 billion, surpassing the weekly average of $1.35 billion recorded since October to December 2024. This renewed interest shows growing confidence in cryptocurrencies as a viable investment option.

When investors pour money into spot BTC ETFs, they are contributing to the momentum needed for Bitcoin’s recovery. This highlights the broader bullish sentiment in the macro financial market, laying the foundation for sustained growth in the cryptocurrency’s price.

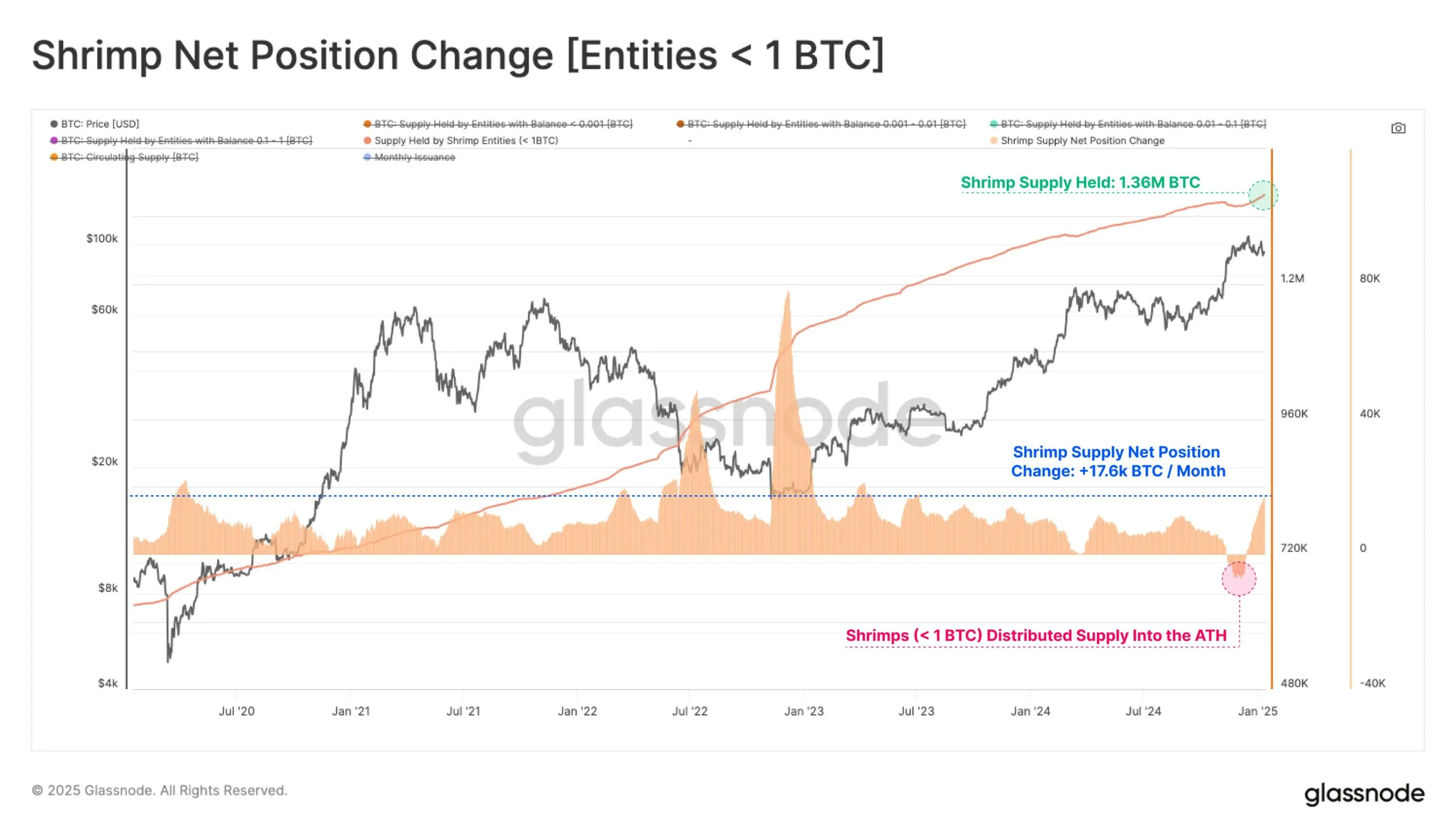

On the macro front, Shrimps’ net position change shows bullish behavior from small investors. Shrimps, holding less than 1 BTC, are actively accumulating a significant rate of 17,600 BTC per month. Their total holdings now reach 1.36 million BTC, reflecting strong optimism about the potential for future price increases.

This accumulation from Shrimps, which typically reacts to changes in price, points to bullish sentiment from retail investors. Their continued buying activity shows confidence in Bitcoin’s ability to recover and increase in the short term.

BTC Price Prediction: Looking for a Breakout

Bitcoin price fell to $89,000 in the past 24 hours, marking a two-month low after losing key support at $92,005. This decline raised concerns but was quickly followed by a strong recovery, showing the market’s resilience.

This price action hints at a false decline, positioning Bitcoin for a breakout of the $95,668 resistance level. Supported by strong ETF inflows and accumulation from Shrimps, Bitcoin could regain momentum and target the psychological milestone of $100,000.

Although the pullback seems uncertain, Bitcoin may struggle to break above the $95,668 level, leading to a consolidation below this resistance and above the $93,625 support. This scenario will slow down the recovery and prolong the trading pattern within the current range.