Bitcoin has risen virtually 50% this yr in spite of staying entangled in many massive and compact corrections and more and more decoupled from the macro natural environment in the approaching fourth quarter. Therefore, Bitcoin (BTC) is officially the very best doing asset of 2021.

Despite Bitcoin’s solid development during the yr, the downside is that higher volatility was not feasible, with a virtually 60% retracement from ATH reached in May impacting the degree of action of BTC.

Yet in spite of continuing dumps, Bitcoin is even now at least 13% ahead of commodities for the yr, information showed this week, and 17% ahead of US microcap corporations. Compared to some of the other investments in the jobs, the image is even brighter for BTC. For illustration, European equities have only risen ten.three% because the start off of the yr.

After the superb functionality of the third quarter #Bitcoin it is now up by + 49.one% from the starting of the yr. The very best doing asset class of 2021. 👍 pic.twitter.com/BMTAMWhQvB

– Bitcoin (@Bitcoin) October 4, 2021

September has often been a hard month for Bitcoin, although the reverse is the situation in October, a timeline that often holds higher hopes for a solid fourth quarter ending. Not just Bitcoin, stocks are anticipated to get pleasure from over-typical returns this month.

– See much more: The purpose why Bitcoin initially returned to the $ 50,000 mark because the July 9th drop

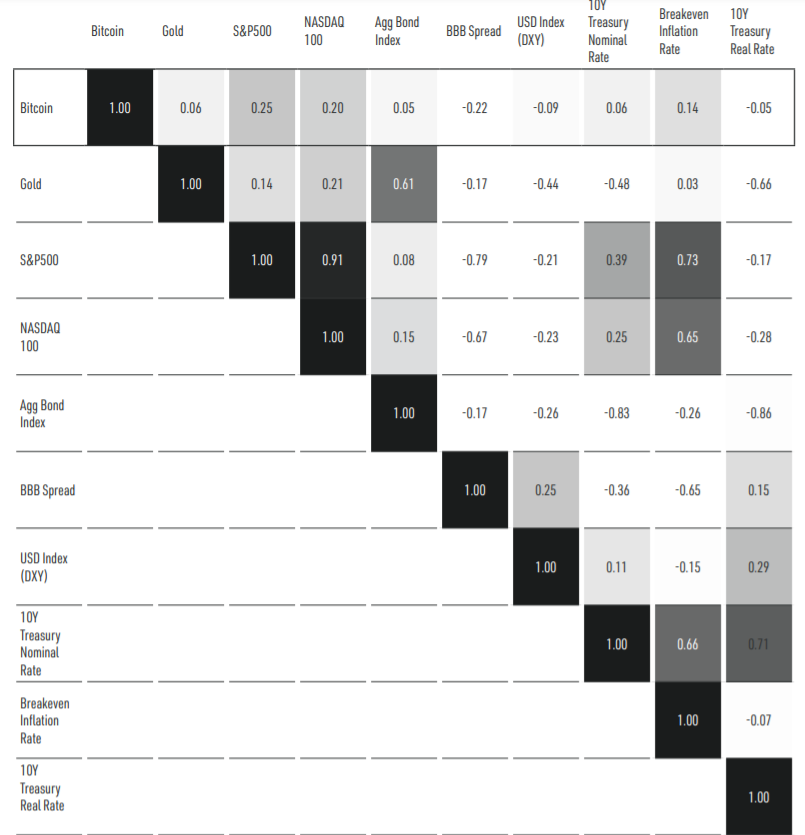

The portfolio allocation choices also propose that, at least for now, Bitcoin’s returns have had a decrease correlation with standard investments in structurally linked capital markets. This displays that Bitcoin is steadily taking a stand on its personal, representing the whole cryptocurrency field independently and much less volatile dependent on the movements of other markets.

However, there are even now side stories of successes that beat Bitcoin in terms of profitability. Obviously this assortment is all about altcoins, there have been lots of altcoins that have viewed unbelievable gains in no time.

Perhaps the most striking is the situation of Solana (SOL) As of 2021, SOL was only close to USD one.six, then hit an all-time higher of above USD 215 in September and in August alone SOL rose 177%. Additionally, the advancement of Binance Smart Chain (BSC) also assisted BNB outperform, trading at USD twenty in October 2020 and repairing ATH at USD 686.31 in May 2021.

Synthetic Currency 68

Maybe you are interested: