Professional traders say that Bitcoin’s recent correction variety affecting the whole marketplace opens up an appealing “entry point” for novices to get.

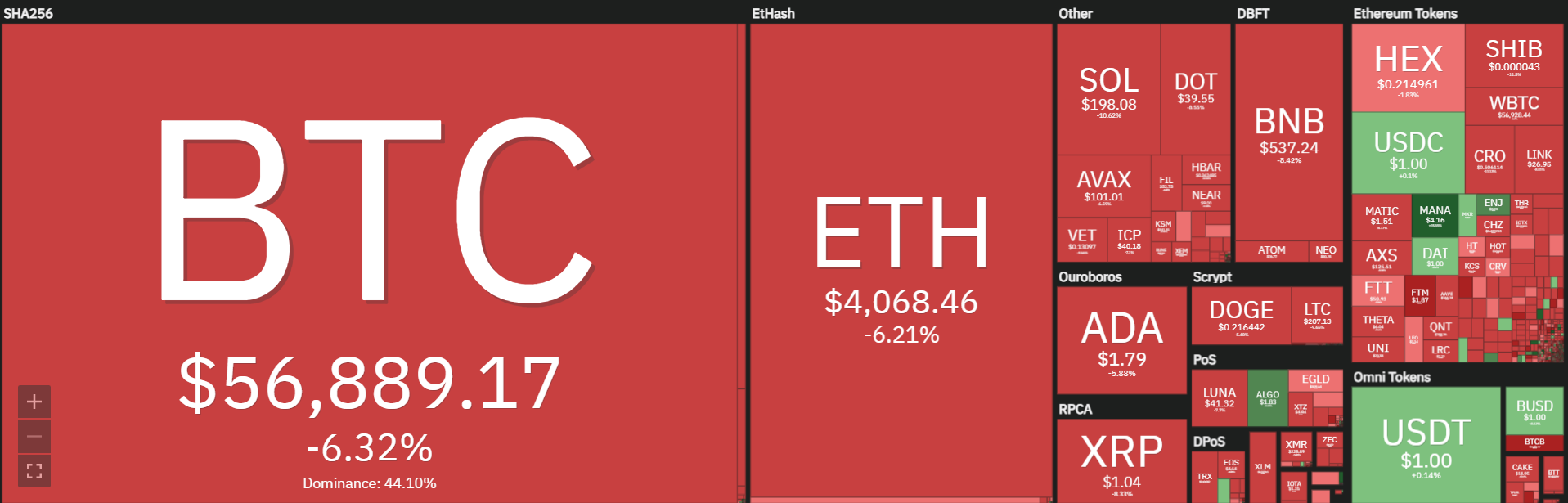

Like Coinlive As reported, all of these aspects had been consolidated earlier in the week to develop some promoting stress which led to the decline of Bitcoin. The selling price of BTC fell beneath $ 57,000 on November 18, triggering a widespread promote-off in ETH and other altcoins.

The $ 60,000 assistance was broken at the starting of the final handful of days and this permitted the bears to get absolute handle in the brief phrase. Currently, BTC is trading all over $ 56,786.

However, in accordance to a latest report from crypto study company Delphi Digital, the promote-off was mostly brought about by a wave of liquidations rather than a basic shift in selling price action. Therefore, it signals the chance that this selling price drop will be brief-lived and possibly set up a fantastic obtaining zone for traders seeking to obtain higher marketplace accessibility.

– See far more: Institutional Cash Flow in Bitcoin (BTC) hit a record $ 9 billion, SOL and ADA brought about a large “surprise”

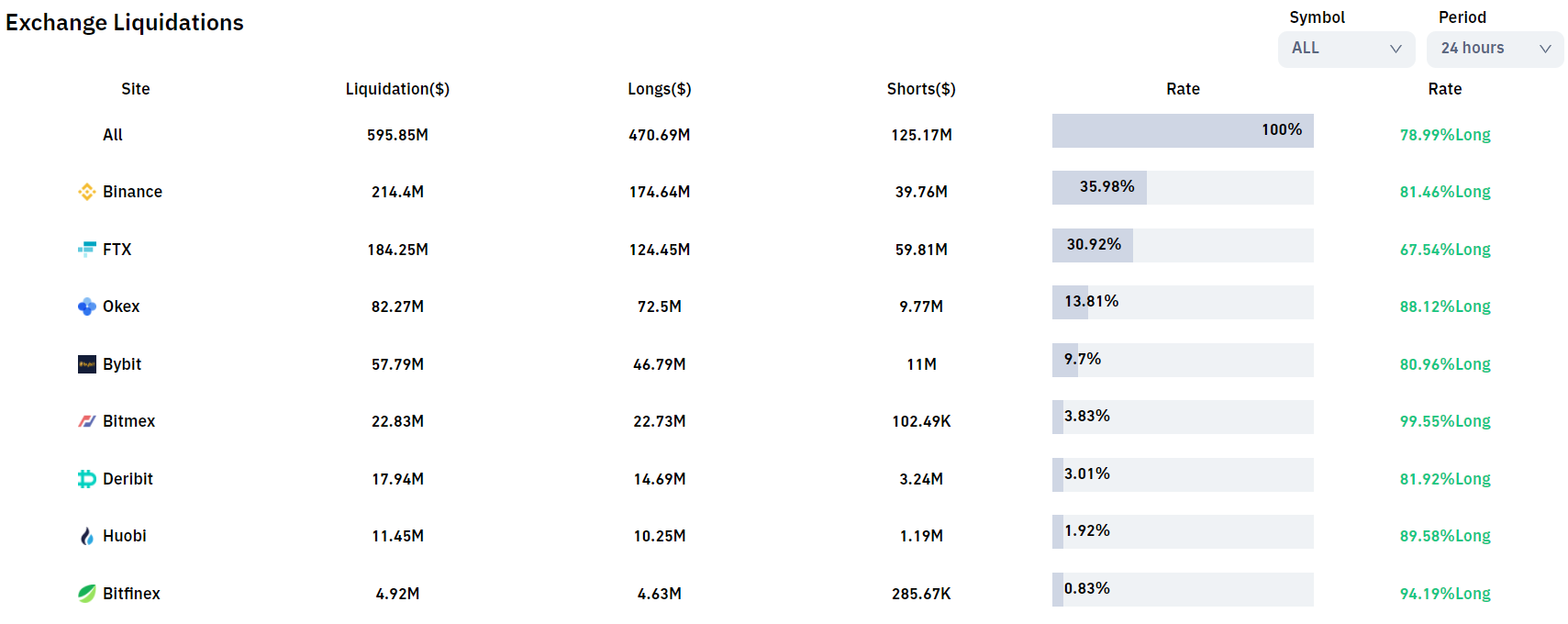

Delphi Digital factors out that while there has been a important quantity of common marketplace decline in excess of the previous week. Typically, the world’s third biggest whale portfolio shifting to “bottom fishing” at three,677 BTC in just four days has not aided reduce the all round boost in complete liquidations on main overlapping exchanges. .

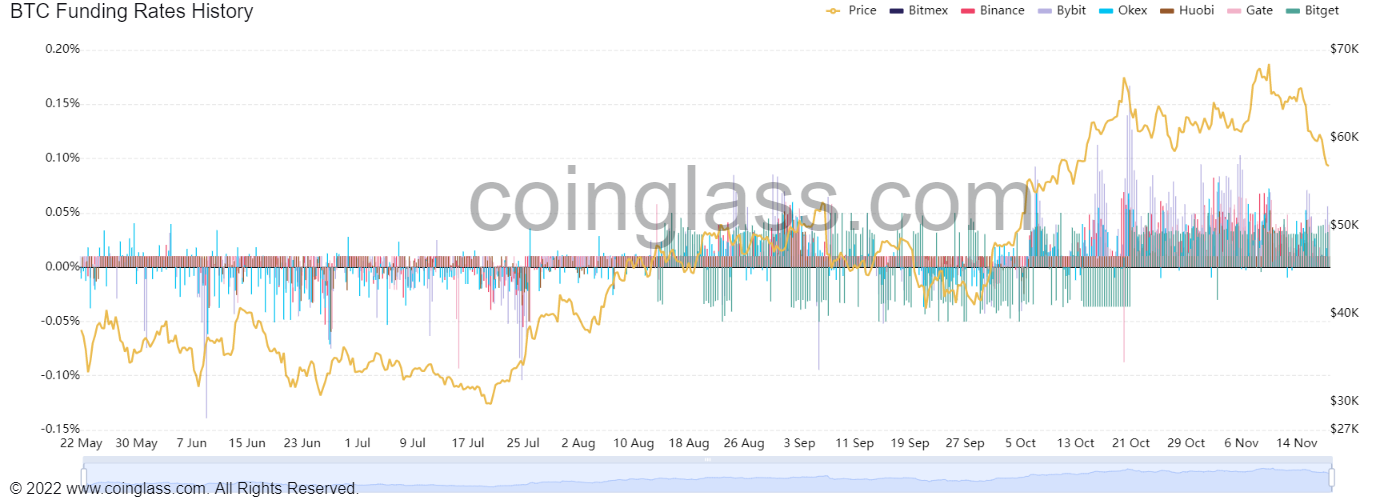

The argument appears appropriate when we evaluate it to the derivatives marketplace funding fee information, the index stays extremely higher in favor of the bulls. This inadvertently made an exceptionally risky “snowball” impact, which engulfed the marketplace in early September and has repeated itself several occasions in the historical past of Bitcoin’s advancement.

In the previous 24 hrs, $ 595.85 million was settled in the derivatives marketplace, of which the vast majority owned by purchasers, which is practically 80% of the complete liquidation worth.

As for what will occur upcoming, Delphi Digital sees the chance of a drop to $ fifty five,000 if promoting stress continues to squeeze BTC beneath $ 57,750, but analysts also propose that any decline in any decline is fairly brief-phrase. , as the truth exhibits that only twelve.9% of the provide of Bitcoin (BTC) stays on the exchange.

“A further decline, Bitcoin could establish a solid accumulation zone, creating even more attractive buying points for long-term believers looking to hoard.”

However, as of this creating, Bitcoin is nevertheless in the system of discovering a month-to-month bottom following hitting its highest weekly near in historical past. From the viewpoint of properly-identified gurus with expertise in the marketplace, analyst Michaël van de Poppe thinks that $ 56,000 will be the breakpoint for BTC’s recovery.

“I think a massive Bitcoin bailout may be imminent.”

On the other hand, Willy Woo is far more optimistic, seeing prolonged-phrase investor obtaining as a constructive indicator that the all round downtrend is something but bullish in this cycle.

I believe I’ll contact this “buying the dip” pic.twitter.com/57kmAtycGF

– Willy Woo (@woonomic) November 18, 2021

Synthetic currency 68

Maybe you are interested: