Bitcoin (BTC) liquidations have been enormous this 12 months. With the sudden adjust in rate, there have been settlements of billions of bucks in a incredibly brief time.

While variables this kind of as funding price, futures basis and leverage are at the heart of the derivatives game, possibility is no substitute for possibility. The clearance numbers have proven that 2021 is the worst 12 months ever for traders in this area.

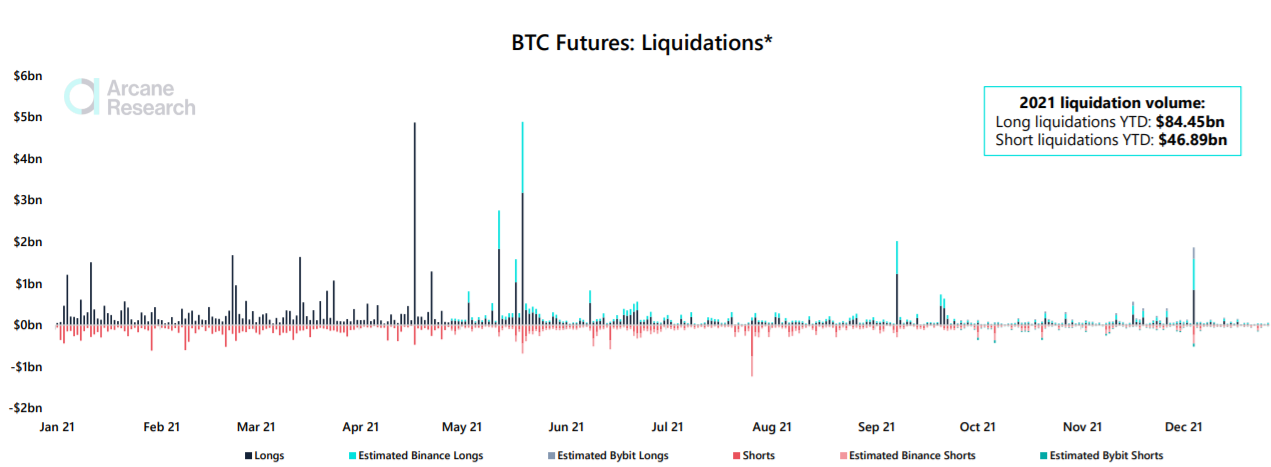

According to a report by Arcane Research, far more than $ a hundred billion was liquidated across the whole derivatives marketplace in 2021 alone. Data modifications constantly based mostly on prolonged and brief liquidations, with Q2 and three many years 2021 representing the most of the influence.

The prolonged liquidations totaled 84.45 billion bucks. As a outcome of different failures, professional-bullish prolonged-phrase traders suffered enormous losses in the marketplace, usually the $ eight,000 “hiatus” in just one particular hour in April, the significant drop from $ 52,000 to $ 48,000 per day. early September and the “bottom hole” incident, which dropped to $ 42,000 in December.

The shorts have been liquidated far significantly less than the longs by all-around 50%, just $ 46.89 billion. However, it is nonetheless a sizeable amount which demonstrates that brief traders are also becoming burned by the volatility of the marketplace, albeit not to the identical extent as bullish traders. .

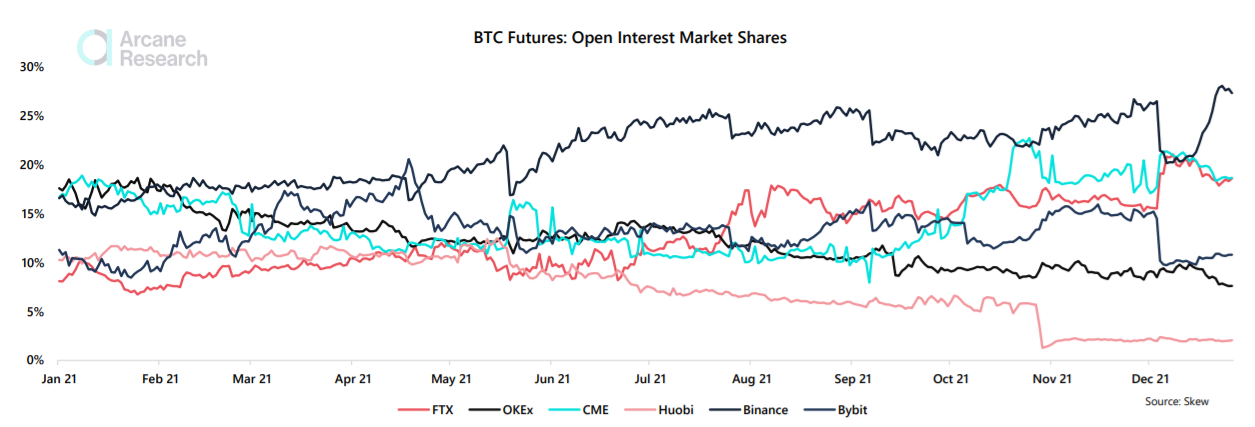

According to the report, Binance is the greatest Bitcoin futures exchange by 308 open curiosity in 360 days. As institutional curiosity wanes as the futures marketplace rises and regulatory strain escalates from China, Binance stays a leader in the futures marketplace.

Bybit recorded a brief spell as the greatest derivatives exchange amid “insane” development in April, whilst CME had a dominant time period in the fund launch. ETFs are based mostly on futures contracts. FTX has also viewed amazing development a short while ago, displaying indicators of finding shut to Binance quickly.

However, the derivatives marketplace is very likely to stay a key trend in 2022. The motive for this is that numerous traders are evolving and adjusting to better possibility appetite in hopes of producing huge income.

However, with the rate of Bitcoin continuing to fluctuate wildly, we must cautiously take into consideration ahead of participating, as the “snowball effect” constantly exists, traders will be liquidated irrespective of their place in predicting a rise or fall in the marketplace.

Synthetic Currency 68

Maybe you are interested: