[ad_1]

Bitcoin (BTC) has seen a significant decrease in buying pressure over the past few days, as the price of the Cryptocurrency has continuously fluctuated between $98K USD and $10K USD. This decline in bullish momentum suggests that BTC may not be ready for its next move up.

Instead, this suggests that the price may continue to trade sideways unless something changes.

Bitcoin Accumulation Decreases

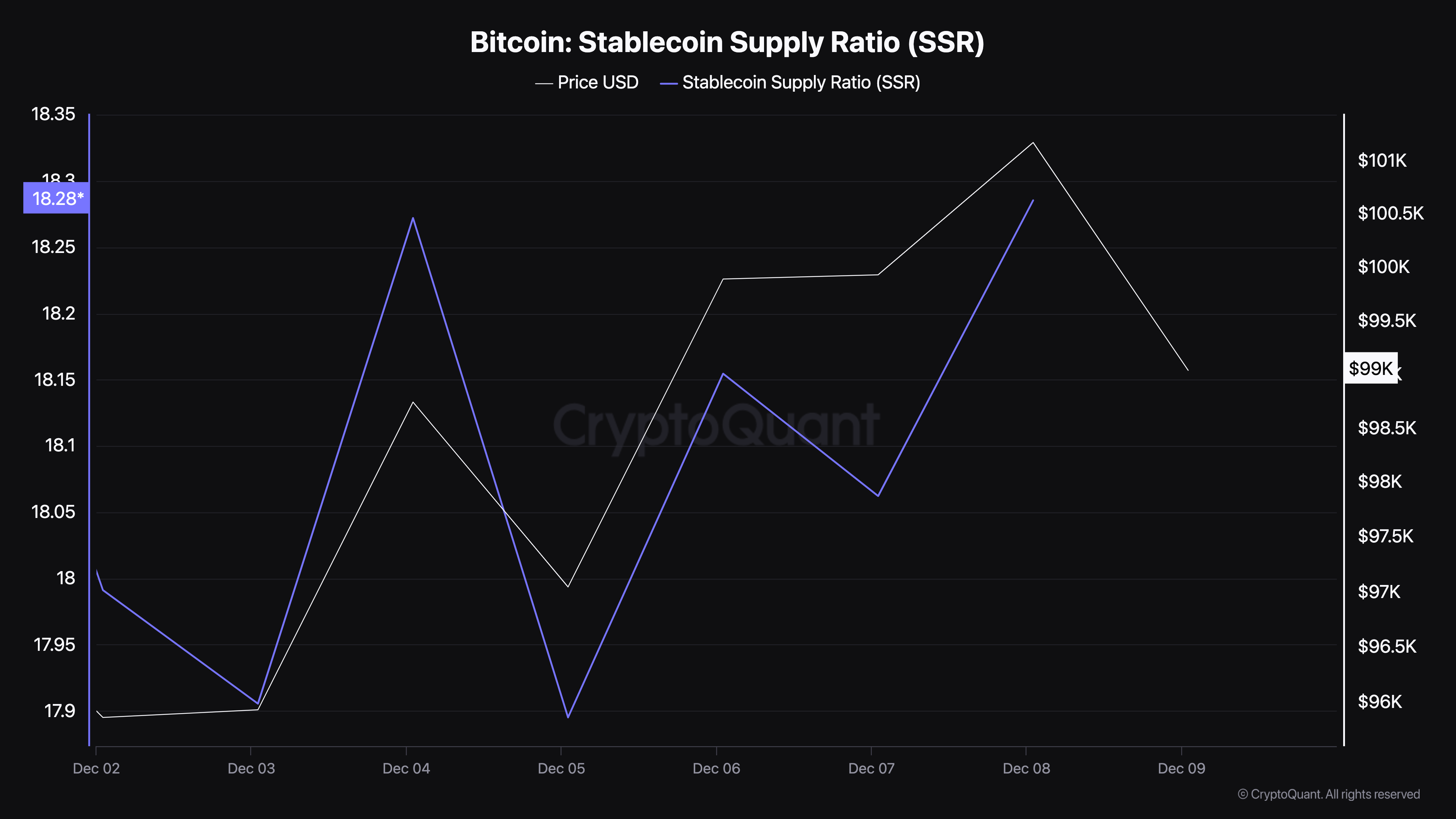

One indicator that shows a decline in Bitcoin buying pressure is the Stable Supply Ratio (SSR). SSR measures the ratio between the market capitalization of a Cryptocurrency and the aggregate market capitalization of all stablecoins in circulation.

Low SSR indicates high purchasing power from stablecoins. This suggests that there is a large amount of stablecoin liquidity available, which could fuel bullish momentum if converted into Cryptocurrency. Conversely, a high SSR reflects lower stablecoin liquidity relative to the Cryptocurrency’s market capitalization, which may indicate weaker BTC buying pressure or limited demand.

According to CryptoQuant, Bitcoin SSR rose to 18.29. The above conditions show that purchasing power is no longer strong. As a result, Bitcoin price may continue to trade below its record high of $103,900.

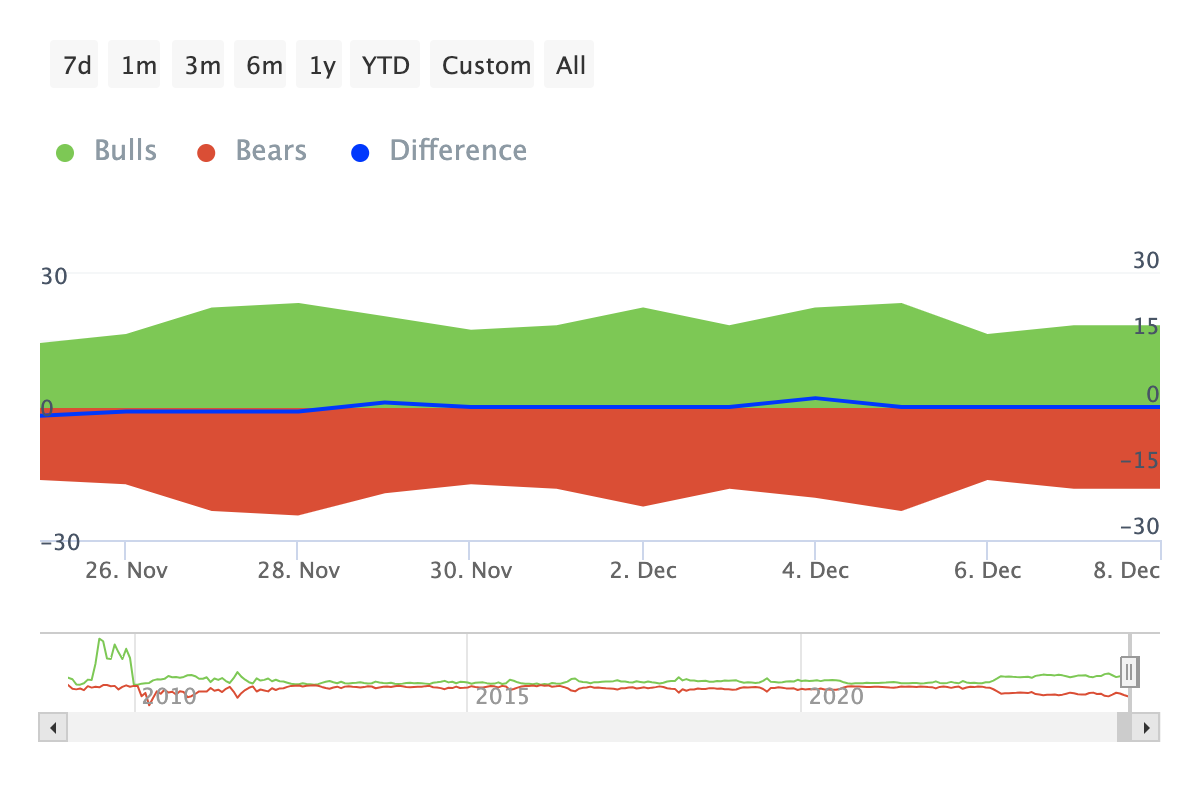

Another indicator that suggests the same is the Bulls and Bears indicator. To understand, bulls are addresses that have purchased at least 1% of total trading volume over a specific period of time. In contrast, bears are those who have sold a similar amount.

When there are more bulls than bears, BTC price is likely to increase. However, if bears dominate, the situation is opposite. According to data from IntoTheBlock, the number of bulls and bears over the past seven days remains unchanged.

This shows that Bitcoin bulls have not bought more coins to push the price up. If this trend continues, BTC price may continue to accumulate.

Bitcoin Price Prediction: Continued Decline Threatens

On the daily chart, the Moving Average Convergence Divergence (MACD) indicator has dropped into negative territory. MACD measures the momentum surrounding a Cryptocurrency.

When MACD is positive, the momentum is bullish. However, in this case, the momentum is bearish, suggesting that BTC price may not experience a significant uptrend in the short term. The indicator’s position also demonstrates a reduction in Bitcoin buying pressure.

If this does not change, Bitcoin price is likely to drop to $90,623. However, if buying pressure increases and bulls buy in large volumes, the Cryptocurrency price could rise to $103,581.

General Bitcoin News

[ad_2]